HOW TO DEFAULT ON STUDENT LOANS: It was a long struggle, but in Oregon, somebody figured out how to beat the system:

The financial advice gets repeated as a mantra: Student loans are the one form of debt that can’t be forgiven, even in bankruptcy. But a Klamath Falls man has proven that’s not always true.

Mike Hedlund waged a 10-year legal battle to force his lender to discharge most of the $85,000 in federal student loans he built up while earning his 1997 law degree from Willamette University in Salem. He argued that, even when working full-time and living frugally, he could not repay that much money and also maintain a minimal standard of living for himself and his family.

Last week, in a decision that could affect debtors in eight states, a panel of the Ninth Circuit Court of Appeals in Pasadena, Calif., ruled in Hedlund’s favor.

It upheld a bankruptcy judge’s ruling that Hedlund proved all three factors necessary to have $53,000 of his debt forgiven: He made a good faith effort to repay the money; he can’t earn enough to both repay the money and maintain a basic standard of living; and his inability to earn substantially more is likely to persist.

There are a lot more details to the case if you’re interested. Mr. Hedlund, who makes $40,000 per year, still owes $32,000, but that’s a heck of a lot better than $85,000. I did like this paragraph toward the end:

Natalie Scott, a Eugene lawyer who represented Hedlund, said lawyers for the loan agency suggested that forgiving most of Hedlund’s loans would “open the flood gates” to healthy college graduates claiming they couldn’t earn enough and demanding their loans be forgiven.

Let’s hope so!

$10 OFF $100 AT HOME DEPOT: Through June 23, use the code JUNEHD. Online only, but you can pick up your order at the store. (H/T: My Money Blog)

FINANCIAL SECTOR THINKS IT’S ABOUT READY TO RUIN WORLD AGAIN: The Onion reports.

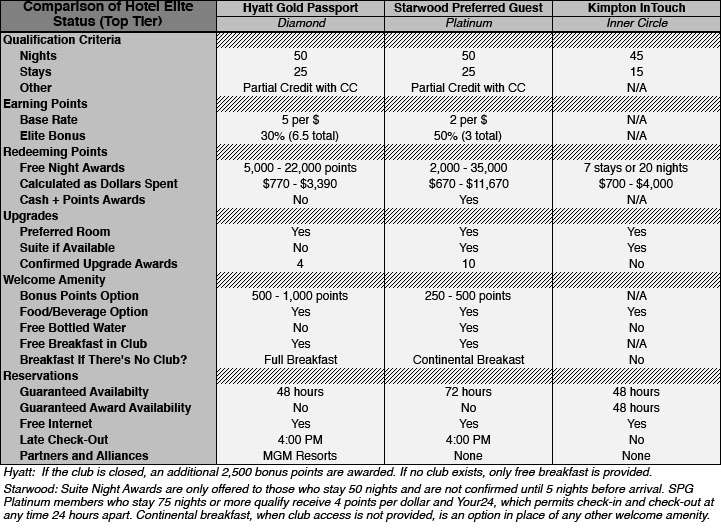

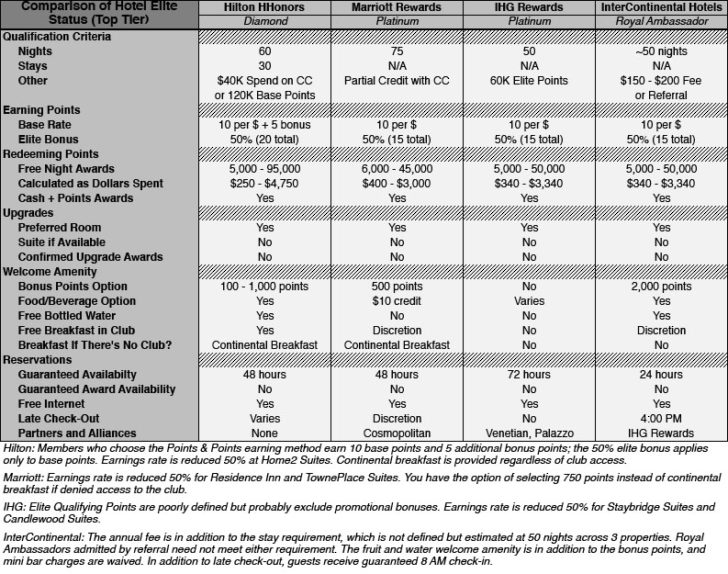

COMPARING TOP-TIER HOTEL STATUS: Hack My Trip did some great work comparing the upper echelons of major hotel loyalty programs. There’s a lot of discussion there in addition to what’s on the charts, so if you’re interested in contrasting and comparing, please check out his article.

ALL-YOU-CAN-FLY AIRLINE: There’s a new company called Surf Air whose business model is offer customers all-you-can-fly privileges in exchange for a set fee every month:

For that monthly membership fee, you receive such benefits as:

- Flying as a passenger as many times as you want within a month for no extra cost or hidden fees

- Always first-class luxury on executive aircraft with leather seats

- A personal concierge to assist you with whatever you may want or need

- Complimentary guest passes as long as you give a minimum advance notice of two weeks

- Snacks and beverages are included in the monthly membership fee

- No having to wait in line to pass through airport security checkpoints and be either scanned or endure a “pat-down” — or both

- As few as 30 seconds to book your reservation

- Quick access from your car to the aircraft — perhaps in as few as five minutes — at airports with free unlimited parking and complimentary Internet service

- Be part of an “exclusive community of air travelers”

The four cities to where Surf Air will launch its airline service will be:

- Los Angeles

- Santa Barbara

- Monterey

- San Francisco

All this could be yours for the low, low price of $1,650 per month! It’s an interesting business model, we’ll see how they do.

I generally enjoy your commentary, but you are definitely off when it comes to the dischargeability of student loans. Students make a choice to borrow the funds either by the college that he or she attends or by foregoing work during school at a community college. No one requires a student to take out the loans – it is voluntary. And check out what college students are spending their money on, they wear nicer clothes and have a better cell phone than I do. When you borrow money, it must be repaid at some time.

Thanks for the comment! I totally get what you’re saying, and for the record, I’m in favor of repayment of debts if at all possible. My issue with student loans is that they are the only type of debt which is generally not dischargeable in bankruptcy. I think that they should be, which would bring higher loan write-offs, would force student loan rates to rise, which would eventually reduce the amount of student loans taken out, which would force colleges to cut costs.

I think our country spends too much money on higher education, or at the very least does not spend the money wisely. On an individual level, I’m sympathetic with your view that yes, these students made dumb choices and should pay up. But systemically, our higher education system is bloated and I wouldn’t mind seeing it slimmed down. Reasonable parties may disagree though.