Asset Location is going to be a focus for my study in the upcoming weeks. I have already formed SEP IRAs and Traditional IRAs along with Taxable Brokerage accounts, and have been fully funding these for several years. I recently read a very interesting book on the concept of Passive Investing, and it went into a little detail on the subject of Asset Location.

Passive Investing is different from Passive Income, the latter being investment vehicles such as Rental Property and Dividend Stocks that pay you income with little active maintenance. Passive Investing refers to a strategy where you purchase Index Funds from firms like Vanguard, who pioneered the concept, and buy and hold, with small and controlled adjustments. The basic premise of such investing is that the lower the fee’s you pay the more of your money you keep. Sounds like solid common sense to me, and is the driving force behind me leaving TD Ameritrade for OptionsHouse.

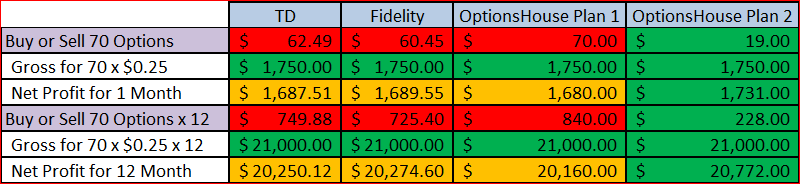

Along with Broker fees, the other major driving force behind the growth of your investment would be taxation, putting highly taxable investments inside sheltered accounts protects your income streams and is something to consider strongly. In an example I cited for comparing the three brokerage accounts of TD, Fidelity and OptionsHouse I highlighted purely the fees saved by picking the right broker when dealing with Covered Calls. Here I will use the same trade and consider Asset Location between a Brokerage Account with OptionsHouse and a Self Directed SEP IRA with them.

As you can see, the clear winner for keeping the most of your Profit is using the OptionsHouse Plan 2, this is the plan that charges $8.50 for opening the position plus $0.15 per contract. The amount of Net Profit is $20,772 over a 12 month period. Lets look at the biggest problem I will now face:

Capital Gains

Whilst the above is talking about 12 months, it is 12 x 1 month trades so we are talking about Short Term Capital Gains here. These are nasty, and the worst thing for portfolio growth at this time. Short Term Capital Gains are taxed as regular income, so that $20,772 just got added to my income and taxed accordingly. Assuming I am currently at the 28% rate of Tax this would mean that from the trades I made over the year I now owe Uncle Sam $5816.16.

However, if I made the same trade within an IRA Account I would not pay any Capital Gains on this. It would increase the value of my retirement account and I would be taxed when I am 59.5 years old on the money I pull out of my IRA as regular income, but the plan is to earn less at that time and not be taxed at 28%. This is called a Tax Deferred Strategy and by making exactly the same trades, carrying the same risks and rewards; I keep 28% more of my money.

This is just the surface of Asset Location, and something I will be looking into more deeply as I go on from here to make sure I keep as much as possible in my pocket.

Related Posts

An introduction to Capital Gains

Comparing Brokerage Fees and the impact on your profit

Leave a Reply