I posted a blurb about Square Cash the other day, as did many other bloggers since it’s a good way to wring some extra miles out of mileage-earning debit cards. A few big names, such as the SunTrust Delta card or the Bank of America Alaksa Airlines card, tend to be the most frequently mentioned ones.

But those aren’t the only options. For those of you willing to look beyond the big banks, there are many more rewards debit cards out there. I have some of them listed below. Most are issued by smaller banks you’ve never heard of, and you’re probably not eligible for accounts with most of them. This list is intended to be representative, not comprehensive, so check out banks in your state, city, town, or neighborhood to see what kind of deals are available.

So what’s out there?

GREENVILLE FEDERAL CREDIT UNION: The CardCash debit card lets you earn up to 1% on signature/non-PIN transactions. It’s a little odd how the 1% window of opportunity works, but hey, it’s something:

So it’s effectively a hair under half a percent cash back for the first $1,600 in transactions each month. This credit union is located in Greenville, SC (an underrated town, by the way)

BANK MUTUAL: This Wisconsin bank also offers the Card Cash product, and it also has an odd cashback scheme:

- 1.00% on qualified monthly purchases totaling $500.01 – $1,000.00

- 0.50% on qualified monthly purchases totaling $1,000.01 – $1,500.00

- 0.25% on qualified monthly purchases totaling $1,500.01 and higher

COMMUNITY AMERICA CREDIT UNION: You can earn 1 point for every $2 in signature transactions–but only if you’re in St. Louis or Kansas City or employed with certain companies.

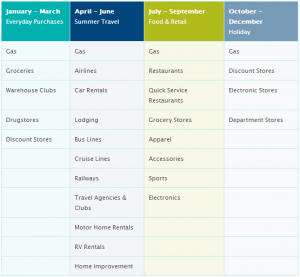

ASSOCIATED CREDIT UNION: Membership is open to all, though you’ll only get one point for every $3 in signature transactions. Though interestingly enough for a debit card, they have a quarterly rotating bonus system where you can get 2 points per $3 in rotating categories:

MECU OF BALTIMORE: 3% cash back on debit card transactions! Granted, it’s only on the first $250 of purchases each month, and you have to jump through a lot of hoops (12 debit card purchases per month, etc.) just to get that little amount, and–you’re right, this one’s not worth it.

FIFTH THIRD BANK: Okay, this is a pretty big bank, but I never see this card mentioned. It’ll get you 1 point per $2 of signature purchases. Incidentally, 5/3 also has an unusual product called the DUO card, which is a debit card / credit card hybrid. If you enter a PIN, it’s processed like a debit card and the money is deducted from your checking account. If you choose ‘credit’, the money comes from your credit line. If I’m reading the fine print correctly, though, you do not get points for debit transactions.

That’s all I have. Anyone have any sweet local bank deals, debit or otherwise?

Actually, the MECU Baltimore debit card is not a bad candidate to use for Bluebird online debit loading. If you keep a $4,000, you get 3% cash back up to $400 every month and since Bluebird only lets you load $100 a day, you’ll really only need to do two other debit transactions per month. The end result is 1.2% cash back on your Bluebird online debit loads.

I still wouldn’t bother as the reward to time/hassle isn’t high enough but some people certainly may find it interesting, thanks for posting.

nothing scalable really.. or did I miss something?

Subscribe

Good point! Thanks.

Nothing huge here, just wanted to make the point that there are debit card reward options beyond the ones that usually get mentioned.

Nice start to getting a list together. Has to be one out there that is worth it. Will keep looking and report back if find anything good.

ufbdirect.com, part of The Bank of the Internet, offers 1 AA mile for every two dollars charged at POS with their debit card.

I’d love it if they also paid miles for, say, making your mortgage payment with the account directly, but not so far.

There is a one time bonus of 100o miles for a direct deposit of $1000+, and you can transfer as little as $100 into a UFB savings for miles, as well. Keep it in savings for a year, and get more miles.

Don’t they have a monthly fee for the mileage accounts?

And speaking of fees, if you can swallow paying a couple percentage points off the top, you can pay your mortgage by credit card with ChargeSmart.

Do any of these count as hard inquiries?

Not sure.

Ufb is actually pretty handy. There is no fee for having the account (you are confusing them with Bank Direct). Plus, Ufb actually refunds other bank ATM charges. So, it is a nice card for a little mfg spend…plus a handy tool to have to get cash at any bank without any fee if needed. Sign up process was “inelegant,” but otherwise they’ve been fine.

Agreed about the “inelegant” sign up procedure. And no customer service on the weekends. However, the linkage to Amazon.com and Bluebird to remove Amazon Payment funds was quick and easy. The $1000 deposit needed to get the 1000 AA miles is just a simple, one- time transfer of the funds- no ACH procedure or anything cumbersome. Also, if you have them set up a linked savings account and keep it open for a year you get another 1000 AA miles. No funds need to be kept in the savings account.