THANKS FREQUENT MILER!: Some kind words and free PR for PFD! Inside Flyer recently interviewed several boardingarea.com bloggers, and Greg, aka Frequent Miler, was kind enough to mention your humble blogger:

Greg says he reads a great many travel blogs but a new blog called Personal Finance Digest has caught his attention. It isn’t a travel blog, but it covers travel deals as well as many non-travel financial opportunities.

Thanks to Frequent Miler for the shout-out, and thanks to Travel Blogger Buzz for letting me know about it!

And while we’re talking about FM, he scientifically proved after exhaustive research that CashBackMonitor is the best rebate portal finder.

HOW A MISTAKE LED TO FREE $2,000 LIFETIME FAIRMONT PLATINUM STATUS: And speaking of TravelBloggerBuzz, a recent post made passing reference to a story I hadn’t heard about, the story of how TBB earned lifetime platinum status with Fairmont Hotels:

On the coupon website Living Social last week, Fairmont’s landmark San Francisco hotel on Nob Hill offered a package that included a stay in a luxurious suite and an extraordinarily attractive bonus: perk-rich lifetime VIP status with the entire Fairmont chain. The cost: Either $2,000 or $10,000.

People who understood the significance of the bonus started snapping up the deal, salivating at the chance to be treated like royalty every time they step into a Fairmont hotel for the rest of their life for as little as $2,000.

But within hours after approximately 117 people bought the Living Social package, Fairmont mysteriously pulled the deal even though it was supposed to have been sold through next Tuesday, March 1.

The lifetime platinum part of the deal was a mistake, but to Fairmont’s credit they honored it. Perks include an annual free night, several free upgrades each year, and an annual $100 dining/spa certificate. Well done! It’s good to know what the heck you’re doing so that you can pounce on deals like this when they present themselves.

(EDIT: An earlier version of this article used the word “free” in the intro headline. A subsequent investigation confirmed that $2,000 is not, in fact, free. We regret the error.)

VIRGIN ATLANTIC 65,000 FOLLOW-UP: Thanks to commenters rick b and Paul for doing some legwork on my Virgin Atlantic 65000-mile credit card offer post. Paul dug up this One Mile at a Time post on redeeming Virgin Atlantic points on Virgin America flights and pointed out that you can also parlay the miles via Hilton into a free night at a $1,000-per-night resort. Rick noted that the miles can also go for cross-country flights on Virgin Australia and for Air New Zealand as well. Thanks guys!

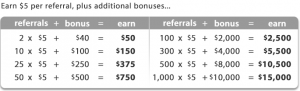

EARN $15,000 VIA EBATES REFERRALS: If you don’t already have an ebates account, you can get a free $10 gift card to the retailer of your choice by signing up here. Note that this is a referral link for me, but this is open to the public so you can set up your own referral link if you want to. In either case, once you’re signed up–or if you already are signed up–there’s some potentially lucrative referral action you can get in on.

As per their referral chart, you get $5 per referral (but only if that referral makes a $25 purchase via ebates within one year of being referred) AND you also get some lucrative bonuses. If you can refer just two people who purchase $50 worth of stuff, that’s a $50 bonus, so your $50 worth of stuff is effectively free. The same free stuff ratio scales all the way up through the first 100 people.

Two thoughts on this: first, I hope somebody reading this is in college so he can sign up his entire dorm and earn $2,500 (or whatever) for a kick-ass party. Second, while looking at the T&C’s for loopholes, I saw this: “The following activities are not permitted and will disqualify you from earning a referral bonus: (i) self-referral…” In other words, you can’t keep referring yourself. But what if Person A refers Person B, and then Person B refers Person A, and so forth–does that count as self-referral? I have no idea. Anyone?

NETSPEND IS HIRING: Can one of my readers please take this job and carve out a friendly space at NetSpend for points & miles aficionados?

The Manager, Predictive Analytics and Modeling designs, develops, and executes key quantitative / modeling projects within Marketing Analytics team to drive decisions, maximize contribution margin, and continuously increase acquisition, retention, and winback efficiency & effectiveness. This position is located in San Mateo, CA.

It’s in Marketing, and not Risk/Fraud, so you wouldn’t actually be setting policy for churners, but you might at least be able to talk some sense into those who are. I’d do it myself for the good of my readers, but as you may or may not recall I have a strict policy against living in high-cost areas. Anyone willing to step up?

LOL, I was wondering why one of the BA bloggers was pimping ebates today.

Yep! Fortunately this one’s open to everybody. 🙂

Sounds like Matt has already got you doing exaggerated headlines lol 🙂

Also I was hoping you’d see the absurdity of calling the lifetime FPC deal free when it in fact cost $2,000. I had ample opportunity to pull the trigger on that one and did not. Just could not justify the $2k. I’ve stayed at a Fairmont once since then, that’d be a damn expensive upgrade. I am amazed George has the balls to criticize every blogger on the planet for claiming travel is free etc when he himself bangs on about this “amazing” deal that he himself forked out 5% of the US median pre-tax income to acquire. I am absolutely certain this remains a profitable “deal” for Fairmont.

On a more positive note, I’d be happy to contribute to a fund to support someone going on a spy job to NetSpend. There is just so much to learn about this prepaid business. We need insiders!!!!

Ha, I didn’t even realize I’d put ‘free’ in the sub-headline! My sick kids have been keeping me up the last few nights, so quality control is suffering. But I find this error amusing enough that I’m going to leave it in.

In any case, thanks for stopping by! I was actually wondering about the breakeven point on this deal. I would guess Fairmont’s in the black for now, but “lifetime” is a long time.

MilesAbound, I am doing a slow clap right now in response to your comment about Fairmont deal. I love you man or woman, whoever you are!

Ok, let me reiterate the Fairmont”deal” a little further:

First, it cost me $1,500 and not $2,000. In Living Social deals if you get 3 people to go for the deal through your link you get it free. So, four of us got together and one got it free and then reimbursed the other 3 for $500 each.

So far, it has gotten me the following: 2 nights at Quebec Chateau Frontenac, 1 night at Santa Monica Miramar and 1 night at Lake Louise (the rest of the nights were due to the Visa). All in suites of course. Every year Plats receive 4 “Passion” benefits. I have had a couple of super nice Adidas bags (lifetime warranty), two bath robes, 3 sets of magnificent teas in a super classy tea case, extra restaurant entries, a subscription to National Geographic magazine, a dessert each year (at LL it was epic!). $100 in dining certs each year MIN. Delicious welcome amenities at every stay. Oh, a spa session too every year!

I let you decide if it was worth it. I am only 46 by the way. There is a high probability this was well worth it 🙂

Hi guys,

I have a question for all you financial folks. If someone is sitting on cash, ready to go into the market (this follows getting out of some expensive funds last spring but then dilly-dallying before re-investing) do you think it better to wait and see what happens with the debt ceiling? I do not thing it very easy to try to time the market, but perhaps with the ceiling fight hanging over all of our heads, it is prudent to wait and buy when the market drops, or ????

Any thoughts?

Thanks!

Hi TWA44–If I knew how to time the market, I ‘d be ridiculously wealthy. I’m not going to pretend to know how to do so. The markets swooned after the last debt ceiling crisis in 2011… but had recovered and then some a year later.

This won’t tell you exactly what you’re looking for, but here’s some good thoughts from Barry Ritholtz on the “markets hate uncertainty” cliche:

http://www.bloomberg.com/news/2010-11-10/kiss-your-assets-goodbye-if-certainty-reigns-commentary-by-barry-ritholtz.html

Timing the market is impossible (though I am doing it right now) but… and the reason I am should be the reason you do too…

If you have a large enough amount trapped in one asset class (or linked asset classes) that should disaster happen you couldn’t repair it, then you are in trouble.

For example, say you have $500K to invest, and your salary affords you $10,000 to invest annually, should the market tank 50% your $500k becomes $250K, and you get to buy more assets ‘on sale’ – this is portfolio repair through dollar cost averaging, you lower your overall basis and it bounces back sooner. But the problem is you can only buy $10K worth because you have no more money.

Therefore if you have a vast disparity between your investable wealth and your income, you should keep some of those investable assets in less/non correlated asset classes, then should it tank you are able to switch those out and buy more stocks.

The consideration you need, is that you need the ‘repair money’ to be sufficiently liquid that selling it to buy more stock does not come at a notable loss.

Classically, the answer was bonds, but when interest rates are low, it is likely they will raise and you will lose face value on your bond, that means nothing if you hold to maturity, but if you hope to sell to buy more stocks, you are trapped at taking a loss (though it likely won’t be a substantial one).

I would suggest you create a synthetic dollar costing to your assets -in that you drop in 20% of the total now (as that helps against inflation) then another 20% after you hear the results, and then another 20% in 6 months, and the final parts in the following 6 months. This will average your way in, but each time you buy in at 20% your ‘repair money’ (starting at 80% and reducing each time) becomes less able to fix your portfolio, therefore as you near 80% of the money invested as you wish ,you should have a very well balanced mix of asset classes so that your entire account does not drop in value.

Personally, if you have enough stashed away, I would still buy bonds and hold to maturity, using a similar plan to described above, dripping in over time.

Of course, for this to be good advice it would be necessary to know a lot more about your finances, however at the least I would not go ‘all in, in one shot’ with markets near all time highs and a number of risk variables on the horizon.

Thanks, guys, for your replies. I appreciate the link to Barry Ritholz’s article and am grateful for Matt’s explanation. I do like the dollar cost averaging approach and will see if I can get my guys to, as we say out here in Niketown, “just do it.” Not only will it accomplish the various things Matt suggested but it will, finally, get it done. I hate that my son has been sitting on a bunch of cash that could be working for him.

PFDigest is a great addition to Saverocity. Lots of good new content these days from you both! Thanks again!

That’s beautiful. Not to mention, sexy. Magnificent tea, spa sessions, epic desserts, Adidas bags. Oh, my! My head is spinning just from reading it. I can see, why they call it “Passion” benefits. Of course, there are 3 major problems:

1) There aren’t that many Fairmonts, so you literally have to plan your vacation around your hotels. Not my cup of tea.

2) I get my hotels free from sign-up bonuses.

3) I could have invested that 1500 dollars in a mutual fund.