Congratulations! You’ve just been placed in charge of a loyalty program. Maybe you work for an airline, or a credit card issuer, or a retailer–no matter. Your boss just told you that costs are out of control and cuts need to be made. How do you maintain or even increase the perceived benefits of your program while reducing the actual benefits to the consumer?

In other words, how do you make your program more evil? Here are some ideas to help you get started:

- Give the rewards an early expiration date. Spirit Airlines, take a bow! Your rewards last about as long as Rite-Aid’s!

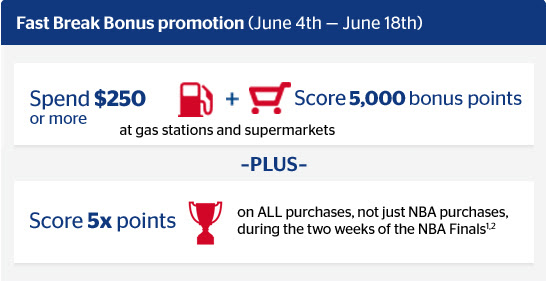

- Slowly erode your rewards currency with inflation. Giving out more points than you can afford to redeem guarantees you’ll have to devalue sooner rather than later. This time-honored tactic is particularly popular with hotel chains, as we generally see a few major devaluations per year from the big players.

- Give out rewards, but keep redemption costs a secret. Delta Airlines has really pushed the envelope in this area and is a source of inspiration to evil marketers everywhere.

- Make your program so confusing that MBAs have to sit down with a spreadsheet for an hour or two in order to figure out if there’s any consumer benefit. Key Bank is the gold standard here.

- Run a normal rewards program, except multiply everything by five. That way you can offer your customers a 50,000-point bonus that’s really only the same as a 10,000-point bonus from other rewards programs. This is how PNC Bank rolls.

- Add numerous terms and conditions to make it difficult for consumers to get value. The frequent flyer industry–not to mention the cottage industry of award ticket consultants–would not exist were it not for this tactic. Capital One’s marketing strategy is in part to position its products in opposition to this phenomenon. Which reminds me…

- Call your points “miles” when they’re not actually miles. Miles, though difficult to use, have a certain cachet. Consider rebranding your credit cards points as miles to distract customers from the fact that you’re forcing them to redeem on travel instead of giving them cash back.

- Blackout dates. The loyalty marketer’s best friend! And there’s a lot of way to skin a cat when it comes to blackout dates. For example, you can advertise no blackout dates for your standard products–but then reclassify almost everything you have as premium.

- Add a minimum redemption amount. This all but guarantees the masses will collectively harbor millions of unredeemed points in their accounts. If you have a 5,000-point minimum redemption for your credit card program that pays out 1 point per dollar spent, that’s thousands of dollars of spending your customers will have to do to get their next reward! Suckers! (And as commenter MB notes below, Barclaycard just changed the minimum redemption for its Arrival Plus to $100. Well done, Barclaycard!)

- Charge customers a fee in order to redeem. This is a great strategy for airline loyalty programs since customers have been trained to accept nickel-and-diming anyway. If charging everybody a fee is too evil even for an evil loyalty marketer such as yourself, you could just come up with a way to charge a lot of people, but not all of them, a fee. For example, many airlines charge you for using frequent flyer miles less than 21 days out. Nice going, United and American! And special praise goes to Delta for disguising its 21-day fee!

This list is by no means comprehensive, as the list of evil loyalty marketing tactics is too long to list here in its entirety. But hopefully I’ve given you enough to make your loyalty program a little more… evil.

Recent Comments