HOW *YOU* DOIN’?: If the New York Times is to be believed–and we’re not merely being rhetorical with our use of that ‘if’–then it is no longer merely banks who use your credit score to size you up. Along with anecdotal evidence of men bringing up credit scores on first dates, the NYT points out the existence of credit score dating sites creditscoredating.com and datemycreditscore.com. We suspect the credit score dating stuff is overblown, but there are some more grounded concerns brought up in the article. For example:

Lauren Dollard, a 26-year-old assistant at a nonprofit in Houston, said her low credit score had helped to stall her romantic plans. Her boyfriend is wary of marrying her until she can significantly pay down the more than $150,000 she owes in student loans and bolster her credit score, she said.

It is striking how many financial ills can be traced back to student loans, yes? College is an increasingly bad financial deal for many in the middle class, as ZeroHedge recently pointed out. Then there’s a more mundane issue brought up here:

John Hendrix, a 33-year-old chemist in San Francisco, said he worried that the vast disparity between his girlfriend’s credit score and his own low one could create tension in their relationship. When the couple leased a car in October, Mr. Hendrix had to leave his name off the contract because his poor credit scuttled his chances for the bargain interest rate that his girlfriend qualified for.

Hopefully Mr. Hendrix has availed himself of the internet and at least tried to get that black mark removed from his record. Then again, going in on a car with somebody you’re not married to is generally not a strong financial move, so maybe FICO speaks the truth about his reliability. (H/T: Flyertalk)

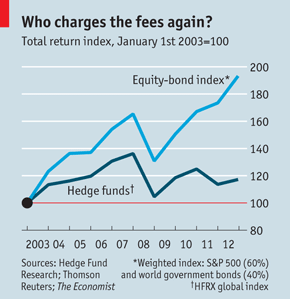

HOW TO MAKE OTHER PEOPLE RICH: We find the continued existence of most hedge funds a mystery to some degree. Take a look at this graph from the Economist:

We can understand why somebody would want to run a hedge fund: the fund generally gets paid 2% of assets per year plus 20% of the gains, so if you get lucky you can find yourself with millions or even billions of dollars in a fairly short period of time. But why would you want to invest in one? Sure, there are a few hedgies who are very good at what they do, but as Barry Ritholtz points out, good luck identifying the best managers ahead of time.

It’s not just that hedge funds do badly; it’s that people pay them a lot of money to do badly. Monkeys with a dartboard could perform much better at a much lower cost (this is the idea behind indexing, and it works more often than not). Hedge funds are essentially a wealth transferance mechanism: they transfer wealth from pension funds and retirement accounts to the people who run them. Asset managers ought to know better, but then again there is a lot of pressure in today’s low-rate environment to generate above-average returns, and better to fail with the herd than fail alone.

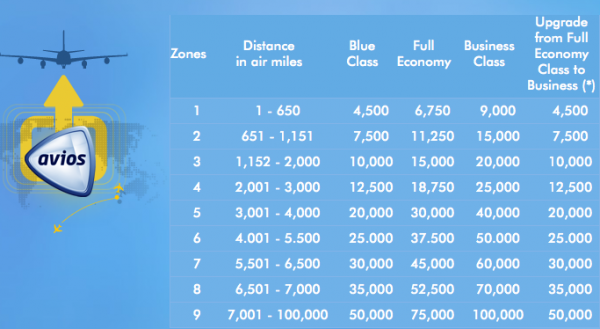

A HELPFUL CHART: Hack My Trip recently posted a very helpful chart we hadn’t seen before showing the amount of Avios it takes to redeem for flights of a given length. The chart shows why we love British Airways’s frequent flyer program so much. There’s a sweet spot for flights of less than 1,151 miles–you can do such flights for only 9,000 to 15,000 miles roundtrip. Taxes and fuel charges are minimal if you’re flying domestic and you can book at the last minute. What’s not to like?

$125 FOR OPENING A CHASE CHECKING ACCOUNT: Here you go. You need to keep a minimum balance of $1,500 or do a monthly direct deposit of $500 per month. If your date asks about your FICO score, this would be a great way to re-direct the conversation.

Recent Comments