Ever since we were kids, there’s been a perception that this country isn’t producing enough engineers and scientists. Do the data bear this out?

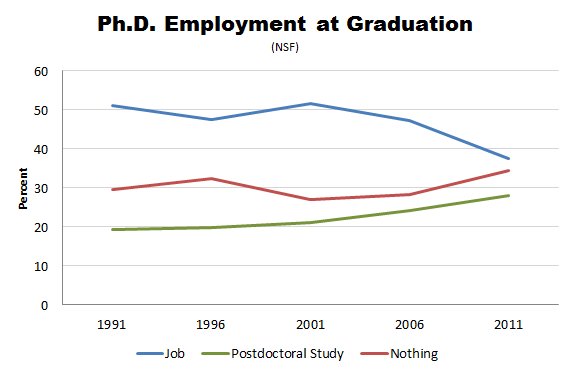

On the contrary, the data would seem to suggest we’re producing too many. The Atlantic reports on The PhD Bust with some striking graphs. Take a look at this one:

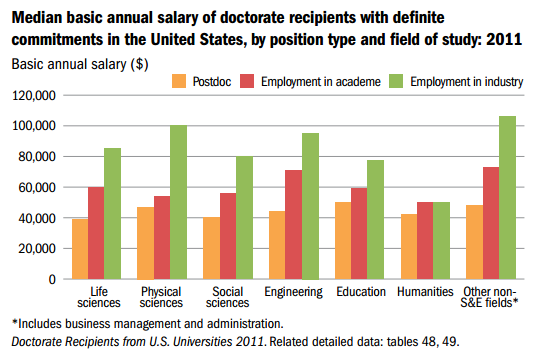

So the trend is fewer jobs, more postdocs, and more nothing. Note that postdocs aren’t exactly raking it in:

Visa issues explain some of the difficulties, though not even close to all; the article’s author looks at foreigners vs native-born scientists here.

Meanwhile, on the law school front, the law school at Arizona State University has hit upon a novel solution to the problem of unemployed law school grads: starting its own law firm:

The result is a nonprofit law firm that Arizona State is setting up this summer for some of its graduates. Over the next few years, 30 graduates will work under seasoned lawyers and be paid for a wide range of services provided at relatively low cost to the people of Phoenix.

The plan is one of a dozen efforts across the country to address two acute — and seemingly contradictory — problems: heavily indebted law graduates with no clients and a vast number of Americans unable to afford a lawyer.

As the article points out, “running a law school is such a lucrative business that as demand for lawyers dries up, it makes sense for ASU to operate a law firm as a loss-leader for the law school.” Lucrative, indeed… for the law school staff. The graduates, not so much.

SHAME ON YOU, DAVE RAMSEY: Money Is Not Important had a nice takedown of finance guru Dave Ramsey (we’re quoting the whole post to give the proper context, so MINI, if you’re reading this, we hope that’s okay):

Earlier today on Twitter, personal finance “guru” Dave Ramsey showed us his plan that would allow everyone to “become a millionaire”:

Saving only $100 per month from age 25 to age 65 at 12% growth = $1,176,000. Everyone should retire a millionaire!

Sure, he’s encouraging people to save, and that’s obviously a good thing. But, he’s also using exaggerated claims about how to achieve some dream-like lifestyle in an effort to sell more of his stuff. The truth is, it’s not that easy for most folks, or even financial professionals for that matter.

After receiving several responses calling out his absurd claim, he took to his radio show to go on an all out rant:

It’s simple concept in a culture that has the savings rate and financial maturity of a two-year-old. To simply put out there that maybe if you save some money you would have some blows people away. This is why I have a job for as long as I want one. I will never be unemployed. Just teaching people to save money and get a bunch of money and get out of debt. Me and Jenny Craig, we got a lock for life, baby. We got enough work forever.

Ouch. Sure, there may be some truth there, but come on. He’s basically said that he likes that people are in debt because it keeps his pockets lined. Not cool, man.

He later went on to say that if you can’t find a fund that averages 12% per year, then you should call his hotline for advice on which funds to pick.

Very convenient…call a hotline to get a list of Ramsey-endorsed funds. I wonder why he would endorse certain funds?

It’s because he gets PAID to endorse those funds! It’s the same scenario when a financial advisor recommends funds that bear his or her company’s name—they get paid more to suggest them whether they’re the best option or not.

All in all, Dave Ramsey does help a lot of people. However, it’s a good reminder that no one really cares about YOUR money more than YOU. Especially someone that gets paid for giving you advice.

Well said. We would add one thing: it’s not realistic for everyone to expect a 12% annual return–especially not in our current age of Quantitative Easing and near-0% interest rates. Dave Ramsey ought to know better than to suggest otherwise, so shame on him.

Recent Comments