The Test

Many of you are probably familiar with Zillow and its “zestimate” valuations. But if you’re looking for a guess as to what a house is worth, there are quite a few online tools out there where you can enter an address and get a number spit out. I thought it would be fun to try out a bunch of them and see how much (dis) agreement there is among all the sources.

Valuing real estate is more difficult in some neighborhoods than others. If you live in a stereotypical suburban neighborhood built 10 years ago housing valuation will be a little bit easier since the stock is mostly the same and there are plenty of comparables. As luck would have it, I live in a great neighborhood for putting these things to the test. It’s a gentrifying neighborhood with both tiny single family tear-downs as well as large, expensive new houses. There are a bunch of condos as well. The diversity of stock, both in terms of size, age, and finish will tend to throw off valuation algorithms.

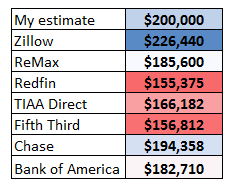

I’m going to use my house as a test subject since I keep up with the real estate market in my neighborhood and I have a pretty good idea about what my house would sell for. Since I don’t like to give out too much personal financial information, I’m going to convert my estimate to an even $200,000, which is close to the price of a median home in the U.S. I’ll normalize all the other estimates accordingly so that you can get a sense of the scale of variation.

The test subjects are: the aforementioned Zillow, ReMax, Redfin, TIAA Direct, Fifth Third, Chase, and Bank of America. To their credit, none of these sites require any personal information from you other than the address so you don’t have to worry about being hounded by realtors and loan brokers.

The Results

So here’s what we get when we plug my address into all those sites:

I recently added on to my house. Zillow knew this. Chase and Fifth Third did not but have a feature that lets you adjust square footage, bathrooms, and bedrooms. The rest of them all had the old data.

Bank of America actually gave a range ($119K to $247K) rather than the value you see, which is just the midpoint of that range. I know it seems like a big range, but like I said my neighborhood is an outlier in terms of housing stock variation so a range like that is defensible for an algorithm. I would expect lower variation for other neighborhoods.

The only estimate which came in above mine was Zillow’s, and I think that’s a function of them using newer data. They may be weighing newer sales more heavily as well (some of the comps in these things go back years).

Anybody else have opinions about the accuracy of these valuations?

Recent Comments