$300 INK CASH BONUS: This had escaped my notice, but the Chase Ink Cash is temporarily offering a $300 cash back bonus. It’s normally $200. This card has no annual fee and gives you 5% cash back on the first $25K spent on office supplies each year. The link I’ve posted is not an affiliate link since I am not cool enough to have Chase affiliate links, but if you are interested in the card, you might want to consider checking to see if your favorite blogger (besides me) has one. If you don’t already have an Ink card, I have to say the combination of a $300 bonus, 5% on office supplies, and no annual fee is pretty good and might warrant consideration on your part if you’re in the market for a business card.

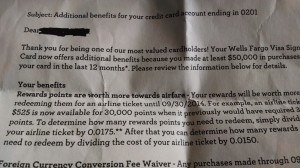

ANOTHER DAY, ANOTHER $500 FROM WELLS: Thanks to Doctor of Credit for bringing this to my attention–it’s the Business Elite Credit Card from Wells Fargo. There’s a steep minimum spend of $10,000, but you get 50,000 points for your trouble. DOC writes:

The main issue with this card is you can’t apply directly. You must apply through your Wells Fargo Financial Advisor and I presume you’ll also need a legitimate business to be eligible (eBay and Amazon “businesses” will not count). Thankfully the deal isn’t that great, you need to spending a massive $10,000 and you’ll only earn an additional 10,000 points for doing so. If this card earned at a decent rate at certain locations then it may be worth trying to get it, but as it stands I wouldn’t bother with it – even if I had a financial advisor with Wells Fargo and a business that warranted such a card.

I agree that this one wouldn’t be at the top of my list, but still, you can do worse than that. I’m still hazy on the Wells Fargo rewards program, but my understanding is you can get up to $750 of value from those 50,000 points, and that’s not a terrible return on ten grand of spending.

POSSIBLE CITI TRICK?: I received an email solicitation from Citi urging me to convert my Preferred to a Premier. The good thing about having a Premier is that you get a better rate of redemption on your ThankYou points. I noticed this buried in the fine print:

Any fee changes, including the annual fee and removal of foreign transaction fees, will be applied 51 days after you upgrade. All other benefits will be applied to your account within 11 days after you upgrade.

Does Citi want people to upgrade, redeem, then downgrade again? They’re practically begging for it!

On a related note, I’m attempting a hostile takeover of Citibank via Kickstarter–have a look!

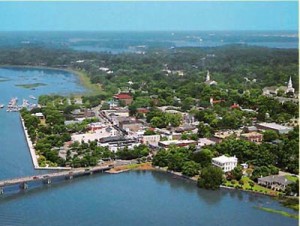

ATTENTION PARENTS: In the wake of the very cool Charlotte meeting of the minds, the Deal Mommy has a poll up to gauge interest in a meet-up focused on family travel:

I envision talking about topics such as:

- Scheduling around a school calendar

- Saving money without relying on only credit card bonuses

- Condo Rentals and hotel rooms for families overseas

- Booking award tickets when you need more than 2

- Destination Planning for families

- How to Save on Theme Park vacations

I think it’s a great idea. One of the presenters at the Charlotte meeting asked how many in the room were parents, and there weren’t tons of people raising their hand. On a related note, I’ve noticed my travel habits are different from many in this space, as I don’t fly first class and rarely stay in suites. (Real suites, not “Country Inn and” suites.) So if anybody’s interested, go on over to Deal Mommy and register your opinion.

Recent Comments