Via Hustler Money Blog, we learn of an intriguing deal: the Citizens Bank CollegeSaver. It’s a savings account (but not a 529, mind you) to help save for college, or anything else your child might want to blow his money when he’s 18. Here’s how it works:

You contribute a certain amount at the opening depending on how old your child is, and then a certain amount each month, and then after years of saving, you get a $1,000 bonus when your kid turns 18. Is this a good deal?

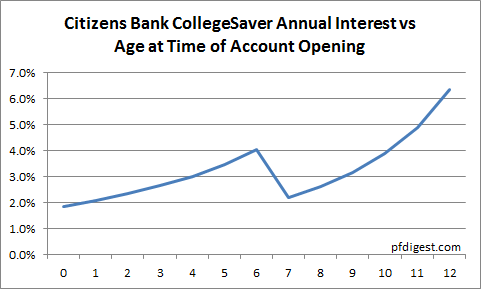

Yes… but only if you had the foresight to have a child 11 years and 11 months ago. We have to say, this is one of the more complicated banking products we’ve looked at; it’s right up there with mortgages. Bond calculations are not our strength, so by all means feel free to double-check our numbers, but here is what we calculate your interest to be based on when you open the account:

So the highest effective interest rate is when you open an account right before age 12. If you have a child who’s 11 years old and 11 months, you can effectively lock in a 6.4% interest rate for the next six years. By comparison, 5-year CD rates are currently around 1.6 to 1.8%, so that is a pretty good deal. Your rate of return is pretty good if your kid is age 10 as well.

Beyond that… it’s a judgment call. If your kid is about to turn six, you can get a 4% return… but you have to tie your money up for 12 years. Some people may find that worthwhile, though we suspect many more would not.

Still, hats off to Citizens bank for coming up with an offer which (a) kept us busy on Excel for an hour, and (b) is optimized for kids who are almost 12.

Caveats:

- One account per child.

- Anybody can open an account for the child–all you need is the SSN and DOB.

- Open only to residents of CT, DE, IL, IN, KY, MA, MI, NH, NJ, NY, OH, PA, RI, and VT.

Recent Comments