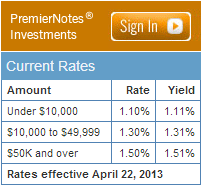

IF YOU HAVE EXTRA MONEY, DUKE ENERGY WOULD LIKE SOME OF IT: We don’t even remember how, but in the course of our internet wanderings we came upon this page promoting something called Duke Energy PremierNotes. This is a utility company offering consumers something like a money market account or checking account, except not as good, and you should stay far, far away from it.

There are two things you need to know about PremierNotes:

- They offer slightly higher rates than you can get from a savings account.

- They are not FDIC-insured.

Obviously there’s nothing wrong per se with investments which are not insured by the FDIC. The question is, does the additional reward offset the risk? How much higher are the rates on this investment vehicle vs. other liquid accounts?

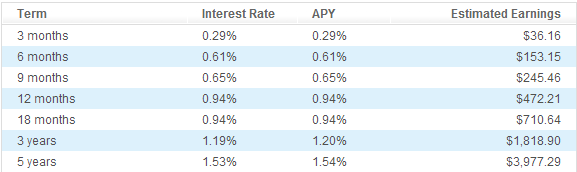

That’s not very high. By way of comparison, here are the CD rates at Ally Bank:

Note that if you pull your money out of the Ally CD before it matures, the penalty is only 60 days’ interest. So at Ally, you’re making an equivalent interest rate AND you’re federally insured AND there’s not a $50,000 minimum.

Note that if you pull your money out of the Ally CD before it matures, the penalty is only 60 days’ interest. So at Ally, you’re making an equivalent interest rate AND you’re federally insured AND there’s not a $50,000 minimum.

How risky is Duke Energy? As per their investor page, Fitch has them at BBB+, Moody’s has them at Baa2, and S&P has them at BBB+. In other words, they are just above a junk bond rating. If you want to invest in junk bonds, then invest in junk bonds–but do so by actually buying the bonds, preferably via a low-cost index fund or an ETF so that you’ll diversify your risk. Your rate of return should be several percentage points higher that the meager gruel served up by Duke Energy.

The Duke Energy PremierNotes pay you much, much less than they ought to given the level of risk you’re assuming. Why do they offer this product? Because they can. Because people without the inclination or the ability to think about their investments hand over their money to a trusted name.

What people are investing in this awful product, you ask? We’re not sure, but we did notice that Duke Energy PremierNotes has an “Employees and Retirees” page. According to BusinessWeek:

“I like to call them a bond with a checkbook,” said John Heffernan, director of the PremierNotes program at Duke Energy. “The unique thing about this is we’re selling them directly to the investors.”

Duke Energy started offering floating-rate notes to individuals about a year ago [Ed: this article is from June 2012], marketing them first to employees and through billing inserts to customers before advertising in newspapers, Heffernan said in an interview. The amount of debt outstanding through the program increased 59 percent to $126 million as of March 31.

$126 million! Odds are they won’t lose their money, but… it’s not worth the risk. Shame on you for offering this product, Duke Energy.

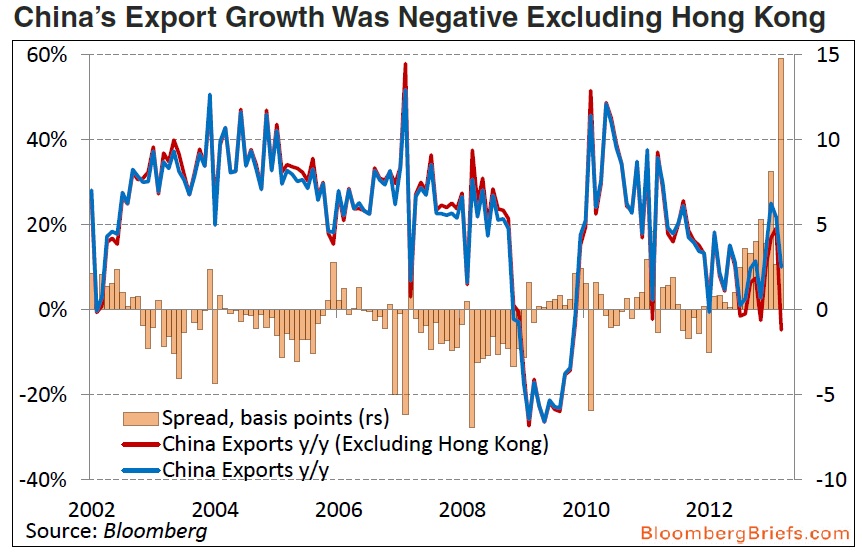

CHINA EXPORTS DECLINING: An interesting graph from Caitlyn at The Big Picture:

An explanation of what’s going on here:

China’s external sector is probably expanding much more slowly than overall export growth implies. Have a look at “unusual surges” in China’s “reported shipments to Hong Kong.” It seems the entire country is either channel stuffing or dumping goods or ever cooking books via inflated invoices. Another thesis is that Exporters are “repatriating capital through export transactions rather than through traditional methods” to avoid Mainland’s controls and/or taxes.

As Bloomberg Brief points out,

Chinese exports to Hong Kong jumped 93 percent year-on-year in March, while annual growth has averaged more than 50 percent since September. Hong Kong now accounts for 27 percent of China’s total monthly ex-ports, compared with less than 16 percent prior to September. None of China’s other major trading partners saw growth of this magnitude.

Odd stuff going on over there…

ONE LAST THING BEFORE WE LEAVE: Enter the code 10APRIL for $10 off a $100 order at homedepot.com (H/T: Slickdeals).

Recent Comments