Breaking news today was that the Securities and Exchange Commission (SEC) has announced Hedgefunds would be now allowed to Advertise Publicly for the first time. There is outrage as people are fearful of how these evil Funds will start manipulating more and more investors and we will have another crisis where the 1% get richer and the 99% get poorer.

Well, first off this doesn’t mean anything to the 99%, other than you might see a billboard ad or a commercial on TV or the Internet for these funds, just because you can see it doesn’t mean you can actually buy into a Hedgefund, since they have strict financial qualifications (in the sense of how much money you have, rather than how smart you are with it…) so the 99% aren’t able to buy in.

The 7.4% though… those guys could be in for a bumpy ride.

The entry requirements for purchasing a Hedgefund are currently the following: You must have more than $1MUSD in Assets, excluding your primary residence OR be earning an annual salary of $200K as an individual or $300K as a couple for at least the past 2 years. The SEC voted to tighten up scrutiny on the Hedgefunds to ensure that their investors meet this criteria, and there is talk that the bar may be raised higher in the future. These barriers to access the fund are designed to trim down the market to people who either have enough financial savvy to understand the game, or have deep enough pockets to weather the storm. And for the most part the idea is sound.

Hedgefunds are Brilliant, Investing in Hedgefunds is pretty daft, their fees reminded me of this old nursery rhyme, Four and Twenty Blackbirds baked in a pie… that is a lot of Blackbirds!

Sing a song of sixpence,

A pocket full of rye.

Four and twenty blackbirds,

Baked in a pie.

When the pie was opened,

The birds began to sing;

Wasn’t that a dainty dish,

To set before the king?

The king was in his counting house,

Counting out his money;

The queen was in the parlor,

Eating bread and honey.

The maid was in the garden,

Hanging out the clothes,

When down came a blackbird

And pecked off her nose.

Hedgefund Fees aren’t (for the most part) Four and Twenty, that would be outrageous.. no they are Two and Twenty… 2% of your entire asset value is a management fee, and on top of that if they make any profit they take another 20% of that before adding it to your account. Of course for this massive fee you are receiving highly secretive and talented people working hard for your money.

Well, I use the word hard loosely, as mostly they will be playing golf or drinking a nice glass of wine by 3pm most days. And when I say talented, well that is a little subjective too, as there are some very savvy people out there. some right lemons Lemons too.

Hedgefund Performance will blow your mind!

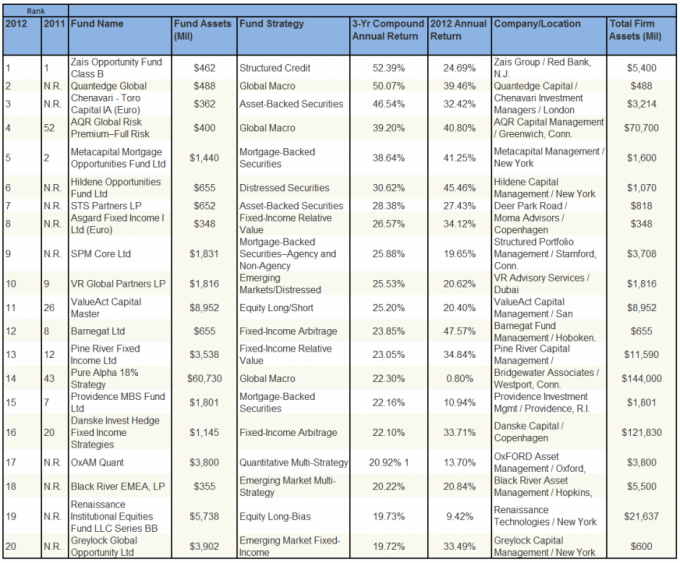

OK so we all know that if we can get in a Hedgefund we will be rich and famous in no time. In fact take a look at the top 20 Performers in the Hedgefund Industry and you will see why people pay those crazy fees to have a piece of the (Blackbird) Pie:

If you had invested in the top performing fund here 3 years ago your investment would have grown by 50% That is right FIFTY percent! How can these geniuses produce such results? Well, they could have just bought this simple fund that does nothing more than track the stock market:

Vanguard Total Stock Market Index Fund Admiral Shares(VTSAX)

1 Year Performance 21.49% (YTD)

3 Year Performance 66.72% (Trailing 3 years in July 2013)

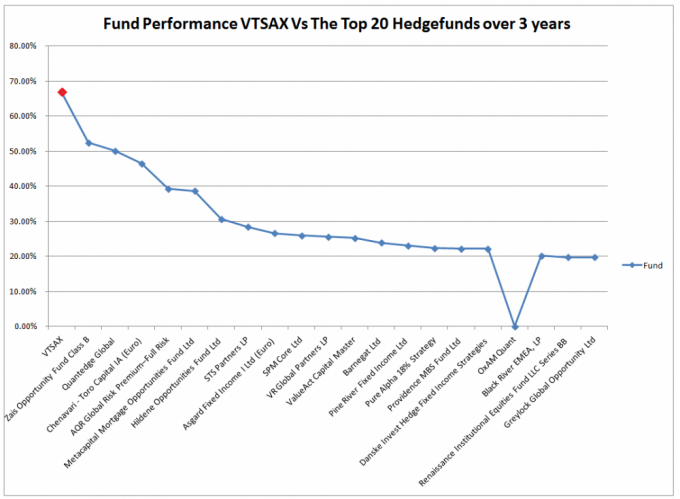

Lets chart that to show how the Top 20 Performing Hedge Funds compare with the boring old Vanguard Fund….

So, just by investing in a single, low cost fund from Vanguard, your investment would have grown more than the top performing Hedge fund; nevermind those funds that actually LOST money over the past 3 years in a market which has risen by over 60%!

So, you ‘7.4 Percenters’ – when you next see that shiny advert and consider jumping into a Hedgefund, ask them how they performed over the past 1,3,5 and 10 year periods, and see if that is worth Two and Twenty Blackbirds…

Before you open up any new funds or positions, check out your current portfolio using a Fund Analyzer like Personal Capital, here is my review on how it saved me thousands in fees:

Can you use the AA gift card to pay for hotels booked through AA website?

Actually, Tim below was correct and my giftcard always invalidated – I still received the statement credit and the refund on the price of the giftcard so achieved my goal of hitting the spend plus monetizing the statement credit- but didn’t get a giftcard in the end so couldn’t tell you. Personally I would apply them to flights but its quite possible other things can be redeemed with them.