YOU’D BE SURPRISED–WE SURE WERE: Hats off to blogger Rapid Travel Chai, who just did 13 credit card applications and posted the results: 11 approved, 2 pending. To us, the remarkable thing is not that he did 13 apps, but that he did five from a single issuer, Barclays. The results? 4 approved, 1 pending. And another interesting fact: the credit line granted went up with each additional approval both for him and for a friend who also did five applications.

If his file gets looked at by a human, there’s a nontrivial chance one or more of his cards will be closed. But the key word there is if. Large banks are set up so that you can apply for a card, make your payments, and even get a credit line increase without a single human laying eyes on any of your information. Therein lies the source of our fun: any system has loopholes and any system can be hacked… and that is what Rapid Travel Chai has just demonstrated.

WHY YOU NEED TO READ THIS BLOG: An interesting article in Psychology Today on how too much data can impair your decision-making. Here’s the key excerpt:

Their experiment was simple. Participants were divided into two groups. Group 1 read the following:

Imagine that you are a loan officer at a bank reviewing the mortgage application of a recent college graduate with a stable, well-paying job and a solid credit history. The applicant seems qualified, but during the routine credit check you discover that for the last three months the applicant has not paid a $5,000 debt to his charge card account.

Do you approve or reject the mortgage application?

Group 2 saw the same paragraph with one crucial difference. Instead of learning the exact amount of the student’s debt, they were told there were conflicting reports and that the size of the debt was unclear. It was either $5,000 or $25,000. Participants could decide to approve or reject the applicant immediately, or they could delay their decision until more information was available, clarifying how much the student really owed. Not surprisingly, most Group 2 participants chose to wait until they knew the size of the debt.

Here’s where the study gets clever. The experimenters then revealed that the student’s debt was only $5,000. In other words, both groups ended up with the same exact information. Group 2 just had to go out of its way and seek it out.

The result? 71% of Group 1 participants rejected the applicant. But among Group 2 participants who asked for additional information? Only 21% rejected the applicant.

It’s not surprising that Group 1 was more likely to reject the applicant. Information overload is a well-known phenomenon; it’s why, for example, magicians use misdirection and pickpockets like to have an accomplice distract you. But the size of the effect is certainly striking, is it not?

Fortunately, there are plenty of websites out there that can help you sort through the clutter and focus on what is truly important. (H/T: TBP)

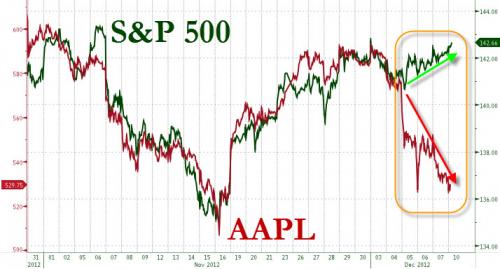

IPARADOX: We’re not stock market professionals, but we’ve been wondering about how the major markets could have diverged so sharply from Apple, the biggest publicly traded stock.

ZeroHedge has given what appears to be a sensible explanation: The S&P 500 is surging as Apple is falling because fund managers who were long Apple hedged with shorts against the broader market (the bet here was that Apple was stronger than the broader market). Now that Apple has shown weakness, they are unwinding their long positions on that stock, but at the same time they are unwinding their short positions on the broader market, thus applying upward pressure. As this Fortune article points out:

Ten years ago there wasn’t a single mutual fund that counted Apple as its largest holding, according to Morningstar. Today there are 683 — or one out of every eight funds. Some of the funds are just about as all-in on Apple as the IRS rules for mutual fund diversification allow. There are 12 funds with 20% or more of their assets in Apple. There’s now an Apple-only hedge fund — Bullish Cross Asset Management, which trades both AAPL shares and options

You might want to look at your mututal fund holdings and see if any of them are loaded up on Apple. Do you really want those mutual fund fees to pay someone to overweight you in Apple? We’re not saying the answer is no, we’re just saying it’s a question worth asking.

As for how to make money from all this: if we knew that, we’d be able to afford to hire people to do the blogging for us. Alas…

$10/$50 TARGET COUPON IS BACK: Okay, here it is. If you want some inspiration from last week, here you go.

Recent Comments