This post will explain how to fund an IRA with a Credit Card, if you are able to follow the steps here you can gain thousands of dollars of extra money through a trifector of: Credit Card points, Tax Rebates and Interest Free Loans. For this to work best, you need a credit card that earns points, ideally with a multiplier so you can earn 2x or more points for your purchase. One thing the observant investor will note is that it is impossible to find a brokerage house that will accept Credit Cards for funding. We get around this hurdle by using the Amex Bluebird Account with its Check Writing ability.

You can use pretty much any credit card for this, if you wish to use the points on the card to offset the cost of the IRA then it needs to be one with a large sign up bonus, like the Amex Gold (when a 50K or higher bonus comes around) or the Chase Sapphire Preferred or Ink card.

The Bluebird/Vanilla Reload Combination

The American Express Bluebird was designed as a replacement bank account option, it comes as a Card, and also you can get a Checkbook with it (you are going to need the checkbook for this, so please apply for one during the sign up process). Bluebird Sign Up

Vanilla Reloads are prepaid debit cards that you can find in Pharmacies, Gas Stations and Grocery stores, the come with a purchase fee of $3.95 per card, and can be loaded with up to $500 from your points earning card. If you purchase the Reload card at a Gas Station (or certain stores that are coded as Gas Stations in the Credit Card network, such as some 7/11 stores) with an Ink Bold or Amex Gold (both offer 2x at Gas Stations) would therefore earn 1000 points for $3.95 which would later be redeemed for a $10 statement credit: net profit of $6.05 per card. There are a lot of cards out there in the Reload market, so make sure you get the correct one, here is a pic so you know, if you are new to this idea of reload cards, don’t buy a different brand of card than this one (some do work, but some don’t so you would be adding unnecessary hassle:

Once you buy the card you go online to https://www.vanillareload.com/ and follow the prompts to add the value of the Vanilla Reload card to your Bluebird account.

Bluebird Card from American Express Checks

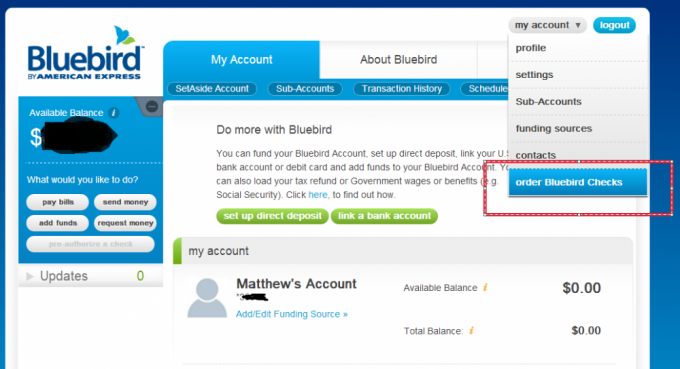

You can get a checkbook linked to your Bluebird account, you are able to order 1 free checkbook of up to 100 Checks for FREE until 01/01/2014. Order them by clicking the my account tab and select, order checkbook:

Pre-Authorizing Bluebird Checks

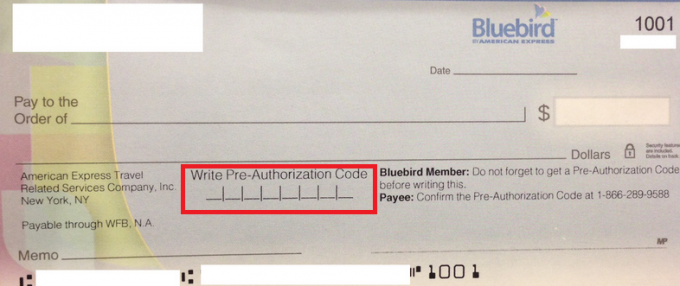

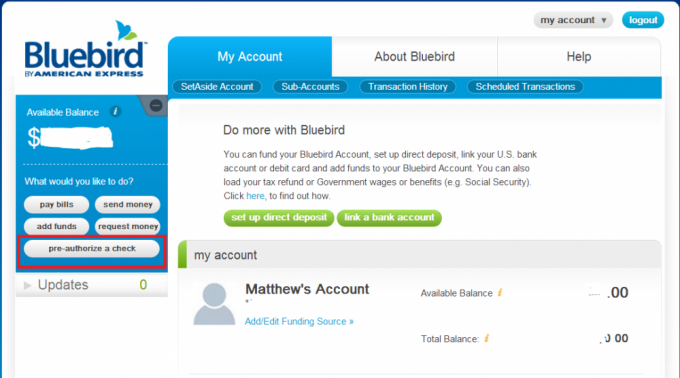

Bluebird asks that you pre-authorize checks prior to mailing them out to do this just click on the link on the left of the Bluebird screen and follow the prompts, pre-authorize your check for the amount you wish to send to your Brokerage, and enter the code they provide to you on the face of the check, mail it to your Brokerage, and you are good to go. This is how to fund an IRA with a credit card .

Your IRA Choice

- The Traditional IRA will allow you to defer taxes until your seek to withdraw in retirement, contributions to it will reduce your current tax bill and put more money in your pocket.

- The ROTH IRA will not allow you to reduce your current tax bill, but you also will not have to pay any taxes when you withdraw in retirement.

- The NON-IRA option would be a regular brokerage account, this works too. The only problem with one is that you don’t get any tax savings, but the interest free loan plus points still make this option a profit maker.

Your 401(k) Impact

An IRA has nothing to do with a 401(k) and you can max out your contributions to your work plan, then also put the full amount of $5500 into your Traditional or ROTH IRA in the same year, think of it as topping up your retirement savings.

IRA Contribution Limits and Rules

- You are able to contribute any amount up to $5500 ($6500 if you are over 50 years old) for 2013.

- In order to contribute you must have earned a gross salary of at least that amount in that year – so if you didn’t earn a salary this year, you wouldn’t be eligible for an IRA (deductible) contribution. I have been advised that Stay at home Moms can still be eligible for an IRA providing their husband was employed and they file jointly, though I would double check that situation with a tax professional as I have never tried it.

The Profit

You decide how much you want to put into your IRA based upon your own needs, here is one example, ideal for someone who has already a nice amount of money in their 401(k) and just wants to add another $1,000 for almost free.

Example: $1,000 Contribution to your IRA for 2013

You’ll need a card that offers a signup bonus, these vary based upon the best offer at the moment however you should be able to find 40K to 50K and upwards for signup bonuses, valued at 1 cent per point minimum (you can actually get more value is you uses these points for travel) lets use the lower 40K for $400 if you spend $1,000 in the first 90 days of ownership. Therefore, if you were to buy 2 Vanilla Reload Cards at $500 each (+$3.95) your total spend would be $1007.90.

This would earn you:

- 40000 Credit Card Points (signup bonus spend met) = $400 Statement Credit

- 2015 Credit Card Points (for the $1007.90 with 2x points ) = $20.15 Statement Credit

Furthermore, if you decide to fund a Traditional IRA you get to claim the $1,000 as a deduction. For a person living in New York earning say $50,000 salary that would be worth:

- Federal Tax Bracket 25% Value= $250

- New York City Tax 3.591% Value = $35.91

- New York State Tax 6.85% Value = $68.50

So by paying $1,000 into your Traditional IRA you would get $354.41 back in your pocket from saved taxes.

Summary Of $1,000 Account Profit

- Starting Statement Credit with Credit Card $1007.90

- Balance Reduced by $420.15 from spend

- Balance Reduced by $354.41 from the extra money you have by lowering your tax bill

Total Balance on card = $233.34

Therefore, you have just adding $1,000 to your retirement account for a cost of $233.34! Furthermore, many of these cards (check your terms and conditions) with 12 months interest free credit. Therefore if you wanted to pay it back at the rate of say $20 per month, you get the entire amount of the $1,000 loaned to you for no fee too!

This is free money, and something that you can’t afford to miss!

From the above, if you decide to put in the full $5,500 you would save even more, as your tax bill would be further reduced, the numbers would run as follows:

Purchase 11 Vanilla Reloads (note there is a $5,000 limit per transaction if you buy them in CVS, and a $5,000 per month load limit on the Bluebird card, but you can spread the purchase and load over a 32 day period and be fine).

Cost 11 x $503.95 = $5,543.45

This would earn you:

- 40000 Credit Card Points (signup bonus spend met) = $400 Statement Credit

- 11089 Credit Card (for the $5,543.45 with 2x points at gas stations) = $110.86 Statement Credit

-

- Federal Tax Bracket 25% Value= $1,375

- New York City Tax 3.591% Value = $197.50

- New York State Tax 6.85% Value = $376.75

Starting Statement Balance $5,543.45 minus Statement credits of $510.86 =$5,032.59

Deduct Tax savings from that=$5,032.59 = total Statement Balance of $3083.34

That means, you get a $5,500 IRA Contribution, potentially financed interest free for 12 months, for the cost of $3083.34

Don’t forget, that you can do this per person, so in a married household you can each do the $1,000 or upwards contribution and take advantage of this twice, providing that you both have earned salary that year equal to the amount of the contribution. If you haven’t earned salary, consider using the same plan for a non Tax Deductible brokerage account.

Please note – for you to claim the Tax Deduction portion of an IRA you need to earn within income limits, which are as follows, if you earn under $59,ooo per year as a single filer, or under $95,000 as a joint filer (joint income) you can load the IRA in full up to $5,500 per person, any more and it starts to phase out in a pro-rated manner, and over $69,000 for single filer, or $115,000 for join filers you can’t claim the deduction if you are over that level, at this point you might want to look into a ROTH IRA as they have higher limits (but don’t reduce present taxes:

ROTH IRA Limits and Phase Outs full amount of ROTH up to $112,000 for single filer salaries and or $178,000 for joint filer salaries, after which they phase out as per below.

If you liked this post on how to fund an IRA with a Credit Card please share it on Twitter or Facebook!

The value in this concept could be useful for people trying to meet minimum spend levels on cards, for example, whilst the PRG Amex often offers a large signup bonus sometimes that comes with an increased minimum spend. Should you come across a 75K point offer based upon $5K spend in 90 days this is a very easy and convenient way to meet that spend threshold and also ensure a different route for funding your IRA than just the simple ACH or mailing in a regular check.

This post has been edited from the original where I recommended the Barclay Arrival card, this is an excellent card and works very well with this plan, but I just realized that unlike Amex and Chase they do not provide a 1:1 statement credit. However, should you use the Barclaycard for this and then redeem for Travel you would be gaining a 2.22% statement credit on travel booked in the future.

Since you could use the credit card to get the bonus anyways, and since you have to fund the contribution within a year anyways (or else pay interest on the card and wipe out any advantage), AND any normal contribution gets the deduction anyways, aren’t you essentially just paying an extra 0.79% ($3.95 fee for each $500) contribution to do a contribution a little earlier than you would otherwise (but not more than a year earlier, and probably less given the contribution deadlines)? That may come out ahead depending on what the market does during that period, but it seems like a lot of hassle for a relatively small benefit that actually might just end up as a net cost.

I disagree.

Firstly you get a 12 month interest free loan which could be critical from a cash flow perspective in order to meet the deadline. A person might not normally sign up for this card, so if they do so specifically to fund an IRA they could get that $1K for $233 because they couldn’t get the tax savings otherwise (should they not have the $1K available).

Not enough people are funding retirement, most people do not max out their IRA’s every year, so even a person who has loaded the 401(k) could now add on an extra amount to the IRA and use the ‘free loan’ to cover it.

There is no 0.79% extra fee from the card purchase, each card purchase nets a profit of $6.12 because you earn $10.07 in statement credit per card by using the BarclayCard, so you are already ahead of the game regardless of the market.

Here’s my point. Whatever contribution amount you decide to make, you’re eventually making with your own real money at some point, either in the form of a direct contribution or by paying your credit card balance after using this strategy. That means several things:

1) The tax deduction is not a benefit of this strategy. It’s simply the benefit of contributing which can be done this way or conventionally.

2) The $10.07 statement credit you earn by purchasing the pre-paid card is just choosing to spend on your Barclay card (or whichever one you use) in one way vs. another way. You could just as easily directly contribute the $500 and use your Barclay card on a different $500 purchase. There’s no additional benefit to using it for the IRA.

3) If a person can’t max out their IRA now, trying to do so with debt is risky. If you end up not being able to pay it back on time you’re hit with big interest rates that make this strategy a net loss.

4) The one potential benefit of this strategy that I can see is if you already have the contribution money but you’d rather use the leverage inherent in this strategy to try and double your returns. The flipside is that you can also double your losses. It’s simply adding risk which could be good or bad.

One more point, as I’ve thought about it a little more. Let’s say you want to contribute the $1000 to your IRA and you’ve thought about this method. Why wouldn’t you just take $1000 out of your grocery/utility/whatever budget and do a direct contribution and then go and put those expenses on this same credit card? That achieves the exact same thing of using a loan to finance your contribution, without the hassle and cost of using the pre-paid cards?

Again, the only reason to do this would be for the leverage, and it carries the same risk for someone who just doesn’t have the money to contribute at this moment, but it seems like a much simpler way to go about it. You still get the tax deduction, the 2% statement credit, the $1,000 spending bonus. Why go through the other hassle?

I think the point is you get the rewards on a transaction (retirement contribution that normally you would not get). So, yes I’m already sitting on $11k for the my Roth’s this year. I can either ACH it over to Ameritrade or I could use the described process and reap the credit card rewards for it. For me it’s a question of how much time/hassle I’m willing to take on to reap a certain amount of reward. In this case, it’s pretty convoluted. I miss the days when I could just head on over to the US Mint website and buy a few thousand dollars of dollar coins with my CC, then have them shipped to me for free and deposit them straight back in the bank. Now that was easy reward $.

Exactly!

Sure, that’s a benefit. So let’s say you do your entire $11,000 contribution with this strategy. The cost of 22 cards is $86.90. The 2% cash back on the $11,000 is $220 (I’m not counting the bonus points because, again, you can get those from spending on anything). That’s a net benefit of $133.10. If you’re only talking about the $1,000, then it’s a net benefit of $12.10. For some people the effort might be worth that cash, and that’s totally reasonable. But that’s a much different proposition than the statement of “you have just added $1,000 to your retirement account for a cost of $233.34!” In reality, you have contributed $1,000 at a cost of $988. Better than nothing for sure, but not quite the deal it’s presented as.

If you have just $1000 to contribute I would recommend using this to double it to $2000. The rest of your statement doesn’t make sense to me, you should put EVERYTHING onto your card since things on the card get cash or points back – making them discounted, groceries and IRAs.

1. Let’s take a look at the potential scenarios where someone “can’t afford” the IRA contribution before the deadline:

Scenario A: The person has savings that could go towards a contribution, they’re just earmarked for another purpose such as an emergency fund. In this case you actually CAN afford it and the deduction is available to you no matter what. Instead, choosing to use this strategy is choosing to take advantage of leverage (the pros and cons of which are discussed in #4).

Scenario B: The person has no savings but does have the cash flow above basic living expenses to afford a contribution. They’re just choosing to use that cash flow for other things (other savings, travel, eating out, whatever). Again, the deduction is available to you either way. Choosing this strategy is either again choosing leverage or is choosing to live above your means, which brings us to…

Scenario C: The person has no savings and does NOT have the cash flow available above basic living expenses. In this case, you actually do have the benefit of a deduction otherwise unavailable BUT at the cost of living above your means. This is how people get into credit card debt in the first place, and fundamentally it isn’t any different from financing a TV you can’t afford simply because you want it today instead of tomorrow. You may hope you have the money later, and may even reasonably expect it, but in between life happens and any hiccup can send you into a very negative debt cycle.

So my conclusion is this: unless you’re choosing to live a debt-driven lifestyle above your means (not a recommendation I would make), then the tax deduction is not a benefit of the strategy. It’s simply a feature of a contribution you could make either conventionally or through this method.

2. I will give you that the 2% cash back is a net benefit and, to me, the primary benefit of this strategy. However, on a $1,000 contribution it’s a net benefit of $12. If you absolutely max out this strategy for all $11,000 (including a spouse), it’s a net benefit of $133.10. For some people that might be worth it, for others it won’t. But we’re not talking huge sums of money here.

As for the signup bonus, that really has to be qualified. You can only attribute it to this strategy if all of your regular spending money is already taken up by other credit card churning opportunities. If that’s not the case, which I think applies to the large majority of the population, then the signup bonus is attributable to spending on the card that could happen anywhere and is not unique to this strategy. But sure, for the small part of the population who doesn’t have the room in their regular spending for another credit card churn, this could be a nice way to do it. It just shouldn’t be presented as an absolute benefit.

3. An interest-free loan is nice to the extent that you do something productive with the money. If it’s not invested in something useful, then there’s no benefit. If you are invested in something useful, then see #4.

4. Let’s say you have $1,000 you’re willing to invest. Option A is to take the conventional approach and put it in your IRA. If your investments return 20% you make $200. If they lose 20%, you lose $200. Simple.

Option B is to execute your strategy here. You contribute $1,000 via the credit card and also invest your $1,000 on the side. So you now have $2,000 invested even though you only started with $1,000. That’s the leverage. Now if your investments return 20% you make $400. Sweet! Your profits just doubled. But if your investments lose 20%, you’ve now lost $400. So your losses doubled. That’s just how leverage works. You shoot for higher returns at the risk of bigger losses. But again, you can accomplish this same thing without the pre-paid cards, as I mentioned in my previous comment. So it all goes back to the REAL benefit of this strategy being the 2% cash back, which is nice but not life-altering.

I have no problem with someone executing this strategy if they truly know what they’re getting out of it. Both the cash back and the leverage are potentially legitimate reasons to want to do it. As is the signup bonus if you legitimately already use all your other spending on other signup bonuses. My general issue with the article is that the “benefits” are presented as absolutes when they are anything but. To say that you’ve made a $1,000 contribution for $233.34 is, for most people, misleading. If you’re doing it for the 2% cash back, more power to you. If you’re doing it for more than that, you really need to understand the other options available to you that can likely achieve the same thing.

Hey Matt,

I really appreciate your thoughts on this, but I respectfully disagree.

You seem to be ignoring the people in the post scenario, that do exist – those that don’t have the cash handy to fully fund a 401(k) AND a Traditional IRA in a year. That is actually the majority of the people out there.

Within that group many would ‘love to have a retirement account’ but have given up hope of one, and by following the steps here they would certainly get a $1,000 account for $233.34.

Certainly they could apply for the Barclaycard arrival card and spend the $400 signup bonus on something else, such as a TV or get 2.2% back if they spent it on travel, but how about using it to offset their retirement accounts? That actually is a great idea.

The 12 months free credit is special because it floats the free loan for long enough to trigger the Tax deduction/rebate from the IRS – so by using the card specifically for the retirement account they get to access Tax Dollars that otherwise would not have been available to them. They are using leverage to get money from the IRS.

The confusion you have is implying that the leverage also contains portfolio risk. In fact, the more money you have in the portfolio (such as by putting more in like this) reduces the amount of risk required to build its value, meaning people can move away from risky all stock approaches.

To say that a person can lose more money because they have more money is a silly argument, it is true if you keep the same asset mix but advising someone to have a lower saved balance so as to lose less if things don’t go to plan is ridiculous advice. The advice we should be giving to have as much balance as possible and to allocate in a manner that provides asset protection rather than asset accumulation.

Also, you are playing with number impact to build your position in this discussion. For example in your first comment regarding your thoughts on the plan you cite a percentage to seem more powerful – that the process comes with a negative 0.79%, once pointed out that you were wrong and it was a positive amount you switched to dollar value to highlight the small dollar value, rather than keep to percentages or to dollars for both.

There is value in this method for everyone, if your own situation is different from the scenario then you could earn less, or more than the example given. Finding citations of each do not detract from this being an excellent way to turn a credit card into an interest free loan (with bonus) for the funding of an investment.

I’m not sure how far we want to take this back and forth, but I still think you’re missing the mark on some of the major points.

First of all, I was wrong about the 0.79% in my original comment because I was forgetting about the value of the cash back on something you wouldn’t normally get cash back on. That was my mistake. As I say in my previous comment, that cash back is a benefit, and is in fact the main benefit of this strategy. If you have the money to back it up and the $12 cash back on a $1,000 contribution (1.21% to keep things consistent) is worth the effort to you, then go for it! It’s more effort, but at it’s core is the same as using a cash back card for any other purchase, which I do all the time. So in that sense, this is certainly an interesting and creative strategy.

But I am not ignoring the people who “don’t have the cash handy”. I specifically addressed those people in my last response. If you have a different scenario in mind than the three I presented, please feel free to elaborate.

Your point about the loan period being long enough to trigger the rebate from the IRS is an interesting one that I had not considered. I will agree that that is helpful to an extent. But again that’s really only applicable if you truly don’t have the savings or cash flow to handle the contribution otherwise (see again my 3 scenarios in my previous comment). If that’s the case, the tax rebate might give you 20-30% of the loan balance, but there’s still another big chunk to cover. Again, that’s getting into a potentially dangerous debt cycle there.

You’re missing my point about the signup bonus. It’s not that you should go out and blow the money on a TV instead. It’s that most people have the $1,000 available in their regular spending budget already, just from things like groceries, insurance, utilities, etc. Unless you’re already using all of that to churn for other credit card bonuses, then the signup bonus isn’t a direct benefit of this strategy. You could get it just by living your daily life.

Finally, I am not arguing the risk of losing more by having more. Please do not confuse debt with “having more money”. That’s extremely dangerous. What I’m saying is that you can lose more because you’re investing money you don’t have. When you’ve leveraged half of your investments and they drop 20%, you’ve actually lost 40%. In my example of leverage above, after paying back the loan you’re left with $600 after an initial $1,000 investment of your real money. That’s a 40% loss on a 20% market decline and is very different than if you had actually invested $2,000 of real money and would be left with $1,600. That extra risk is actually the entire basis of investing with leverage. It doesn’t mean that using leverage is bad. It’s just an attribute that increases risk and the decision to use it should be made with that understanding.

I’ll give you the last word here and let you respond however you want. I applaud the creativity here and I think this is an interesting approach for anyone who’s already maxed out their churning ability with their regular spending, or for anyone who wants a way to get cash back on a little more money. For others, I think the stated benefits are being applied inappropriately when looked at from the point of view that they’re available in other ways. And I also think it’s dangerous for someone without an extra $1,000 to their name to start using credit cards to find it, even if it is for a noble goal such as retirement.

Thanks for the interesting discussion.

I think the key element that you are missing is time.

A person who has the ability (in the sense that they meet the salary requirements and have not fully funded the IRA already) to put money into an IRA but who cannot due to lack of liquidity in their cash flow can extend the period of time needed for contribution, and furthermore can finance said contribution over a period of upto 1 year.

By doing so, they are able to access the additional money that the tax advantaged nature of the contribution will provide, which otherwise would have been taken off the table when the deadline for contribution has passed.

Furthermore, not everyone that does not have the $1000 (or more) is poor, or in debt, you can actually use this policy if you are far from that, but living a lean lifestyle.

Hi Matt,

1. The tax benefit IS a direct benefit of this scheme for those people who otherwise could not afford to get the IRA before the deadline. For those that were contributing anyway then it is not an additional benefit.

2. Incorrect, the statement credit, minus the fee to buy the card provides a profit, this puts you ahead of the game and better off than just ACH or sending a regular check. Furthermore if you are putting in the $5,500 or other large amount this is a great way to meeting high spending bonuses on other cards (such as those that come with a $5K requirement like the Ink Bold or Amex Gold – meaning you could apply for a new card at IRA time, and wipe out min spend in one swoop. Putting money on your card rather than not is ALWAYS a good idea for those who pay in full.

3. An interest free loan of up to $5500 for a year is NOT a bad thing, spinning it otherwise is silly.

4. How does a flipside potentially double your losses – if you have the money put the payment on the card using the VR strategy, earn the points, pay off the card and you are better off.

Hey mate sorry but I am going to have to tear this one up. First of all you won’t pay back $1000 in 12 months by paying $20 a month 🙂 Second it is just a huge assumption on the part of the tax benefits. You can only take a tax deduction if your income is below a certain level, which is just $69,000 for a single tax filer (that is about the rate a phone answering admin straight from school earns in NYC). I would get zero. And most people do not face state and city taxes that combine into double digit taxation rates. The trouble with this kind of idea is that it would be too easy to forget that the $1000 was funded on the credit card until the interest kicks and then the money is tied up in the IRA. If you are just above the threshold earning $70k you can put ~23.5% of your income ($16,500) into a 401k if you want. These IRAs are more useful for people who either don’t have access to a 401k plan or like me want to save more than the $16,500 allowed per year in a 401k on a tax deferred basis. They are not for funding with a credit card on zero interest when you are 25 years old .

You pay back the $1000 in 12 months by paying $20 per month ($240) applying the signup bonus of $400 and the spend on earned on the signup bonus ($20.15) that would make your balance of $1000 valued at $339.85.

You then take that $339.85 and apply your tax savings to it, in the example I used (50K salary in NYC) the tax savings are $354.41 making the balance zero.

I agree about the income limits, and will add in a note about that, since if you do earn too much you can’t claim the tax deductions.

Figures don’t lie, but liars can sure figure…

Thank you as ever for your nuggets of wisdom.

Love it when you stick to Travel and Miles/Points 🙂

Stay at home moms can do it if spouse works.

Like MA said, no tax savings if you have a less than decent income. People should still look to max 401ks and do the Regular IRAs if they can get the tax deduction or Roth IRAs if they are not limited by income. Doing non deductible IRAs is okay but there is a lot of pain in the back end keeping track of the taxability of the distributions (probably not worth it).

I would not even mention the zero interest loan option. All it takes is one missed payment and the whole thing gets to be very expensive proposition. And guess what? It does happen in real life… a lot! Looks like Chase is about to pay another $3 billion fine, guess where the money for these are coming from 🙂

I would never even suggest people buy 10 VRs at a time. Barclays can be really weird dealing with!

The scaling of this is limited. Same with the mortgage payment option. Nice to have…or you can simply transfer the money back to your checking account and/or “pay” your spouse and then fund IRA/pay mortgage payment with your checking account too. Same bang and probably much smoother as you avoid (low) chances of getting Bluebird running into some issues and then having to deal with its atrocious customer service.

I am not going to say anything about youknowwhat 🙂

Love the willingness to think creatively here…

Not angry at all 😉

I think this works really well for a very clear segment of people, less so for those high earners, it seems that many of my readers earn a lot. However even within families that do make a decent wage, such as ours fully maxing our 401(k) and IRA options isn’t cheap and wouldn’t be possible for most.

Therefore, giving access to start building a retirement account, or accelerating it are good things.

Yes, scaling is limited – it is an IRA which is by nature scaled to $5,500 per person per year.

I genuinely wrote it into reply to a twitter exchange yesterday where the guy said he might not have enough left over to fund his ROTH, I propose a Traditional over the ROTH in order to get the tax savings to pay down the account, and said put it on the card. This is a great solution. In fact I would argue that if you do the full $5.500 and pay off at a $100 per month for the life of the balance you would still come out ahead by doing this, even if you incurred credit card interest).

Thanks for forgiving the youknowwhat. I earned it I hope with the idea.. but am aware of your constant all seeing eye 🙂

Thanks for the input!

Gotta hand it to you, this would work. And don’t worry about the “you know what”, definitely earned it with this one 🙂

My only concern would be finding a place that accepts credit cards for Vanilla reloads. My sister works at a grocery store that pulled that option about a year ago. Seems most places are leary of selling those using a credit card for purchase. But, if I could find a place, that would definitely work. The Barclaycard is on my next churn, so theoretically, I could make this happen.

Thanks for putting this together, just need to get me the dang Bluebird card already. 🙂

Thanks Jacob, I wrote it for you after our exchange on Twitter, there are lots of people who can seriously benefit from this!

I love your creativity, Matt, as always. First, SAHM can absolutely get her own IRA, as long as you file a joint return and the husband has income. Second, as a former tax professional, I would also be very leery of advising someone to put IRA on a credit card, even with 0 percent interest for a year.

A person has to be very disciplined to do that. Something else you might add is a Saver’s credit, which would give 10 percent (or more) on the first 2000 dollars contributed to an IRA for each spouse. That is as long, as they fall within required income limits. I think 59000 AGI for this year, but I’m not positive.

Thanks for the correction. I am sure that you need a salary for the IRA, but didn’t know that the spousal salary counted when filing jointly.

I have heard of this strategy before, so I appreciate you laying it out step-by-step. I agree with other commenters that playing with debt can be risky, but this can work in a scenario when you already have the funds and will pay off the credit card immediately. I could also see this working for paying off student loans as well. Although it’s easier to pay my student loan company online, I might try this for my next big lump sum payment — with the caveat that I would never EVER do it without having money in the bank to pay off the credit card immediately! (I am risk-averse like that!)

I wonder, too, if you bought the reloadable cards at CVS, whether it would contribute to the money you get back in Extra Care Bucks at the end of the quarter? Or, with grocery stores that have gas rewards, it might also have the benefit of getting you points for $$ off of gas.

Glad you liked it – and yes there is risk here. The post is never intended to be ‘wrack up debt and then don’t pay it off’.

You don’t get extra care points at CVS as far as I know, but I have heard of some other rewards from certain stores like supermarkets etc as you mention.

I realize you’re getting a bit shredded over some pieces of this approach and it’s actual value, but I think you should be lauded for providing a very detailed blog post on a complex process that may benefit a few folks. Keep hustling.

Thanks Slug, I think its a solid idea so am ready for the haters 🙂

Hi Matt,

Since you can no more purchase Vanilla cards at CVS with Credit Cards , what options do you recommend to load your bluebird ?

Advice will be highly appreciated.

You can still find Vanilla reloads at some places, mainly gas stations, but I don’t bother looking as it seems weird to me to buy there. Alternatives are to load other giftcards at Walmart, it is not as neat and easy as it used to be!

Can you still do this as of 9/20/14?

The Vanilla Reloads are much harder to find now (that are available via Credit Card) so it is not as easy as before. It can be done in other ways, such as using other gift cards, but it isn’t as clean and easy as it was when I wrote this post.

Matt ,

Please give an example of which gift cards could be purchased with a CC and then converted to cash to direct fund an IRA at at brokerage.

Thanks

Rick,

It’s not so much which giftcards, but which retailers will allow you to purchase. This is region/store/clerk specific to varying degrees.

Matt

Hi. I am a new subscriber! Is there any advice on doing something similar using money that it’s already in Serve Amex? Thanks in advance!

Serve doesn’t have checks- but it’s possible you could look up ACHing to your broker.

Any new updates for 2017 product options on funding IRA by credit card? Most of the info. here is no longer viable for usage sadly. Thank you!