Matt is doing a contest on the forum, called the Cheapskate challenge, giving away $100 to the person that can get the lowest possible price on a range, taking into account shopping portals, discounts, etc., and it reminded me of a prior post, so I updated it. Good luck!

With Black Friday (or Thursday, depending on what store), Cyber Monday, the holidays, and all the other days in between looming on our calendars, I decided it would be apropos to speak about a thought process for a purchase, to maximize our dollar value (and potentially our miles!). This applies as much to travel as to actual goods. My personal algorithm involves three steps, and I use it for most anything over $10. I’m not advocating that you use this for everything, but the more you use it, the easier it becomes. Here are my three steps, in order:

1. Review

2. Reduce

3. Reward

See? It’s simple, just three steps. Let me go over them.

Review – this is the hardest part, for me at least, and really only applies to discretionary purchasing or pleasure travel, although I feel as though you should periodically reassess if your essentials are really essential (such as cable). For me personally, travel is a high priority, more so than accumulation of “stuff”, so this rule applies less if I decide I want to travel somewhere. If I want to buy something, and I don’t need it right away, my goal is to sit on it for at least 48 hours and not think too much about it. If I still feel like it’s something I definitely need to purchase after that time frame, I’ll go ahead and pull the trigger. For instance, I was agonizing over getting a new refrigerator for several months last year, due to lack of space and crappily functioning freezer, before I finally pulled the trigger; in the end, since I still felt I needed it, and especially because I’d done so much research and homework on prices, I felt it was the proper purchase (detailed below in anatomy of a purchase).

Reduce – This step is easier, although it requires the most legwork. You always want to get the absolute best price for anything, especially for pricier purchases on goods and travel. For travel, I’ve detailed using ITA matrix to search for cheap fares. Other websites I search for cheap fares are Kayak, Hipmunk, and skiplagged, the last of which searches for hidden city and throwaway fares to search for cheap flights. If I have a trip in mind for the far future, I’ll sign up for alerts from airfare watchdog to let me know if the fare drops. Finally, The Flight Deal has great deals if you live in a major city. Booking cheap award travel is a whole other post, which will come subsequently.

For deals on “stuff”, most people know about Groupon and Living Social, but I subscribe to a bunch of other deal sites. Slickdeals and Bradsdeals always have breaking deals, The Wire Cutter has great reviews in addition to deals, and then there’s always one of my favorites, Lifehacker, which gives a great rundown of 10 tricks for getting discounts on anything.

In terms of coupons, I have not gotten into extreme couponing like many people online have, but I am a big fan of using gift cards, as you can often get a good percentage off the price. I’ve used Card Pool most often, but a great aggregator for gift card sites is Gift Card Granny.

Finally, USE YOUR MILITARY ID! Probably the reason you’re on this site is because you’re in the military, and we’re all about leveraging that for perks and benefits. I’ve already detailed what perks you receive for flying military, and will be going over hotel and lodging perks in an upcoming post. For buying things,Military.com has some great discounts on it, as does Military Benefits. It never hurts to ask if the retailer you’re at has any military discounts – I’ve definitely been surprised before when I’ve asked.

Reward – The most fun part of buying something is getting rewards back for it. If you’ve never heard of them before, I want to introduce you to shopping portals – they are the best (and for me, the only) way to shop for things online. In it’s most basic sense, you start in the portal, click through to whatever merchant you’re using, and get money or points for using that portal. There are several different types – cashback sites, airline portals, where you get airline miles for purchases, and bank portals, like American Express Rewards, and Chase Ultimate Rewards. There are many portals though, but luckily for us, we have Cashback Monitor, which is an aggregator of portal rewards, and although there are other aggregators, this is by far the best one. You type in whatever merchant you’re using, and it gives you the best rates for cashback, airline, hotel, and bank portals. Unfortunately, the merchant I use the most, Amazon.com, rarely has any portal rewards, but it never hurts to check. Many of the discount travel sites, such as Expedia, Travelocity, and Orbitz are represented on shopping portals, so if you’re booking through them, make sure you use a portal.

Another way to get rewarded that I use all the time is airline dining rewards. What you do is pick which airline dining program you want to use, register whatever credit cards you might be using, and everytime you patronize a restaurant in their list, you get some airline miles back. Check out the Rewards Network, as you can get miles for Alaska, Delta, United, Southwest, US Air, or several others. Unfortunately, you can only pick one airline or program at a time, but can register as many credit cards as you’d like. I’m continually surprised when I get an email saying I’ve gotten rewards from dining at a restaurant where I had no idea I was getting rewards.

Finally, using the correct credit card is of paramount importance for getting more rewards. Frequent Miler has a great rundown of the best credit card bonus categories, and in a subsequent post, I’ll do an overview of the best cards for the military member.

The Bottom Line:

–REVIEW – Sit on it for 48 hours

–REDUCE

-Airfare deal sites

-Reduced good deal sites

-Gift cards and coupons

-MILITARY ID!

–REWARD

-Shopping portals, Cashback Monitor

-Rewards Network for dining

-Using the best credit card

—————————————————————————————————————————–

So, enough talking, let’s go over my recent purchase of a new refrigerator (exciting I know!) and how I halved what I normally would’ve paid:

Anatomy of a purchase

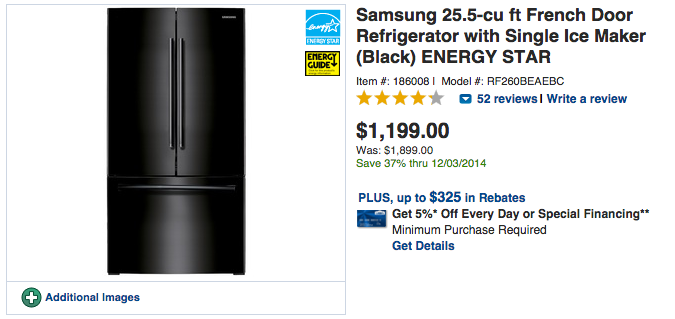

I knew from lifehacker that Oct and Nov are the best times to buy appliances, especially around Black Friday, so I started searching on Lowes, Home Depot, and Best Buy. I knew going in what dimensions I needed, that it needed to be black to match the other appliances in my kitchen, that my max was $1500, and that I needed more square footage than my current crappy fridge, so I searched based on that. I found this one on Lowes.com, which was 37% discounted on the site, $1199 down from $1899, the same one on homedepot.com, which was around $300 more expensive, but had a 38% discount, and this one on bestbuy.com, which was indistinguishable from the one at lowes and $100 more. All three stores offered free shipping, which is huge. Because Bestbuy doesn’t offer a 10% military discount like Lowes and Home Depot do, I nixed that one. Next I went to my local stores, and the only difference between the two was that the more expensive one had an outside ice and water dispenser, while the cheaper one at Lowe’s had an internal ice maker. I was ok not having an external dispenser, especially since I’d be saving $300, so I decided on the one from Lowe’s.

I could’ve taken advantage of a shopping portal had I ordered online, but your 10% military discount is only valid for instore orders, so I decided that was a more lucrative discount. I wanted to blunt the cost a little further than the 10% discount, so I went to Cashback Monitor, and looked up my favorite gift card retailer, cardpool. Topcashback, one of the most popular cashback sites, was offering 2% cashback for purchases through cardpool, up to $1000. Perfect! I went to TCB, clicked through to cardpool, and found 3 cards which added up to $997, but which only cost $925, a 7% discount, and bought them (there aren’t any credit card categories for this, so I used my Amex SPG which offers 1 SPG point per dollar). I bought gift cards which were redeemable on mobile devices, so I didn’t have to wait for physical cards through the mail, and since I planned to use them the next day. Finally, there was still a balance to be paid, because I didn’t get enough gift cards to cover it – luckily, at the time, I used the Amex Sync program to sync my Amex card to a $10 off a $50 purchase at Lowe’s deal, so I used that for the balance. Let’s do a rundown of the savings and rewards:

Savings

$1899 – original price of refrigerator

$1199 – discounted price on Lowe’s site

$1079 – price after 10% military discount

$72 – how much I saved purchasing $997 of gift cards for $925

$82 – price after gift cards, charged to my Amex Platinum which is synced to a deal

$925 + $82 = $1007 actually paid, representing a 47% discount from the original price

Rewards

$19.94 – 2% of $997, courtesy of Topcashback

$11.56 – 1% of $925 of SPG rewards, although it could be argued they’re more valuable than that

$10 – Amex Platinum credit card statement from sync deal

$0.82 in Amex Rewards points, although it could be argued they’re more valuable.

$42.32 total rewards value, which could be lowballing it

$1007 – $42.32 = $964.68, which is over a 50% discount from the original price!

BONUS – I sold my old refrigerator on Craigslist for $300, after $20 worth of spare parts from Sears.com. Final cost – $684.68!

SOMETHING TO CONSIDER!!

If this is an appliance you want long term, you might want to put it fully on a credit card that offers an extended warranty or other type of purchase protection. If that is the case, I wouldn’t use the gift card strategy I outlined above. Since I’m moving out of my house soon, and the Lowe’s warranty covers that time, I decided the gift card route would work for me.

How do you get 1.25 SPG/$?

I actually have no idea. I don’t know why I wrote 1.25/$. Hmm, not sure what I was thinking. I’ll modify it.