I’d never thought much about the BJs credit card before, but BJ Wholesale Club–the #3 retailer in its segment after Costco and Sam’s Club–recently opened up a branch more or less right next to my house. Since the nearest Costco or Sam’s Club is 15 minutes away in good traffic, we joined BJ’s and we already love having something like this so close.

There are multiple types of membership at BJ’s, though, plus multiple BJs credit card options on top of that, and it takes a bit of work to determine which one is optimal for your particular situation. For anybody dealing with this, here are the options along with some thoughts on picking out the one that will work for you.

Standard Membership: This costs $50 per year. If you’re not sure how much you’ll spend there, a standard membership is the way to go to start off with. Note that BJ’s sometimes runs promotions on memberships. With little effort we found a coupon for $10 off, and there have been other promotions to take the cost down even lower, so Google before you join.

BJ’s Perks Rewards Membership: This costs $100 per year, but it entitles you to 2% back off your purchases, excluding the usual list of forbidden items–lottery tickets, gift cards, alcohol, and so forth. That’s 2% back on top of your usual credit card rewards, and keep in mind that unlike certain other wholesale clubs, BJ’s accepts all credit cards. To get back that incremental $50 over the regular membership fee, you’d have to spend $2,500 per year, or right around $50 per week. Worth it? That’s up to you. I plan to wait and see how our shopping patterns shake out, but I wouldn’t be surprised if we decide to upgrade.

Of course, if you can purchase a standard membership at a discount but pay full price for the Perks membership, that effectively makes Perks less attractive. If you can reliably figure out how to pay $25 per year instead of $50, that means you’d have to spend $75 per week, not $50, to make the Perks level pay for itself.

BJ’s Perks Plus Credit Card: The website makes it a little confusing and lists a $50 fee for this card, issued by Comenity Bank, but just to be clear: you don’t pay an additional fee for the card vs. a standard membership. With the Perks Plus credit card you get 3% back on all your purchases with the card, but note that you can actually do better than 3% with the combination of a 2% Perks membership (which, let’s not forget, costs $50 more than this card/membership combo) and a 2% rewards credit card. You get 10 cents per gallon off your gasoline purchases as well. With gas currently around $2 in a lot of places, that’s 5% off, which is pretty good.

Cardholders can also get $10 off their membership via auto-renewal, so that saves a bit of hassle in looking for a deal every year. The value in this card comes from the ability to get pretty good rewards along with a reduced membership fee. Note that if you spend more than $6,000 or so per year (about $120 per week), you’re actually better off with the $100 Perks membership plus a 2% credit card.

BJ’s Perks Elite Credit Card: As with the Perks membership, there is a $100 annual fee, but you can get $25 waived with an auto-renewal. You also get 5% off your purchases, plus the gas discount. Once you get to a few thousand in annual spending, this card becomes the superior option. Now that I’ve run the numbers, this card actually looks like it good be a pretty good value for my family, but like I said I’m going to wait to see how things go.

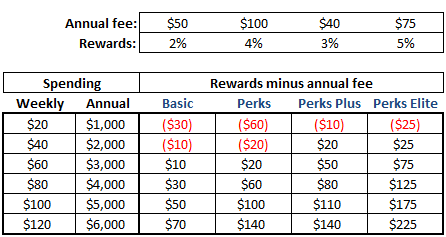

I made up a table to lay out where you’d stand with each of the four options. If something looks wrong, please comment below. I had to simplify to make the table easy to use. I assume you’ve got a 2% card and that you’re paying the annual fee as given in the table (i.e., no bargain-hunting on membership fees, plus you enroll in auto-renew with the BJs credit cards). I didn’t take gas discounts into account either. Obviously, your mileage may vary.

And if you’re looking at the credit card options and thinking, “A $50 difference isn’t worth it for a credit card hard pull,” keep in mind these are annual savings. So if you’re reasonably confident you’re going to be a member for more than a year, take that into account when making your decision.

[…] for you I ran the numbers to see exactly what level of spending to make the card worthwhile, so go here and take a look. Note that if you’re on BJ’s email list you can get a preapproval for this one, though […]