This concept was rife several years ago, with many people getting massive profits and earnings from taking out debt from 0% APR Credit Cards and using that money to earn profit by investing it in some form of guaranteed product, such as Certificate of Deposit (CD) that would mature prior to the expiration of the Interest Free Period. Heavy hitters here were often getting lines of credit in the mid-high 6 figure range, and earning at 4% or more on that.

As I am looking at taking on a little debt this system is something I looked into now to provide me with a no cost loan, though in fairness whilst the system itself offers interest free credit, depending on your method for monetization you might incur some fees on the way.

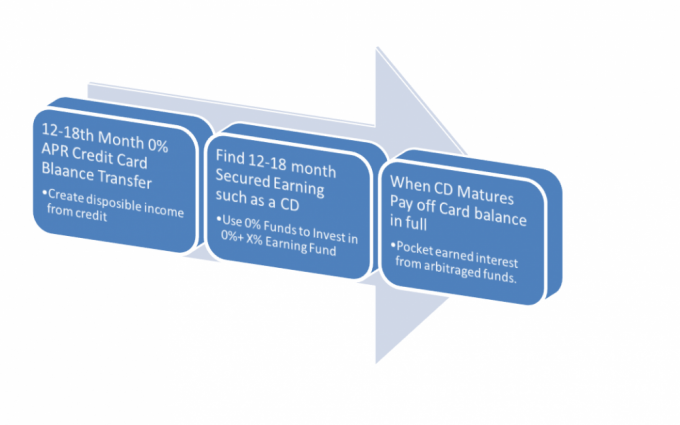

Here’s how it works:

The challenge is finding a method to monetize the credit card balance transfer, so you have a way of turning your 0% Offer into a Certificate of Deposit. Banks got savvy to this practice and made things more difficult by doing the following:

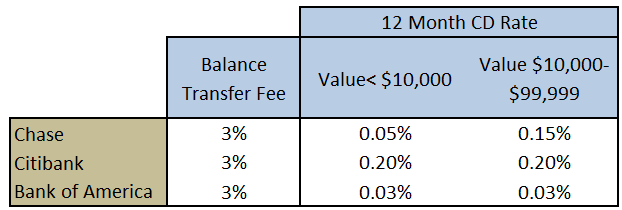

1. Charging a minimum amount of initiation fee to Balance Transfer – all of the big guns out there like Chase, Citi, Amex etc do this; when you receive a balance transfer offer from them they will invariably include terms that prevent this abuse. The small print that catches you is the 3% upfront fee for the total value of the transfer. In today’s financial environment with very low interest rates on savings this will kill most value, but even with this you can actually still profit.

2. Create restrictions for the type of payment you can transfer via Balance Transfer – they issue checks but will they honor every Payee, or just ones that are from Credit Card companies?

3. Offer less Interest on their savings products than their earning products, so they always end up ahead of the game. The average BT transfer fee is 3%, the average 12 month CD from Citi, Chase or Bank of America is appalling:

12 Month CD Rates from the Big 3 Banks for a sum around $10,000

Thus far, we have established Opportunity, and we have established that when opportunity is exploited sufficiently it will be addressed by the organizations being exploited (those poor banks) with this concept in mind, I will not be spoon feeding the solutions in this post, as if I provide a simple 3 step solution to work around the Banks defense of this the banks will become wise to it and make the necessary adjustments to prevent the loophole.

It isn’t that I don’t want you, as the reader, to benefit, it is more the case that if I was to post it perhaps 5 in 100 readers (at most) would actually try what I am doing, and the scheme would be passed onto the banks. Just not worth it.

Give a man a fish and you feed him for a day. Teach a man to fish and you feed him for a lifetime.

This statement has never been more true than when it comes to finding new deals like Balance Transfers for Profit, if you were given just:

- Use Bank 1

- Apply for Card 2

- Use CD 3

When they were shut down you would have to ask for another ‘fish’ I’d rather you learned how to spot opportunity, and recognize value.

Ok – at this point you probably feel that I have betrayed you and got you really excited about something then pulled away the prize at the last moment, so to avoid any death threats I’ll give a few more clues on where the value lies in the modern world of Monetization of 0% Balance Transfers.

Credit Unions offer value far beyond big banks

Here are some things that are currently on offer from Credit Unions:

1. 12 Month CD Rates of up to 3% from Navy Federal (requires Checking and a DD, and capped at $3,000) Link

2. Checking, Savings and Certificates of Deposit that earn Frequent Flyer miles: No Link, because they would shut this down with a link. But look for them!

3. Rewards earning Credit Cards that offer 0% Balance Transfers with no Transfer Fee: Link

Other factors that create monetization opportunities

- You can buy gift cards using Bigcrumbs and then cash them in, you make a profit on the purchase of the card and can 0% balance transfer the Amex you paid with, earning miles too: Link

- You can use Credit Card Balance Transfer Checks to pay down Student Loans and HELOCs. The latter would be a simply monetization, the former would reduce your APR on your student loan to Zero for the life of the Transfer.

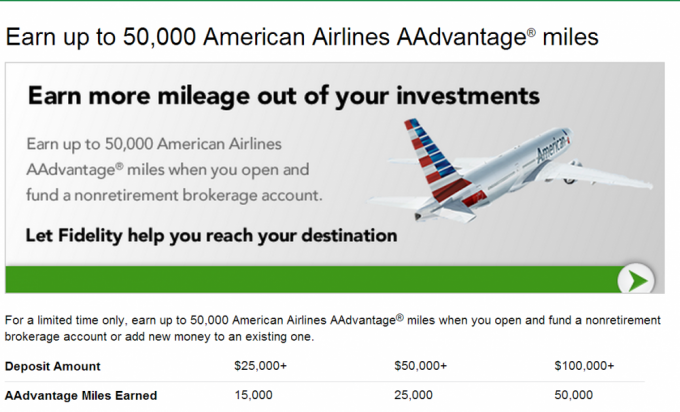

Not enough money in Monetizing the free loan, how about Pointerzing it?

Ok that might not be a real word… sorry. But anyway. There are opportunities out there for holding money in an account, the common forms of these would be Brokerage accounts such as Fidelity. They require that you hold the money in the account for 6-9 months (dependent on program) and pay you miles for doing so, they have tiered levels, and having an extra $10-$15K could well bump you over the next threshold. You can simply let the money sit for 6-9 months within even investing it and then withdraw to pay off the card.

The Trap

There are many opportunities available if you can find the different factors required to leverage this opportunity, the danger is that you are sitting on a time bomb- if you Balance Transfer and lose the borrowed money you will suddenly be paying interest at a very high rate, which will negate any gains you made.

I have a 1% BT right now and 19K that isn’t due for 13 months. I used it to pay off my mom’s vehicle prior to sale. Now I have acccess to the money before it’s due… What to do?

If you want to do it, you need to find an offer that has no risk, because if you invest the money in the Stock Market it can fall and you will be in real trouble.

Your options are:

a. A CD that matures in 12 months (in time to cash out and pay the bill)

b. An interest checking or savings account.

You need to find one of the above that offers more than 1% and enough more to make it worth your effort. You can find good deals on this at Fatwallet: http://www.fatwallet.com/forums/finance/775437/?start=2280