The abridged answer to this question is: I don’t know for sure, and I am not a tax professional, and please don’t try to sue me for anything – thanks for stopping by!

I was looking recently into the Upromise Program, it offers some of the most generous Online Shopping Portal bonuses available, if a store is listed on Upromise for Cash Back it seems to be almost always offering 5% Cash Back which is frequently the most generous option available. I did a lengthy review of Upromise and how you can earn 10% Cash Back or more with the program. Here is an overview:

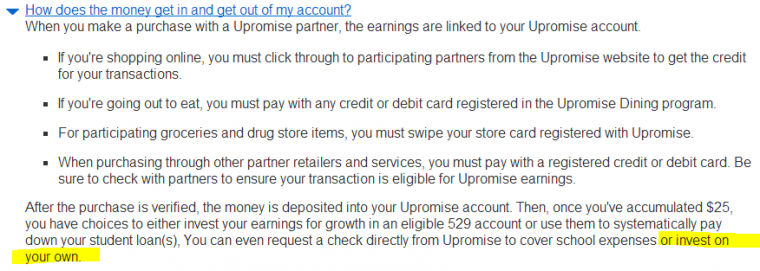

Upromise was created by Sallie Mae, they focus on college savings and allow you to funnel money into 529 Plans, or pay down debts. They offer cash back from shopping at upromise.com and also offer a co-branded credit card that offers some solid rewards, and up to 5% cash back again in certain categories of spend. What many people miss when considering Upromise is that it works for people who don’t want 529 plans and who don’t have student debt, you can still earn at these great rates and request your cash in the form of a check.

Taxable Nature of Rewards

One of the reasons that Credit Card rewards are so attractive is because they are not considered taxable income. If they were all equations would have to be re-evaluated, but I am sure that people would still use them, albeit with a little less profit and a little more complaining.

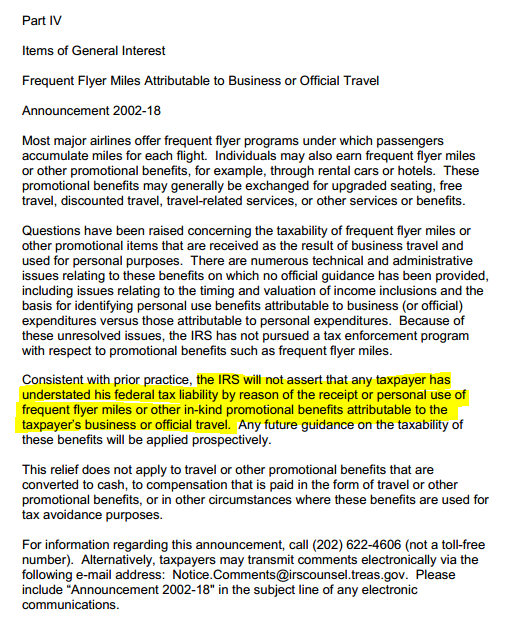

The ‘latest’ information on frequent flyer rewards from the IRS is found here, note that the verbiage implies that it is ‘earned through travel’ miles, doesn’t mention credit card rewards…and that it was made in 2002. Are we due for a devaluation?

Credit Card Cash Back Rewards

Here is a nice video from Turbo Tax that explains the IRS treatment of Cash Back rewards, it shows that in most cases you do not have to declare this as income, as it is considered a rebate. Now, the catch is that if you are claiming deductions you need to be more careful. EG If you buy a phone for business purposes and deduct $100 for the cost, but also earn $10 in cashback, you should only claim $90 of cost for the phone. For non business people, you wouldn’t be deducting the $100 since you aren’t allowed to claim business expenses, so you just are buying it at a discount, using a rebate program, and therefore have nothing to declare. Remember- I am not a pro – ask someone smarter than me about it before you think about doing this, getting arrested then blaming me.

Shopping Portal Rewards

From what I can gather, shopping portal rewards, both Cash back and points/miles operate in exactly the same way, they are rebates offered by the company. Therefore, as a business owner don’t over claim, but as an individual you are fine to receive these without any announcement to the IRS. In fairness, as business owner myself it is a tough one to track, so I think if it is especially overt, such as a direct cash earning, you should certainly declare a price that reflects the rebate/discount, but if it is points and miles perhaps you might have a little more leeway. I have not heard of a single case where the IRS has gone after a business for deducting a genuine office expense and omitted that they bought it at Staples using the Ink Bold for 5% back, but that doesn’t mean it couldn’t happen if you got an overzealous auditor at some point in the future.

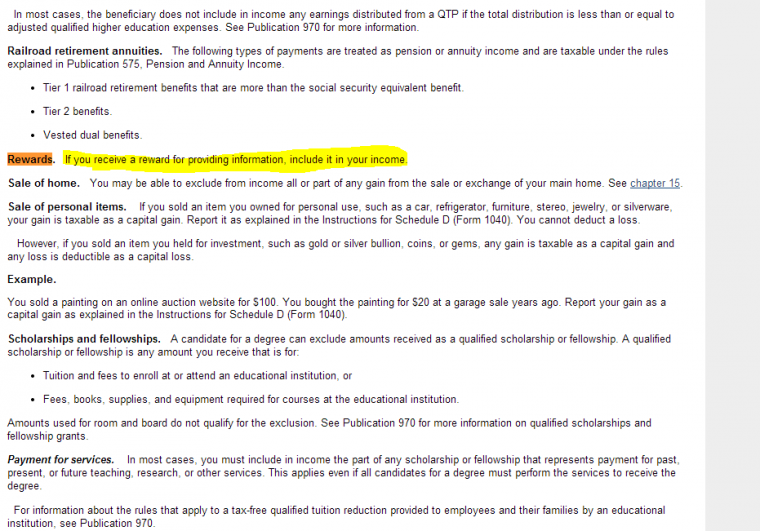

Information Gathering Rewards

This is actually something of an anomaly, but the IRS Publication for Other Income states you should declare rewards earned for information given, so in theory, if you are one of those people who likes to complete surveys to earn points/miles/cash you could be called out on this for not declaring it. It is my suspicion that the rule wasn’t created for the completion of online surveys, but it is always advisable to watch out for presidence in the text of IRS publications, as they can seek more readily to pursue you for such things if it ‘fits in their box’.

The IRS website is not the Law

Lawyers and Tax Pros please correct me if I am wrong here, but it is my believe that the information found on the IRS website is not necessarily Tax Law, rather it is the interpretation of Tax Law by the offices of the IRS. What that means is that it can be challenged, so the question more accurately isn’t whether you are breaking the law or not when not following the directives of the IRS, but that they will impose charges that would frequently place the burden of proof on you to resolve. So it is more of a question of ‘do you want to fight them on this’.

My take on it

You can earn a bunch of money via sites like Upromise, cash them out into real money, and not declare it as income, since it is a rebate on your purchase. Remember – that’s just my theoretical, free speech, conceptual, not to be used against me in a court of law, opinion on this!

Very enlightening! It never occurred to me that one might need to reduce a business expense, say a printer bought at Staples, by the cashback amount, before listing it as an expense on one’s tax forms. Given the large number of CCs people in this hobby have, and the many GCs/prepaid cards people use as well, tracking the points/cashback derived from a purchase may not be an easy task. And there may have been a signup bonus involved as well! It could be a challenge even for the best recordkeepers among us!

I again think it wasn’t really designed for this, and nobody is going to enforce cash back/ points back cards against cost, but the rules are out there and it seems notable that business folk may be more at risk from using rebates since they are the ones deducting.

I can remember a scenario where this makes sense… back when I was in grad school (late 90s/early 00s), it was quite common for computer equipment to have huge rebates as a percentage of the cost. Like $50 for a scanner, with a $45 rebate. So, it effectively cost around $5. If you’re going to deduct the cost of that as a business expense, it’s pretty obvious that your expense should be closer to $5 than $50, if you got the rebate. Like you said, something like that is much more straightforward than the credit card and store rewards we are dealing with now.

I am not a tax professional, but my understanding is the one thing related to this game that might be currently taxable is bank signup rewards. Granted, most of us are getting credit card bonuses, but if you sign up for a bank account you may need to pay taxes. I never thought about this before but I wonder if it applies to brokerage accounts too.

It depends on how the bank deals with it- citi decided it is an expense and deduction on their side so you must declare income on your side