SERIOUSLY?: You always have to take articles like this with a grain of salt because the media has an interest in playing up the silliness, but apparently people are getting a little nutty about this Mayan apocalypse stuff. It’s a bunch of nonsense of course, but anytime you see people acting crazy, a good question to ask yourself is, “Can I make money from this?” Our favorite example is selling pet insurance to people who believe in the rapture, followed closely by the purchase of a whole bunch of insurance on subprime mortgages at the height of the real estate bubble. Neither activity is our cup of tea, but it’s helpful (and fun) to consider crowd psychology, make sure you’re not a member of said crowd, and look for opportunities.

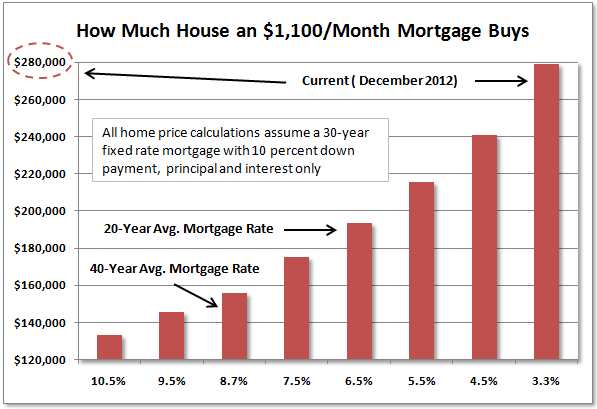

HOW YOUR HOME PRICE IS AFFECTED BY FED POLICY: Most people don’t find macroeconomics as interesting as we do, but you have to find graphs like this from Iacono Research entertaining:

The fed has been keeping rates very low the past several years, and you can easily see on the graph how much a change in interest rates from 5.5% to 3.5% increases the amount of house you can buy. The big question is, what happens to home prices when rates start to go up again? Or, as some wonder, will rates start to go up again, or has the Fed boxed us into a Japan-style low-rate purgatory? Either way, rates don’t have too much farther to fall, which is why we think there’s more risk to falling home prices than on missing out on rising prices. (H/T: Barry Ritholz)

THE RISE AND FALL OF LENNY DYKSTRA: Remember several years ago when all of a sudden former baseball player Lenny Dykstra was some sort of financial whiz, and he even had a column on thestreet.com? Wasn’t that odd? It’s a sad story, but Newsday has a great feature on Dykstra’s rise and fall which explains how it all happened. Dykstra, incidentally, was sentenced to 6 1/2 months in federal prison a few days ago.

FREE MUSEUMS, AN UNFORTUNATELY OBSCURE PERK: Miranda Marquit at Bargaineering has an article on five credit cards perks you probably didn’t know about, and to her credit she mentions our personal favorite, the Bank of America “Museums on Us” program. The first weekend of every month, B of A cardholders can get in free to a bunch of museums all around the country. It’s a great collection of museums, and you can use any Bank of America card, whether credit, debit, or ATM. Add authorized users for extra admission fun. Enjoy!

Recent Comments