A giant thumbs down to IBM and AOL, both of which screwed with their 401(k) matching policy in a nefarious way: [Read more…]

The $9.84 credit card hustle, plus how to get unlimited free stock trades

THE $9.84 CREDIT CARD HUSTLE: There’s a blogs called Krebs On Security that’s done a tremendous job lately in covering the Target credit card breach. Blogger Brian Krebs has a new article out on what he calls the $9.84 credit card hustle–mysterious (and fraudulent) charges for $9.84 that are showing up on credit card statements. Krebs does quite a bit of digging into what’s going on, and it involves London, Cyprus, and Malta.

This goes to show that it’s usually a good idea to keep an eye on your credit card statements–it’s easy for a random charge to slip through unnoticed if nobody’s looking.

VIRGIN AMERICA CREDIT CARD IS BACK: Gary has the story. The gist:

My rule of thumb is that Virgin America’s points are deflated, that one Virgin America point is worth about 2 points in a European airline frequent flyer program. Their points are reasonably good, then, for redeeming on partners (with fuel surcharges). And the credit card is reasonably good at acquiring those points — since the price of partner awards is low, and the card earns one point per dollar, it’s like earning two points per dollar with a ‘regular’ award chart.

You can use the points for about 2.2 cents apiece towards travel on Virgin America, or for fixed-point redemptions on their partners.

There are some partner opportunities that may be of use is certain situations such as west coast to Hawaii for 20K miles roundtrip on Hawaiian Airlines. Aside from that, meh. Read on if you’re curious.

CARIBOU LAUNCHES LOYALTY PROGRAM: It’s nice to see that the Starbucks loyalty program has some competition:

Caribou Coffee Co. Inc. launched its Caribou Perks customer loyalty card Thursday [January 2].

Coffee drinkers began getting the cards Thursday morning to earn rewards like size upgrades, baked goods and drinks.

The Brooklyn Center-based coffee chain is using a surprise method of handing out the rewards. It isn’t saying how often or exactly what customers will get, but over time the rewards will be tailored to customer tastes.

Uncertain, erratic rewards? Hmm… that’s interesting, I suppose. In any case, you can get a free drink when you sign up here.

10,000 UNITED MILES FROM OPTIONSHOUSE: Here you go. You’ll need to fund with at least $5,000 and then do 10 trades. Not my cup of tea but I’m sure at least one of you might be interested. (H/T: Maximizing Money)

UNLIMITED FREE STOCK TRADES: My Money Blog reports:

Is the endgame for stock commissions really free trades? Silicon Valley startup Robinhood.io wants to try, this time in smartphone app form. Recently approved by finance regulatory agency FINRA to become a broker-dealer, this comparison chart shows their ambitious plan to offer unlimited free trades with no minimum balance requirement.

This has been tried before. Zecco stood for Zero Cost Commissions. They had no physical branches, free trades had to be placed online. They had a “lean engineering team”. They used social media. They tried to make enough money from margin interest and order flow to cover everything else. But it wasn’t enough, and they gradually had to raise commissions.

While we await the inevitable demise of this business model, you’re all welcome to spoon-feed me ideas for risk-free guaranteed-profit commission-free trades in the comments below.

AND FINALLY: A friend of mine is participating in the Sprint Mobile Health Accelerator competition. His team’s idea: “A mobile app that rewards users for tracking health data and participating in market research by subsidizing health costs.” You had me at “rewards”! Click here to give ’em a like on Facebook if you’re feeling charitable. Thanks everybody!

A Staples mystery! And the trouble(s) with money orders

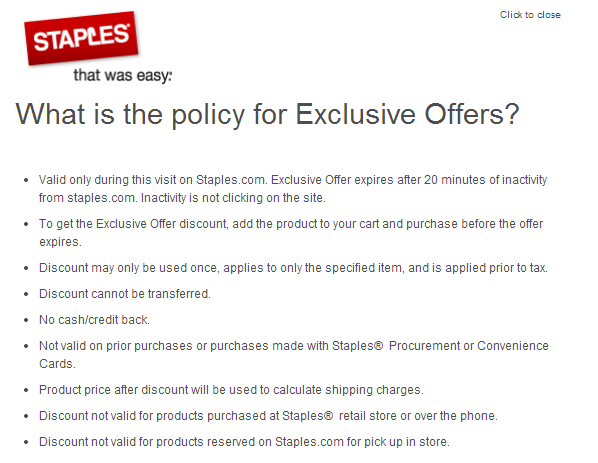

A STAPLES MYSTERY: Chasing The Points reports on a mysterious event that happened while perusing the Staples website: he brought up a Nordstrom gift card, let that tab alone for 15 minutes, and when he came back a message had popped up offering him 5% off that gift card if he bought it in the next 20 minutes. He can’t figure out how (or if) he did something to trigger it, and neither can I. My effort consisted of starting an anonymous browsing session in Chrome, pulling up the gift card, and waiting… but no luck.

INTERESTING ODDBALL STOCK PICK: CIBL, a discounted pile of cash with high optionality. If that title doesn’t grab you, then I don’t know what to say. Nate Tobik, as always, gives us a good read.

EDDIE LAMPERT EMPIRE CRACKING?: My curiosity about the financial health of the Sears empire was piqued several weeks ago when they began offering ridiculously generous bonuses for buying their stuff. Like this one, for example. Or this one, or this one, or this one. I wrote at the time:

I’m starting to suspect Sears’ managers–under pressure from incompetent CEO Eddie Lampert–are making a desperate and ultimately counterproductive attempt to meet their numbers with giveaways, so by all means get in on the action before the inevitable bankruptcy.

Which brings us to a CBS News article today:

Now, a group of clients that came over through Goldman Sachs (GS) have asked Lampert to return the roughly $3.5 million they invested with him in 2007, The Journal reports.

But instead of giving those investors cash back, Lampert is paying them partly with Sears stock. He’s returned some 7.4 million shares to them, in fact. As a result, ESL now only owns 48.4 percent of Sears’ shares, down from 55 percent from as early as October, Bloomberg reports.

So were investors happy to get paid in Sears stock? The answer can be seen in the company’s plummeting share price last week. The stock started a week ago in the $64 range — the day before Lampert disclosed the fund redemptions — and closed Friday at $48. And lurking behind that 25 percent drop is a harsh reality: Many of the investors who get paid in Sears shares will turn around and sell.

So… any other retailers getting a little too generous with their promotions?

MS 101: MilesAbound has an intro to buying money orders with a debit card. It’s quite clear and well-written, and it elicited some good discussion in the comments. World-famous Flyertalk personality Marathon Man writes:

The subject as a whole is not really one, in the opinion of me and many others, that can just be lightly put out there for discussion. There are oh so many things people may or may not know or have seen, and things that I personally would have to include if I ever were to actually write a piece about this subject. But my piece, if I were to write one, and I wont, would be hugely long and drawn out, and so that is one reason to actually avoid the subject.What things, you ask?

For example…

- Ever seen one where the numbers on the tear off recibo do not exactly match the check numbers across the bottom? What would you do with it if you did?

- Do you/others know the process, time and cost to recoup problematic MOs from Moneygram?

- IF–no, rather, WHEN the printer jams or breaks, what’s the standard length of waiting time one must endure to actually walk out of there with their MOs? AND what do you do if your bank actually fails to charge you for the ones you just got?

- What 3 forms do walmarts often make customers get booked in even if we know they shouldn’t and where is this book usually kept?

- Where does your ID info go when they enter it into the system on making you a +$3k purchase?

- What’s the most one single MO transaction can be and what will happen if you go a penny over?

- When the power goes out in the WMT, what is the procedure for recouping MOs that happened to be in process at that exact moment?

- If they try to reverse out a debit charge on a GC vs a debit card?

- WHY do banks really shut you down when you deposit MOs?

- Should you ever mail one? And when?

- Which major bank ATMs take them and which ones do not?

All good questions, and all have something to do with why I don’t bother with some of the more esoteric personal finance practices–it’s a pain. As always, YMMV.

DO YOU HAVE TOO MUCH MONEY?: No worries! Bargaineering has you covered with “Sock of the month club a cool new way to squander money, dignity.” What’s shocking here is not that not just one but a dozen companies offer sock subscriptions. Socks! Since the NYT is now covering this trend, I suppose the hipsters have already cancelled their sock subscriptions and moved on to some other whimsical thing while the huddled masses are getting out their wallets in order to sign up for overpriced socks. I guess we have to buy something different now that cupcakes are old hat, right?

How to make six figures with Airbnb! And how to make $1.25 (plus points) with Staples

HOW TO MAKE SIX FIGURES WITH AIRBNB: Some clever entrepreneurs are making good money with Airbnb.com:

Airbnb insists it’s not a hotel. Even while admitting that its hosts should be responsible for hotel taxes. While defending itself in New York City–where the attorney general demanded user data on 15,000 hosts in order to crack down on “illegal hotels”–the company pointed press to a survey showing, at least by its own measure, that 87% of Airbnb hosts are the primary residents in the homes they rent out to guests. In San Francisco, it’s 90%, according to another survey.

But among the other 10% are people like Bradley, who very much sees being an Airbnb host as a business. “With trading, you look for arbitrage opportunities, where you have an opportunity to buy things for cheaper and sell them for more,” he says. “In the same way, I was like, I can rent apartments for $2,000 a month, but if I were to rent them on Airbnb, I get $150 a night.”

At 90% occupancy, Bradley can make about $4,000 per apartment on Airbnb. He pays about $2,000 of that in rent and utilities. That comes out to about $2,000 profit per apartment per month, or $24,000 each year. With six apartments, he could make up to $144,000 in a year.

It’s a good read–the full article’s here.

WHO LIKES FREE MONEY AND POINTS?: Frequent Miler reminds us that there’s still money to be had at Staples:

- Register credit card with Plink. Add Staples to your Plink Wallet.

- Go to Staples.com via uPromise.

- Buy a single $100 Visa gift card for $106.95.

If all goes well, you’ll earn $5.35 cash back from uPromise and $3 worth of gift cards from Plink. Let’s value the gift cards at 95% face value so that we get a rebate of: $5.35 + $2.85 = $8.20. That’s pretty cool since the combined fees for the Visa gift card came to only $6.95. So, you earn $1.25 profit plus 5 points per dollar.

Why worry about your cost per point when you can actually get paid to take points off peoples’ hands?

UNITED GETS MEDIEVAL ON “MISTAKE” FARE USERS, SORT OF: Some folks on Flyertalk found and exploited a glitch with United’s website to book themselves $80 tickets to Hawaii, and United has responded by shutting down the frequent flyer accounts of the guilty parties. It seems as though only new accounts set up for the purpose of exploiting this software flaw with United’s site were shut down, so I’d say that’s fair.

TIMESHARE VACATION OFFERS: If any brave souls want two nights in Vegas (or three in Orlando) plus 10,000 HHilton HHonors Ppoints and a $200 certificate, all for just $199, here you go. This requires sitting through a timeshare presentation, so don’t go unless you’re fully prepared.

WHO LIKES BANK DATA?: Nate Tobik, who runs the interesting and well-written stock blog Oddball Stocks, has launched a new service focusing on bank investing. The site is called CompleteBankData.com and you can get a free 30-day trial here.

12 UNUSUALLY PLACED SPORTS VENUES: Cool pics, bro!

MONEY-SAVING TIP: Cooking at home is a great way to save money! If you don’t know how to cook, here’s an easy recipe to get you started: How To Make Ice.

What can I say, it’s Friday… enjoy the weekend!

- « Previous Page

- 1

- 2

- 3

- 4

- …

- 8

- Next Page »

Recent Comments