ANOTHER WAY TO LOAD BLUEBIRD: Unbeknownst to me, this one apparently has been bubbling up for a little while, but now that Million Mile Secrets has written it up, there’s no benefit to being subtle about it. It turns out that the no-fee Home Improvement card–Frequent Miler has some background on this product here–can be used to load the Amex Bluebird. Now that the word is out, this one may have a limited shelf life, so carpe diem.

You can set a PIN with this card now, though apparently that’s not necessary if you’re going to load it at a Walmart ATM. Folks are reporting mixed results with their attempts to pull this off, so perhaps a small test is in order before you go whole hog.

THE CHINESE POINTS AND MILES UNDERGROUND: A reader named Peng wrote me with some interesting information I was not familiar with:

Mitbbs is a Chinese BBS forum based in the U.S. Most of the Chinese immigrants and students come to that site everyday. There is a “Money” division, in which people talk about all these credit card tricks everyday. Also, there is a “Flea Market” division, in which you can sell the points/miles you earned from the credit cards. Some people collect the points/miles to buy air tickets and build up their frequent flyer status.

In the summer when the students and visitors are both buying the air tickets, the China-US round trip tickets can be as expensive as $2,000, so in this case award tickets are way better than buying with cash. So in the summer some travel agencies collect the points/miles in the “Flea Market”. United miles are normally worth 1.8c/mile, sometimes ppl will get 2.1c (I saw this once last summer).

The award ticket for China-US round trip costs 65k (Coach Class), which face value is $65k*1.8%=$1170, way better than $2000. So buying 1.8c still gives the collector big profit margin out there. Starwood points are normally worth 2.1c/pt, sometimes 2.2c/pt. I sold my 40k SPG bonus (30k from the intro offer) at 2.2c/pt this summer.

…Some other points/miles values: Amex MR 1.6c/pt, AA miles 1.8c/mile, USAirway miles 1.7c/mile Delta 1.3c/mile, Citi Thank you Point 1.05-1.08 c/pt (It changes all the time).

Interesting stuff–thanks Peng! For the record, I don’t recommend this practice as selling your miles is against the terms of service and companies can shut you down, take your miles, and/or blacklist you for doing so–but then, some of you are going to do it anyway, so if you do, you may as well get the best value. There’s also a Fatwallet discussion of rewards2cash.com if anybody’s interested.

SPEAKING OF MILEAGE VALUATION: A research group called IdeaWorks did a study on United’s frequent flyer program. The conclusions contained therein are not earth-shattering (first class redemptions get you the most bang for the buck) but it’s got some good data and pretty charts.

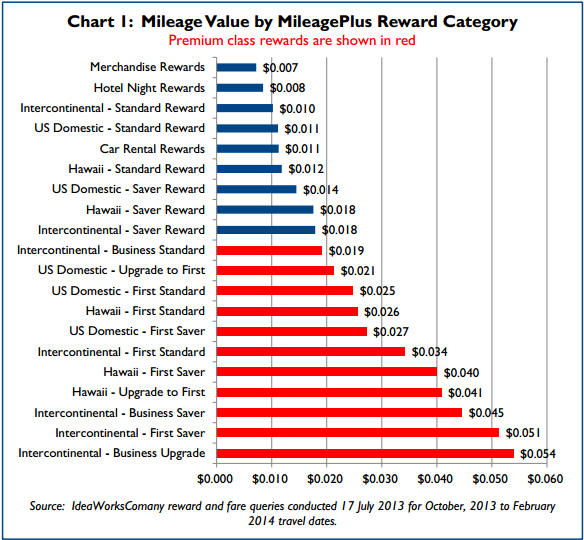

For example, here’s the value per mile for the various tiers of award redemption:

Here’s the same data with hotel, car rental, and merchandise redemptions thrown in. You see why the people at boardingarea.com always go for the business and first-class awards?

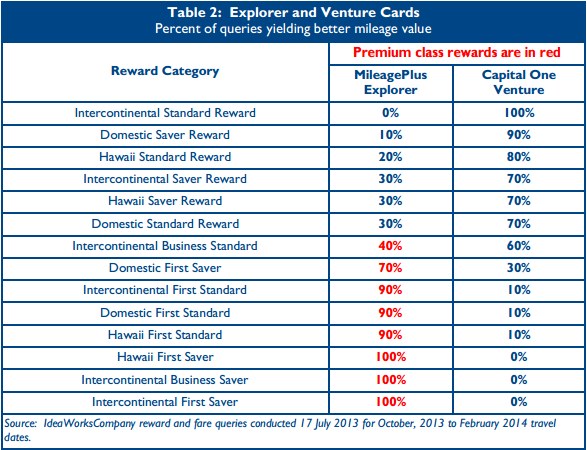

The study also compared the United Explorer credit card to the Capital One Venture card to see which one is better for the different types of redemptions. The results:

All of which is to say that credit cards and frequent flyer programs are a great value for people who know what the heck they’re doing, which is why you should be reading fine blogs like this one.

Recent Comments