A reader writes:

Thanks to your advice, my wife and I now have enough United miles for a free trip to Hawaii. (We each got the 55,000 United miles from the Chase United Mileage Plus card.) Now, though, we’re wondering what we might do to amass enough hotel points so that we don’t have to pay for that, either. We have some time — probably a year or two — but our schedules are not that flexible, and we’d probably have to travel in peak season, in the summer, so the hotels will probably jack up the points needed. What do you recommend — Hilton? Starwood? Something else? Is it realistic to expect that we could earn enough points to cover our hotel stays?

As in all matters of travel-hacking and bank-outsmarting, the answer is: it depends.

There are a few different ways to go at this. If you don’t mind changing hotels every few days, it’s fairly simple to string together a bunch of free nights from various rewards cards without having to worry about having to accumulate a lot of points. The Citi Hilton Reserve gives you two free weekend nights when you get the card, and one free weekend night each anniversary. So if you and your wife both have this card, there’s 2-4 nights accounted for. The Chase Priority Club card gives you a free night each anniversary (plus 60,000 points when you join), so there’s two more. And the Chase Hyatt card gives you two free nights upon joining plus a free night every anniversary, so there’s another 2-4.

The free night certificates from the cards mentioned above will cover just about any hotel within the respective chains, so if you go this way, your goal should be to stay in the best hotels you can, since the free nights are not being paid for with points or cash. It’s the same costs regardless of whether your hotel room goes for $99 or $399.

The other way to go is to try to amass enough points to stay in one hotel your whole trip for a more relaxing stay. One of the best ways to do this via credit cards is with the Club Carlson credit cards, but unfortunately for you Club Carlson does not have a presence in Hawaii. French Polynesia yes, but not Hawaii, go figure. Fortunately, you can still accumulate a bunch of Hilton points in a hurry. The following cards give bonuses of 40-70,000 HHonors points upon sign-up:

- Amex Hilton HHonors (40,000)

- Amex Hilton HHonors Surpass (60,000)

- Bank of America Hawaiian Airlines (35,000 miles –> 70,000 HHonors)

- Bank of Hawaii Hawaiian Airlines (35,000 miles –> 70,000 HHonors)

- Citi Hilton (40,000)

So between you and your wife, there are several hundred thousand HHonors points there for the taking. Combine that with the Citi Hilton Reserve’s free nights mentioned above and the Amex/Gold discounts for reward redemption (The Points Guy has a good rundown of how these work). And don’t forget that the Reserve grants you automatic gold status (as does the Surpass for the first year you have it), which gets you free breakfast as well as access to the executive lounge, both of which can help cut down your food costs, which can be high in Hawaii.

Another option is Starwood. If you and your wife both get the Starwood Amex in the personal as well as the business version, you’ll find yourself with 100,000 Starwood points, which should be enough to set you up for a while.

Aloha,

PFD

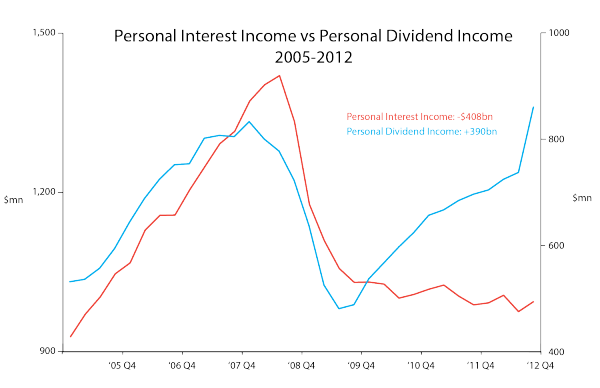

MACROECONOMICS IS BORING: …Which is why we’re showing you this very clear chart courtesy of John Mauldin:

This graph shows the result of our nation’s monetary policy the last several years. What’s happening is that interest income (from boring old savings accounts), represented by the red line, is way down. Dividend income (from totally exciting equity and bond markets which), represented by the blue line, is at record highs. Our monetary policy has the effect–and mind you, this is intentional–of hurting the most conservative investors and rewarding people who load up on riskier financial assets. If macroeconomics were more accessible to the general population, people would be outraged, but it’s not, so they’re not.

We don’t know how this will end, but given the fed’s track record over the last decade and a half, there’s a good chance it will end badly.

Recent Comments