Every now and then I like to take a jab at PNC bank for having a needlessly complicated rewards program, but no more! KeyBank Rewards is the new champion of lousy rewards programs. This one requires extensive work with a spreadsheet.

If you take a look at the rewards language on Keybank’s website, you see this:

- Earn 1 reward point for every $6 spent in signature debit net purchases and PIN/POS net purchases.

- Earn 1 reward point for every $1 spent in KeyBank Platinum MasterCard Credit Card purchases**

- Earn 5 reward points for every $1 spent in Key2More Rewards MasterCard Credit Card purchases**

I know that debit card rewards are weaker than credit card rewards, but something is out of whack when the standard credit card reward is 30 times that of the debit card. That’s just weird, KeyBank, and you ought to be ashamed of yourself.

So just looking at that, we know that either debit cards are worthless from a rewards standpoint or that the KeyBank credit card is the greatest deal in the history of credit cards. How do we find out?

Let’s have a look at the KeyBank Rewards Guide! Maybe we can find clarity and guidance there:

..or maybe not. That’s only part of it the guide, by the way–there’s more. The guide actually makes things more confusing: 10 points per dollar for the Private Bank credit card? A 60X rewards gap between debit and credit? A birthday bonuses? ATM deposit bonuses? Intriguing! But confusing! How rewarding is all of this anyway?

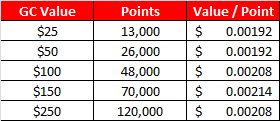

Let’s try the KeyBank Rewards site itself. If you browse their rewards catalog itself, you can see how much it takes to redeem for certain items. Looking at the Target gift cards, we see the following denominations and redemption amounts (I’ve added in the value per point):

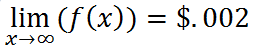

So at last we have some idea of how much a KeyBank rewards point is worth. Expressed mathematically, we can say that for any KeyBank rewards function f(x) where x is your total points earned:

I haven’t had calculus or pre-calc or whatever it is they teach limits in for twenty years or so, so pardon me if my math is sloppy.

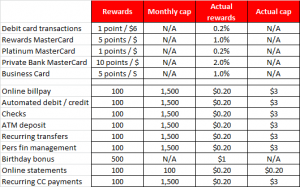

Anyway: let’s re-do that KeyBank rewards guide page with a value of one fifth of a cent per point. How does it look now?

So if you’re willing to put up with KeyBank’s program for some reason (for example, if you’re a KeyBank executive’s mother and you don’t want him to feel bad), you can get a whopping 1% back on your credit card purchases. (Or 2% if you’re wealthy enough for their Private Bank). And if you’re willing to jump through a lot of hoops, you can get $20/month back from the incentives on their deposit accounts. It’s probably not worth your time, unless you’re very clever and/or efficient.

Could be the worst deal out there!

Really like the maths here…. used to be so familiar with those symbols….

And I was going to rant against PNC Bank’s program soon, thanks for making one of my next posts totally irrelevant now man!

OMG, ranting about PNC is soooooooooo yesterday… everybody’s ranting about KeyBank these days.

This explanation made more sense than any of the bank staff could have ever made. Unbelievable, why do banks not give an actual cash reward. That would be better, especially for people who would never figure out this whole process. And thus the points add up but never redeemed. Ha ha I tried to help my husband redeem for something a gift card,I think and after all that work I got an email stating that the form was not filled out correctly. I FOLLOWED THE STEPS OF WHAT THE BANK TELLER EXPLAINED HOW IT WAS DONE. So he keeps earning points and maybe someday he will cash it in. On a piece of licorice maybe. Lol

horse pucky

hacking through the jungle!!

change banks

unfortunately, need to keep the card

due to credit bureau criteria