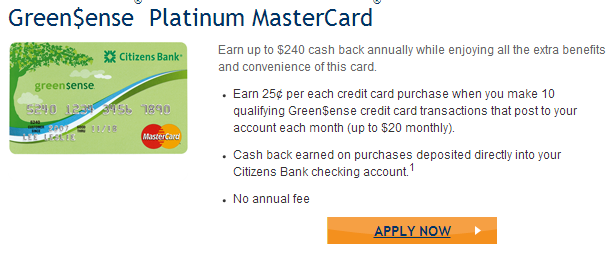

Chasing The Points alerted me to a new credit card from Citizens Bank, the Green$ense Platinum:

You can earn $20 per month with this thing, BUT you would have to make 80 transactions per month in order to get that $20. It’s a lot of work unless you can figure out a way to automate a bunch of small transactions. Given the much lower-hanging fruit to be had with manufactured spending, there probably aren’t a whole lot of people into this sort of thing right now. That makes it a great time to talk about this since there’s probably little danger of killing this deal by writing about it.

Where can you do a bunch of small transactions? Back in the good ol’ days that cranky old-timers are always talking about, you could buy Amazon gift certificates in one cent denominations. Ka-ching! In fact, Chase was paying out ten points per purchase at this time, and this led to a hundred-page credit card statement for at least one person (and I would assume more). Chase later raised the minimum gift certificate purchase to $0.15, then just a couple of months ago it went up to $.50. So unless you already do a lot of shopping there, Amazon’s off the table.

Next, there’s the question of how you can automate. I think there’s something called iMacros that can be used for this, though I’ve never looked into it.

So yes, there’s some work to do upfront, but I would imagine that as you get up the learning curve it becomes less work. I could be wrong, but I would also guess that if you build up a competency in small transactions you might find other opportunities as well. Worth the trouble? Beats me.

If you have a spouse, you’re looking at $480 per year, which is roughly 1% of the median household income in the U.S. Question: how many deals are there where you can earn a few bucks per month? If you put them all together, how large an income stream would that potentially be? Off the top of my head, I can think of Staples ink recycling and the Santander Bank thing, but I’m sure there are others.

Recent Comments