AN EASY $200 FROM CITIZENS BANK: If you open a checking account by November $15, Citizens Bank will gladly pay you $200. As per the offer page, all you have to do to claim the bonus is “make any deposit (excluding opening deposit) or have five qualifying debit card payments or purchases post to and clear your new account by January 31, 2014.”

The downside: as per the rep I chatted with, “It is currently required to reside within our business area to not only qualify but also open an account with us.” Citizens operates in Connecticut, Delaware, Massachusetts, New Hampshire, New Jersey, New York, Pennsylvania, Rhode Island and Vermont. Hopefully that covers a non-trivial percentage of my readership.

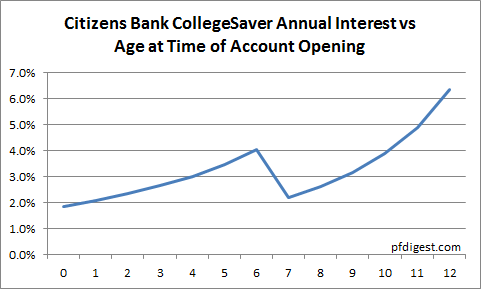

Incidentally, Citizens boasts one of my favorite weirdly fascinating financial products: the CollegeSaver savings account. What makes it interesting is how complicated it is. I go into more detail here, but in a nutshell the effective interest rate depends on how old your child is when you open the account. The net result is that you can get anywhere from 2% to 6.4% depending on your child’s age:

So if you have a kid who’s about to turn 12, this is a like a 6-year CD paying over 6%. But if he’s a newborn or has just turned 6, you get 2%.

A NOT-QUITE-AS-EASY $200 FROM TARGET: Via FatWallet, you can trade in an old iPad for a $200 Target gift card with the Target electronics trade-in program. As this FWF thread points out, you can get first generation iPads for less than that on eBay and Craigslist. As per the Fatwallet thread:

The $200 will be issued as a “Target Electronics Trade-In” gift card. This is not a regular Target GC but can be used in store or online. It is branded MasterCard and some report it can be used as a regular card once it is registered, etc. YMMV.

And also:

Trade ins are only done at a store with a Target Mobile. Check to make sure this service is available.

GOOD NEWS FOR TRANSACTORS: One of the more frustrating things about credit bureau reports is that they do not say whether or not you’re paying off your balance every month. So from a risk standpoint, somebody who’s chasing promos and buying a bunch of Vanilla Reloads looks a lot like somebody who’s leveraged up on credit card debt.

That, fortunately, will change:

The three major credit bureaus have started adding new details about credit card payments to credit reports that reveal whether a cardholder is a “revolver” — someone who carries a balance each month, racking up interest charges — or a “transactor” — someone who makes purchases but typically pays off the balance in full.

Credit bureaus say the additional information will help card issuers better target their products to customer needs and better identify people who are the best credit risks. Customers who pose the least risk generally are offered cards with the best rates and terms.

Transactors are “absolutely” less likely to default on debt than revolvers, said Ezra Becker, vice president of research and consulting at the Chicago-based national credit bureau TransUnion.

The last time I saw my FICO my biggest negative factor was “balances on too many cards”, so this is a change I’m happy to see, and presumably some of you out there will benefit as well.

22 DEPRESSING PHOTOS THAT SHOW HOW KMART IS DYING: That’s the headline of the article, and I can’t top that, so here you go. Of possible interest to those who may have bought a Sears/Kmart gift card or two:

Even Kmart’s registers are outdated. “Pictured is one of the most outdated point of sale terminals I have seen in recent memory. It sits off in the electronics section. Oh, and all of those wires are exposed to the paying consumer,” Sozzi writes.

Kmart doesn’t have a store within 30 minutes of me, so I haven’t been to one in a couple of years. I do recall that my last visit was slightly depressing though. Does anybody remember when Eddie Lampert was supposed to be the next Warren Buffet?

Recent Comments