Welcome back to Chase Sapphire Preferred week! Today’s topic: the Chase Sapphire Preferred credit score conundrum, aka what credit score do you need to get one of these cards? And does it even matter anymore?

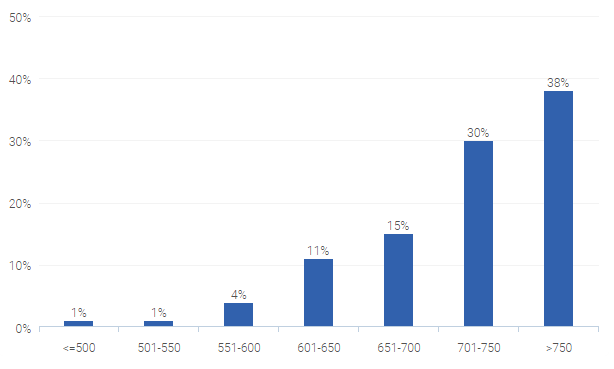

As luck would have it, there’s some good data out there on this. Credit Karma surveyed its members on the CSP, and here’s the Chase Sapphire Preferred credit score distribution they came up with:

I also went through the comments on that CK page and tallied up the scores for those who said they were approved, and I came up with an average of 712. This obviously isn’t the most scientific method ever, but 712 is actually pretty close to what I’d imagine the midpoint to be based on looking at the graph. If you’re curious, you can also go read the relevant posts in the myFico forums.

Of course, there’s more to getting approved for a Chase Sapphire Preferred than just a credit score. As you may have heard by now, Chase has tightened up the underwriting on its Ultimate Rewards-earning cards (i.e., the Freedom, Sapphire Preferred, and Ink) and will not approve you if you’ve had too many cards open recently. Doctor of Credit and Miles to Memories, among others, have reported on this new, unfortunate development. And there are some other datapoints in this Flyertalk thread if you’re so inclined.

How many new credit cards is too many, you ask? The consensus is that even five new cards (both Chase and non-Chase) in two years is too much. So even if you have a credit score of 800, you can still get turned down. And it gets worse: according to the Doctor of Credit article (which you really should go read), even being added as an authorized user to another card counts against that limit of five. The Chase Sapphire Preferred is a jealous lover, it seems.

Worst of all, according to DoC:

A friend of mine has 3 INKs and applied for 2 more. Not only did they deny his applications, the reconsideration rep forced him to close two of his three existing cards.

I’ll repeat that: the rep denied his applications and forced him to close 2 of his existing cards.

So if you’re a newcomer to the wonderful world of credit cards, things are in your favor. Just make sure you apply for your Chase Sapphire Preferred before you apply for any other cards, lest you be denied the 40,000 Ultimate Rewards Points that is rightfully yours.

For the rest of us who have high credit scores and several credit cards, the new underwriting standards represent an unfortunate development in the hallowed history of the Chase Sapphire Preferred card. The Frugal Travel Guy is fond of reminding us that our credit is one of our most important assets. How are we, the citizens of the United States of America, supposed to utilize that asset if we can’t apply for more than 2 or 3 credit cards per year? Let us hope that cooler heads (by which I mean the people in the marketing department) prevail at Chase credit card headquarters.

Jamie Dimon, if you’re reading this, can you help us out? It’s senseless to withhold the Chase Sapphire Preferred® card from those who need it most. I’d like to think that my children will grow up in a world where this fine card is available to all Americans, not just a privileged few. It is imperative that we put this Chase Sapphire Preferred credit score issue to rest and move forward!

Recent Comments