Doctor of Credit has a good review of retail credit cards worth getting. The only omissions I can think of are maybe the Marathon credit card and the Kohl’s credit card. I don’t have any expertise on the latter but Frequent Miler wrote favorably about it a few years ago though I have no idea if he’s still enthusiastic about it. And the Best Buy card was awesome back in the day–Amazon gift cards earned from their rewards program paid for Christmas gifts in the PFD household for a few years–but unfortunately for us they tightened up the loopholes.

Of course, this raises the question of what retailer credit cards are not worth getting. I don’t think any one person has the knowledge necessary to write a comprehensive list, but I’ll point out that the Old Navy card, despite being a sister card to the Banana Republic card, doesn’t do much in the way of promotions. (We don’t have a Gap card in the household so I can’t speak to that one.) We haven’t heard a peep from marketing departments for the Dillard’s card, the Dick’s Sporting Goods card, or the Fuel Rewards card either, though it’s possible the last one may still be valuable depending on what grocers are around you.

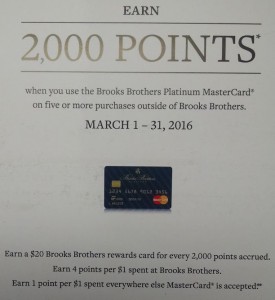

Oh, I’m sorry, did you click on this article because of that ‘ten percent rewards’ thing I mentioned? All right then. As mentioned in the DoC article, I recently received this nice little offer from the Brooks Brothers credit card:

I’ve read the fine print and the offer seems to be uncapped, so I dusted off my Brooks Brothers credit card. I’ll probably get some restaurant gift cards from my usual haunts before the promo period ends to run up the total. (When, oh when, will restaurants start selling prepaid Visas?) Keep in mind this is the first decent promo I’ve received on this card in a few years so I don’t think I’d recommend it just yet.

The other ten percent deal, which is I just made use of last night, is Toys R Us:

Note that this is a legitimate 10 percent off your receipt. It’s not given in the form of points and there are no hoops to jump through. And it’s in addition to any other sales (or at least that was the case for me last night). And since the 10% discount reduces the amount of sales tax you have to pay, this could actually be more like an 11% discount depending on what the sales tax is in your state. Knowing what I know now, would this 10% discount be enough to get me to sign up for the card? In my case the answer would be no since I don’t live particularly close to Toys R Us or Babies R Us. But if I did, and especially if I were still buying diapers and other baby stuff, that 10% could really add up. I suppose it could also add up if you were a reseller. It’s not just a seasonal thing either; they’ve been running 10% off on Thursdays for a while now.

In other news: Bass Pro Shops is buying Cabela’s, and Capital One is buying Cabela’s credit cards. I cannot figure out for the life of me if Capital One will also be taking over the Bass Pro credit cards as neither that article nor this release makes it clear. It’s a moot point anyway since I never shop at Bass Pro and they don’t sell gift cards.

What retail cards would I consider getting at this point? I’m thinking again about the BJ’s credit card since my membership is up for renewal, though the Chase Freedom keeps offering 5X on warehouse clubs. I’ve long wondered about the TJX card as well if anybody has any experience with that one. And that Sears TYP card DoC mentioned could be interesting too.

Recent Comments