BA 100K: The on-again, off-again 100,000-mile offer from British Airways is on again. Whether or not this is a good deal depends on whether you’ll take advantage of the sweet spots of this program, [Read more…]

Barclaycard is testing a 40,000 point offer… and last chance for an old Discover card

COMING SOON TO A MAILBOX NEAR YOU?: Courtesy of Frequent Miler, we learn that there is apparently an invitation-only 40,000 point sign-up bonus for the Barclaycard Arrival World Mastercard. The best public offer is 20,000 points, which is twice the offer we received in the mail last week, so nuts to you, Barclays. Keep your eyes open, as sometimes it does pay to open junk mail from banks. A 40,000-point bonus would put this card on par with the Chase Sapphire, though Chase still has the superior product as its points can be transferred to frequent flyer programs for values in excess of one cent per point.

CHANGING OF THE GUARD AT DISCOVER: Rapid Travel Chai lets us know that effective January 2 Discover is discontinuing its old lineup of cards in favor of the Discover “it” Card. It is therefore a good time to get a Discover card if you don’t already have one, as there’s a $200 bonus available with their cardbuilder tool.

NFL/NCAA APPAREL ON SALE: The normally high prices are somewhat reasonable now on Amazon. More info on Slickdeals.

Discover More Cardbuilder: $200 bonus! Also: your genes on sale

IT PAYS $200 TO DISCOVER: The Discover Card website has one of those DIY card pages where you can tweak various settings–APR, rewards, etc.–and pick your own card. If you choose “all available offers” and sort by “welcome bonus”, you’ll see that it’s possible to get a $200 bonus for spending $1,500. There’s also a 25,000 “mile” bonus, although it’s paid out over 25 months, so that’s probably not worth the trouble. (H/T: MyFico forums via FWF)

$1K IN ANNUAL FEES!: It can be both interesting and informative to look at people at the far end of the bell curve. We don’t know the exact nature of the travel hacking distribution, but we’re sure that Lucky from One Mile At A Time is pretty far toward the tail end. We say that with nothing but respect and admiration, of course. With the provocative title “I spend $1,000 per year in annual fees on credit cards I don’t use“, he lists each and every one of said inactive credit cards along with his reason for maintaining the card. Here are his cards and his reasons (and Lucky, if you happen to read this, we hope this excerpt isn’t too long), and we recommend reading his post for the full explanation.

Starwood Preferred Guest® Credit Card from American Express

Annual fee: $65 (waived the first year)

Reason I pay it: It gets me two elite stays and five elite nights towards Starwood Platinum status annually, which are nights I’d probably otherwise mattress run for.Starwood Preferred Guest® Business Card from American Express OPEN

Annual fee: $65 (waived the first year)

Reason I pay it: It gets me two elite stays and five elite nights towards Starwood Platinum status annually, which are nights I’d probably otherwise mattress run for.Citi Hilton HHonors Reserve Visa Card

Annual fee: $95

Reason I pay it: It gets me Hilton HHonors Gold status for as long as I have the card, which comes with free breakfast and internet.Chase Hyatt Visa Card

Annual fee: $75

Reason I pay it: It gets me an annual free night certificate good for any category 1-4 property, like the Andaz West Hollywood or Hyatt 48 Lex New York.Chase Priority Club Visa Card

Annual fee: $49 (waived the first year)

Reason I pay it: It gets me an annual free night certificate good for any Priority Club propertyThe Platinum Card® from American Express

Annual fee: $450

Reason I pay it: It gets me a $200 annual fee credit ($400 the first year, as discussed here) which can be used to purchase airline gift cards, gets me lounge access which I’d otherwise pay for, and gets me access to Fine Hotels & Resorts.US Airways Premier World MasterCard Card

Annual fee: $89 (waived the first year)

Reason I pay it: It gets me an anniversary bonus of 10,000 Dividend Miles annually.Citi Platinum Select AAdvantage Visa Card

Annual fee: $95 (waived the first year)

Reason I pay it: As discussed here, gets me a 10% rebate on award redemptions, up to 10,000 miles per year.

We don’t have the inclination to travel so much as to justify this sort of a credit card portfolio, but it’s always helpful and fun to see what’s possible when you think creatively.

KNOW THYSELF: We’re going to do something a little different today and recommend a product we use. We don’t receive any money or freebies for this, it’s just something we think is pretty cool and off the beaten path, plus they just lowered their price from $299 (where it’s been all year) to $99. The product is the genetic testing from 23andme.com. So far we’ve had Mr. and Mrs. PFD’s DNA sequenced, as well as our parents and even one grandparent. What, you ask, does your $99 get you?

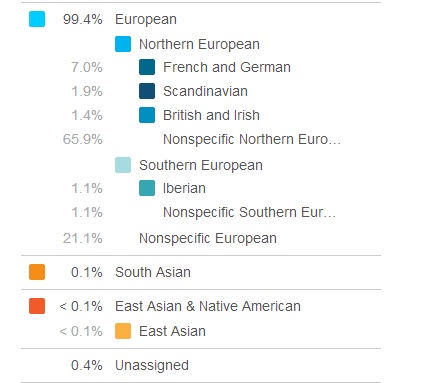

First of all, it tells you something about your ancestry. In the case of Mr. PFD and his north European ancestry, it’s pretty straightforward…

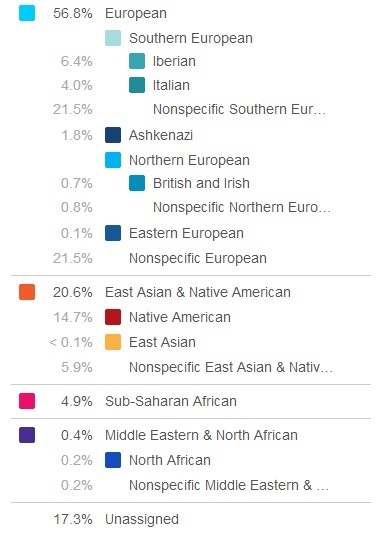

…but Mrs. PFD, who hails from Central America, is a lot more interesting:

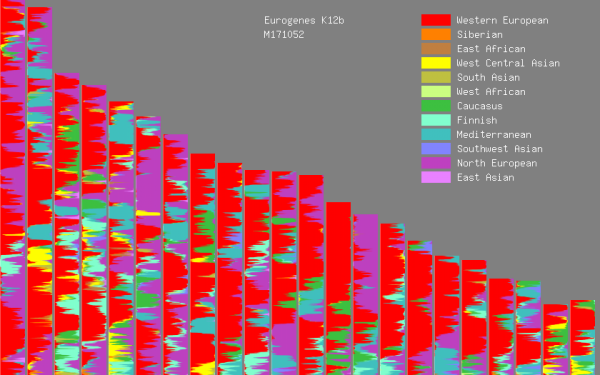

There are also websites to which you can upload your 23andme data to do further analysis. 23andyou has links to third party websites like GEDmatch that let you do cool things like chromosome painting:

Besides data visualization, you can get information on genes known to affect your health. We, for example, have the APOE-e4 variant, aka the Alzheimer’s gene, which doubles one’s risk of Alzheimer’s, stastically speaking, from 7% to 14%. Since there is some speculation that dementia is linked to a lousy diet, this helps keep us inspired to lay off the chips.

If you’re into genealogy, there’s also a relative finder that helps you find distant relatives. We’ve been contacted by distant kin in Poland and Russia, among other places. It’ll also verify whether or not any two people are, in fact, related, so if there are any paternity questions in your family, you might want to think twice about this.

If you want to get really hard core, you can do your own data crunching. The excellent Razib Khan shows you how here. If you’re wondering what kinds of question can be answered with said data crunching, here’s a recent post from Razib looking into a potential Indian ancestor for a pasty white guy.

And that’s enough genetics for now. We’ll get back to torturing Fortune 500 corporations and other odd personal finance topics tomorrow, we promise. Speaking of which, we hear that a tennis star has cornered the market in donkey cheese…

How many credit cards can you apply for at once? More than you think…

AT LEAST SEVEN, APPARENTLY: FWF’s resident credit card expert, who goes by the nom de plume imbatman, did what is known as an app-o-rama a few months ago. This is a practice wherein multiple credit cards are applied for at once in order to maximize either the amount of available credit offered (this would have been the case 4-5 years ago when 0% offers flowed freely and savings account rates were 3-5%) or, as is more common now, to maximize the signing bonus.

He applied for eight cards simultaneously: Starwood Amex, Gold Biz Amex, US Bank FlexPerks, Chase SouthWest Airlines, Barclays USAir, Citi Premier MasterCard, Citi Premier Visa, and the Discover IT.

The results? Approved for all cards except the Citi Premier Visa.

But wait, you say… surely his credit score has tanked to subprime levels? No: Experian went from 751 before to 725 now, Equifax went from 796 to 771, and TransUnion went from 753 to 737. And we can pretty much guarantee you those scores will be back to where they were, if not higher, in a few more months.

$5 OFF $25 AT AMAZON: Here you go, and all you have to do is type a name and post your response to Facebook.

A CLOSING THOUGHT: “In cable news, debate means two opposing ideologues get equal time to spout bullshit. In trading, opposing views means someone is actually going to be right and someone is actually going to be wrong. Seek out debate and use it to clarify or disprove your thesis. Find people who will challenge your opinions and listen carefully to their arguments. Don’t be afraid to change your mind.” –10 Tips From the Trenches, Dynamic Hedge (H/T: Barry Ritholtz)

Recent Comments