TALK IS CHEAP: Cell phone plans continue to get cheaper! The latest El Cheapo entry comes from FreedomPop, a company I wrote about a few weeks ago. And the plans don’t get much cheaper than $0/month, which is what FreedomPop plans to charge for its new entry-level plan. [Read more…]

I, for one, welcome our new Saverocity overlords

It’s official: Personal Finance Digest is joining the Saverocity family! From now on, you’ll want to go to the new homepage for the exciting content you’ve become accustomed to. You can find the new RSS feed here.

Why move, you ask? Good question! Among the reasons: [Read more…]

The ten most popular links!

My blog is a little different from a lot of others in that I want people to leave it and visit other sites. Sure, I have some original work, but my goal in starting this thing was to get all the cool stuff in one place, and I’m certainly not up to the challenge of producing everything worth reading in the domain of personal finance. I therefore consider it a success every time somebody clicks a link on my blog.

So with that in mind: in case you missed any of these the first time around, here are the ten most frequently clicked links I’ve posted in the past 90 days:

10. How to Book United Stopovers Online (Frugal Travel Guy): This is a nice travel hack that shows you how to wring more value out of your United miles.

9. Why You Should Die with a Lot of Credit Card Debt (Chicago Tribune): I included this article as an afterthought, so I was a little surprised at its popularity. Apparently, my readers are intrigued by the thought of sticking it to the banks from beyond the grave. (My readers are the best, and don’t let anybody tell you differently!)

8. The Leanest Start-up in Silicon Valley (Inc.) The heartwarming story of an entrepreneur who lives in his car to keep costs down.

7. Lending Club New Account Bonuses (Maximizing Money) This one had a nice little tip about how to play with the referral link to get better bonus offers.

6. How to Get (Almost) Free Credit Card Rewards (Consumer Reports / Yahoo Finance) A mainstream article about the dark financial arts.

5. Keybank $200 Checking Bonus Promotion (Hustler Money Blog) Apparently $200 to open a checking account is a pretty good deal. I think this one is available until September 20 if anybody is still interested.

4. Stock Up for Holiday Gifts by Recycling Ink at Staples (Saverocity) A great guide to turning a profit with Staples’s ink recycling program

3. Credit Card Cancelling Like a Pro, Part 1: American Express (Saverocity) Congrats to Matt from Saverocity, as his website was the only one to appear twice on this list. Apparently lots of you have Amex cards to cancel.

2. Success with Vcom ATM! Generate Points @ $.0049/points (Chasing The Points) Some high quality research in the growing field of manufactured spending.

Aaaaaaaaand the #1 most popular link of the past three months is….

1. Wells Fargo Credit Cards Rumor has it there’s some sort of uncapped 5% cash back offer on gas, grocery and drugstore purchases.

Have a great weekend!

What do marketers know about you? Thanks to Acxiom, you can see for yourself!

A lot of people wonder what sort of data big banks, retailers, and other marketing operations have on them. Thanks to Acxiom (and thanks to moderator mia at Flyertalk for posting a thread on this), we can all have a look for ourselves.

Acxiom, for those of you unfamiliar with it, is a massive consumer data company. They collect a wide variety of data on anybody they can and then sell it to other companies in order to help those companies market more effectively.

Which brings me to the topic of today’s post: Acxiom–as part of a PR campaign–is letting you have a look at what they know about you. They’ve got a site called About The Data where you enter your personal information to identify yourself and get a peek at some of what they know about you. I highly recommend going there right now and signing up. You’ll have to scroll down a little bit, as the sign-up is toward the bottom of the page. I’ll wait right here while you do that.

Ready? Good.

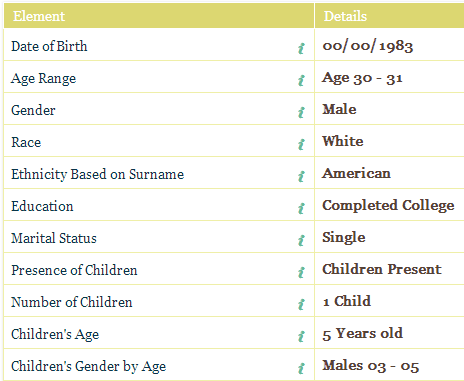

So what do you they know about you? They know a lot and not much at the same time. To see what I mean, let’s take a look at what they know about me. We’ll begin with the characteristic data:

Right off the bat, they missed my age by about a decade. (I do have a youthful exuberance about me, though, so perhaps their sophisticated models picked up on that.) Gender, race, ethnicity, education–they’ve got me there. I do have children, though more than one. And Mrs. PFDigest will be crestfallen to learn we’re not married.

They also have home data and vehicle data. Most of that stuff is a matter of public record, so Acxiom is pretty solid aside from failing to notice I have two cars (though one was only recently acquired, so I really can’t fault them).

But let’s take a look at economic data. Who wants to know how much money I make per year?

You’re not going to find out from Acxiom, because they certainly don’t know my income. They did correctly surmise that I’m a bank card holder, despite the fact that they don’t read my blog. I don’t know what’s going on with that ‘number of purchases’ field–the description says that it’s the number of credit card purchases made in the last 24 months at ‘select retailers’. It must be a very select bunch of retailers if I’ve only got one purchase.

Let’s move on now to the “Shopping” category, which is where things get wacky:

A grand total of three purchases? So far Acxiom thinks I’m a single guy who buys women’s footwear via mail order. This is not a flattering picture. Maybe I’ll do better in the “Household Interests” section?

Ding ding ding! Acxiom’s got me there.

So there you have it… that’s me in a nutshell.

Or rather, it was me in a nutshell. Acxiom is letting you make changes to your data as part of this PR initiative. I like to be the recipient of high-end marketing campaigns since I’m more likely to be offered good deals that way. Therefore, I gave myself a data makeover:

Much better! I wanted to put my income at something ridiculously high, say $800K per year, but $125K/$250K is as high as they go. Still, I hope that this will have positive repercussions on the quality of the offers that show up in my mailbox. Compete for my business, marketers!

Keep in mind that the data Acxiom is sharing with you is only the tip of the iceberg. I’ve looked through some of their stuff in my past life as a banker, and there’s a lot of it. Check out this PDF of their lifestyle segments for a taste of what they have to offer marketers. Here’s a sales page advertising some more of their capabilities.

While I’m waiting to be discovered by luxury marketers, I suggest all of you sign up and have a look at your data. How accurate does your profile look?

- « Previous Page

- 1

- …

- 16

- 17

- 18

- 19

- 20

- …

- 28

- Next Page »

Recent Comments