BA 100K: The on-again, off-again 100,000-mile offer from British Airways is on again. Whether or not this is a good deal depends on whether you’ll take advantage of the sweet spots of this program, [Read more…]

A new trick for your old Bluebird, the Chinese mileage underground, and a cool United study

ANOTHER WAY TO LOAD BLUEBIRD: Unbeknownst to me, this one apparently has been bubbling up for a little while, but now that Million Mile Secrets has written it up, there’s no benefit to being subtle about it. It turns out that the no-fee Home Improvement card–Frequent Miler has some background on this product here–can be used to load the Amex Bluebird. Now that the word is out, this one may have a limited shelf life, so carpe diem.

You can set a PIN with this card now, though apparently that’s not necessary if you’re going to load it at a Walmart ATM. Folks are reporting mixed results with their attempts to pull this off, so perhaps a small test is in order before you go whole hog.

THE CHINESE POINTS AND MILES UNDERGROUND: A reader named Peng wrote me with some interesting information I was not familiar with:

Mitbbs is a Chinese BBS forum based in the U.S. Most of the Chinese immigrants and students come to that site everyday. There is a “Money” division, in which people talk about all these credit card tricks everyday. Also, there is a “Flea Market” division, in which you can sell the points/miles you earned from the credit cards. Some people collect the points/miles to buy air tickets and build up their frequent flyer status.

In the summer when the students and visitors are both buying the air tickets, the China-US round trip tickets can be as expensive as $2,000, so in this case award tickets are way better than buying with cash. So in the summer some travel agencies collect the points/miles in the “Flea Market”. United miles are normally worth 1.8c/mile, sometimes ppl will get 2.1c (I saw this once last summer).

The award ticket for China-US round trip costs 65k (Coach Class), which face value is $65k*1.8%=$1170, way better than $2000. So buying 1.8c still gives the collector big profit margin out there. Starwood points are normally worth 2.1c/pt, sometimes 2.2c/pt. I sold my 40k SPG bonus (30k from the intro offer) at 2.2c/pt this summer.

…Some other points/miles values: Amex MR 1.6c/pt, AA miles 1.8c/mile, USAirway miles 1.7c/mile Delta 1.3c/mile, Citi Thank you Point 1.05-1.08 c/pt (It changes all the time).

Interesting stuff–thanks Peng! For the record, I don’t recommend this practice as selling your miles is against the terms of service and companies can shut you down, take your miles, and/or blacklist you for doing so–but then, some of you are going to do it anyway, so if you do, you may as well get the best value. There’s also a Fatwallet discussion of rewards2cash.com if anybody’s interested.

SPEAKING OF MILEAGE VALUATION: A research group called IdeaWorks did a study on United’s frequent flyer program. The conclusions contained therein are not earth-shattering (first class redemptions get you the most bang for the buck) but it’s got some good data and pretty charts.

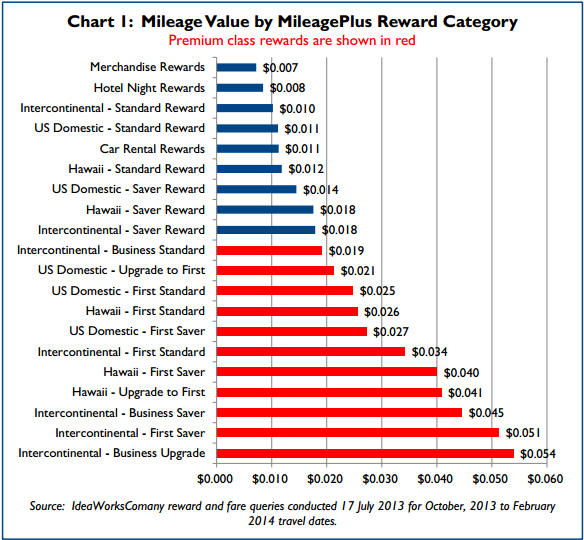

For example, here’s the value per mile for the various tiers of award redemption:

Here’s the same data with hotel, car rental, and merchandise redemptions thrown in. You see why the people at boardingarea.com always go for the business and first-class awards?

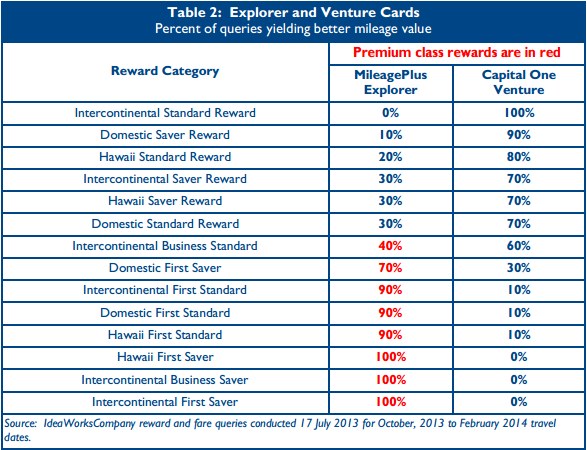

The study also compared the United Explorer credit card to the Capital One Venture card to see which one is better for the different types of redemptions. The results:

All of which is to say that credit cards and frequent flyer programs are a great value for people who know what the heck they’re doing, which is why you should be reading fine blogs like this one.

Money on sale at Staples, miles for a Mercedes, how to earn Hyatt elite status in Vegas, and Nicaragua news

MONEY SALE AT STAPLES: “Money often costs too much” — Ralp Waldo Emerson

Of course, Emerson was never lucky enough to shop at Staples! Now through July 20th, Staples is offering a $15 Staples gift card when you buy a $200 MasterCard gift card. And thanks to Slickdeals, I see Staples has some other good sales this week as well:

- 4oz Staples School Glue $0.25

- Slider Pencil Case $0.25

- 24-pack RoseArt Crayons $0.25

- 200-sheets Staples 5.5″x4.25″ Fat Book $1

- Staedtler Protractor $1

- 7-pack Zebra Z-Grip Mechanical Pencils $1

- 5.5″x8.5″ Dry-Erase Board $1

- 35-piece Staples Erases and Grip Combo Pack $2

- 4-pack Staples 3/4″x300″ Invisible Tape $2

- Staples 3-Hole Binder Hole Punch $2

But wait, that’s not all! Points, Miles, & Martinis points out that Staples has paper towels on sale at prices so low, they’re practically giving them away–and you can earn 8X UR points by using Chase’s portal. As someone whose basement is currently stacked floor to ceiling with paper towels and toilet paper purchased at Staples several months ago (if you’re going to jump on a deal, you may as well go big), I’ll also add that Staples sometimes has a catalog at the front of the store with coupons giving you a discount on breakroom supplies, a category which includes paper towels. I have no idea if such coupons are available, but it might be worth a look if you happen to be passing by.

MILES FOR A MERCEDES: I’d never heard about this program before, but apparently you can get up to 25,000 United miles by buying a Mercedes. Of course, my readership tends to favor high-end Italian vehicles, but I just thought I’d throw this one out there just in case. (H/T: Maximizing Money)

HOW TO GET HYATT ELITE STATUS IN VEGAS: Hyatt recently started a partnership with MGM resorts, which means there are now 12 properties in Vegas you can use to help score elite status with Hyatt. The Points Guy has a nice rundown. For example:

…one of the participating resorts is Excalibur (which counts as a Hyatt Category 2 property now). Looking at the week after Labor Day, rooms are going for a low of $29 per night for several nights. Granted, that gets bumped up to about $47.50 with taxes and a $15 per day resort fee. But if (and I’m not saying this is likely since it would take an incredible amount of planning and spending a fair amount of time in Vegas), I wanted to book 25 individual one-night stays at similar rates in order to reach Diamond status, it would only end up spending $1,187.50– that’s less than a single night at some top-tier Hyatts cost!

If you’re interested in working the Vegas angle, there’s a lot more here.

A MAN, A PLAN, A CANAL: I’ve been meaning to get around to mentioning this for a while, but did anybody notice that they’re actually going to move forward with a competitor to the Panama Canal?:

The £25bn Great Interoceanic Canal will be built by the Hong Kong-based company Nicaragua Canal Development Co Ltd (HKND), which has been granted a 50-year concession to build it with an option for another 50 after that to run it once it is operational.

Plans to build a canal through Nicaragua have been proposed in various forms for at least two centuries, and indeed the United States had planned to build a canal there until it realised it would be cheaper to buy out and finish the then under construction French canal in Panama.

Since I have in-laws there I’m predisposed to find news out of Nicaragua more interesting than most, but even taking that into account this is still pretty cool.

Back before the Panama Canal was built Nicaragua was actually one of the best ways to get from the Atlantic to the Pacific on account of the San Juan River and Lake Nicaragua, which allow you to make most of the journey by water:

The Accessory Transit Company was a company set up by Cornelius Vanderbilt and others during the California Gold Rush in the 1850s, to transport would-be prospectors from the east coast of the United States to the west coast.

At the time, an overland journey across the US was an arduous undertaking and could last many weeks. The Accessory Transit Company instead took passengers by steamer from New York to San Juan del Norte on the Caribbean or Mosquito Coast of Nicaragua. From there, they traveled up the Rio San Juan to Lake Nicaragua, crossing the lake to the town of Rivas. A stagecoach then crossed the narrow isthmus to San Juan del Sur, where another steamer traveled to San Francisco.

The ATC provided the cheapest route to California from the east coast, and was soon carrying 2,000 passengers a month at a fare of $300 each, later reduced to $150.

Mark Twain famously made the journey when he went from San Francisco to New York in 1866.

Anyway, it’ll be interesting to see if they can pull this off. I guess Nicaragua’s the next Costa Rica and the next Panama?

Re-Advisor: Getting home for the holidays

Over on Fox Business, there is some advice to a lost soul whose goal next year is to get from New York to San Francisco for the holidays. The advice columnist eventually hits upon the right answer, but leaves out some important points, as she spends most of the column talking about cards with rewards for spending. If you want enough for an airline ticket, it is much easier and much quicker to sign up for a card or two as signing bonuses are almost always going to be a quicker way of accumulating points than spending bonuses.

To her credit, columnist Cathleen McCarthy does recommend the Chase Sapphire Preferred and its 40,000 point bonus. But she doesn’t say why this card is one of the top choices in this situation.

The reason is that our would-be traveler wants to travel around Christmas, and frequent flyer miles are notoriously difficult to redeem this time of year. The optimal course of action is a card with a large bonus that can be redeemed as a cash equivalent for an airline ticket. Chase Sapphire fits the bill. McCarthy mentions that the points can be redeemed to United miles, and normally that’s a good thing, but not this time of year. Log into United and look for available seats from New York to San Francisco around the holidays and you’ll see what we mean.

So the emphasis should have been: (1) Earning the points through a sign-up bonus, and (2) Points should be flexible cash-equivalents.

McCarthy did ultimately recommend a good solution. The 40K bonus on the Sapphire translates to $500 worth of airfare, which should be enough to cover a roundtrip ticket.

Another acceptable option would be one of the new Citi Preferred cards, which are offering bonuses of 40K and 50K ThankYou points on the personal and business versions respectively. It should be noted that both of these have somewhat high minimum spends of $6K each, so Chase is the simplest option. Citi, however, has a higher ceiling, and here’s why.

The Citi ofers equate to $400 or $500 in airfare, or $900 if you get both. But wait, there’s more: if you get the Citi Premier, you can increase your points’ travel redemption value by 33%. That card is available with a 25K TYP bonus. So if you get all three in the course of next year (trust us, Citi has no problem with folks having multiple cards), that’s 115,000 points which you can redeem for $1,530 in travel expenses. So maybe bring a friend or two home for the holidays, or travel first class, or book a hotel room for New Year’s Eve. Or maybe just get the $500 ticket and redeem the rest for Amazon gift cards to pay for your Christmas shopping.

You see why we like this stuff so much?

Recent Comments