You may have heard the classic story of the Shoemaker’s children having no shoes, or the phase Physician, heal thyself. But who is wurs shod, than the shoemakers wyfe, With shops full of newe shapen shoes all hir lyfe? [1546 J. Heywood Dialogue of Proverbs i. xi. E1V]It is a very real phenomenon that dedicated professionals are […]

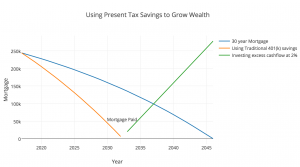

Should you have a Roth 401(k) or Traditional 401(k)?

I saw this topic today over at Nerdwallet, and wanted to share some insight on the matter. Note the standard disclaimer that everyone is unique, and to pay a professional if you want to do anything involving your money.In order to understand this decision, you need to first understand the basic difference between a Roth and […]

Smarter questions to ask your financial advisor

Last night, on Twitter, I suggested a few questions that you should ask your Financial Advisor, let’s explore them a bit more closely here, along with a few more pearlers.Note that this is an advanced series of questions, most other lists focus on just the fiduciary vs suitability standard, and encourage people towards a fee only […]

Guiding your way through Long Term Care

Long Term Care refers to the period of time in which loved ones will require additional assistance to complete the routines of daily living. Importantly, it isn’t just about money, or finding a facility that will be able to accommodate them in their retirement, but that is a part of it. This post will explore […]

Intentionally disqualifying Employee Stock Purchase Plans

Employee stock purchase plans (ESPPs) are, in short, amazing. If you have access to one and your are not maximising it, you should take a second look. They come with one giant downside, which is mitigated somewhat by intentionally disqualifying them. In simple terms, this means pulling out your money as fast as possible.The downside […]

Big Picture, Little Picture #Brexit

So the ‘Brexit’ vote happened. The markets weren’t expecting it, and they are about to show their disappointment. Big picture, the actual leaving of the EU might be a good thing for Britain, but to a US based investor, that doesn’t mean much.Markets are driven by speculation, and people and organizations are able to move […]

Should you use a personal credit card for business purchases?

Conventional advice is to put business purchases onto a business credit card. I myself have done this for many years. However, we might want to explore the ‘why’ of that, and perhaps make some adjustments.The logic behind using a business credit card is that it helps in two ways: Your expenses are neat, and reconciling […]

Thoughts on Daily Portfolio Rebalancing with Robo’s

I like Robo’s, especially Betterment as they appear much more human than the wicked Wealthfront. As an advisor myself I find that the strategies they implement offer a lot of food for thought in terms of offering the very best to our clients.One thing that does bother me a trifle is the use of marketing […]

The Pattern

The Pattern is what I call the path of most efficiency, the order in which things should be done. Everything has a Pattern, here’s one you might understand and can apply to other things. For my morning coffee I sometimes have to wash a French Press. This means that I need water from the one […]

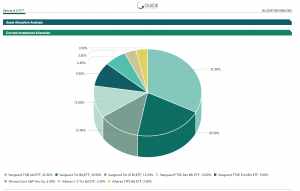

Introducing Guide Wealth Management

I created Guide Wealth Management to prove that you could offer exceptional quality of service for a reasonable cost. We launched almost a year ago in New York and I wanted to explain what the firm is about today, and how it dovetails into Saverocity Finance, and the Finance area of the Forum. Financial EmpowermentI’ve been […]