Time to consolidate my brokerage accounts. I have over the years opened up quite a few different accounts, primarily chasing their signup bonuses which are very lucrative. However it is time to consolidate now (since the holding period for the funds is over) and I plan to move over to a low cost broker.

I currently have:

- 3 Fidelity Retirement Accounts

- 1 Options House Non Retirement

- 1 TD Ameritrade Non Retirement

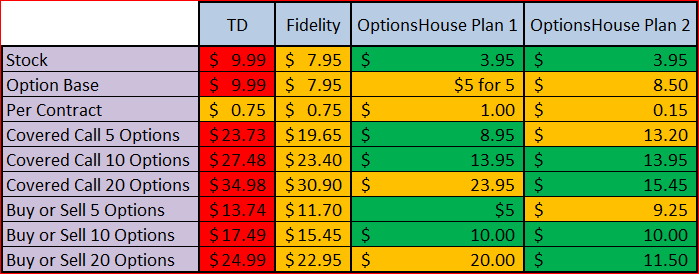

One thing I plan to do a lot more of in the coming year is trading options to add Alpha to my accounts. I will be doing this in both Retirement and Non Retirement Accounts primarily in the form of Covered Calls, though I might do some more speculative moves too, if the risk feels right. Out of all my accounts the one I preferred as a beginner I have already closed – eTrade. It had the most friendly interface and ease to execute trades, conversely the most difficult to navigate was the OptionsHouse Account. However eTrade can charge you $19.99 per side of a trade, vs $3.95 at OptionsHouse for a Stock, and for options its much more. Since eTrade is in the past now, I’ll compare just Fidelity, TD and OptionsHouse below, it is important to see the differences and what annoys me most about TD and Fidelity is they are not transparent with the trade fees. Options trades are variable fees depending on the amount of Contracts you sell, OptionsHouse tells you exactly what the trade will cost or net you, plus what the fees are before you execute – I love this about them. TD Ameritrade on the hand is so mysterious about its fees that even if you go to the brokerage fee page you don’t see what they are charging you for brokerage fees – its fluff and nonsense! https://www.tdameritrade.com/pricing/brokerage-fees.page where is the trade fee?!?!

Here is how they breakdown, OptionsHouse actually has 2 plans, depending on how you trade you should pick the one you like. You can swap between plans but have to leave it a little time between each switch.

Don’t forget that these prices are just One Side of the trade – so you have to pay double the above if you plan to sell your position. With Options sometimes you won’t sell as they just expire, but it is worth bearing in mind.

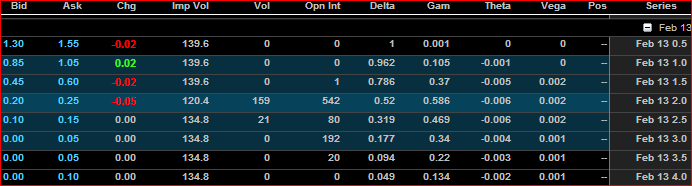

One trade that I am planning on making soon is OCZ Options, I own 7000 of the underlying stock so I could sell 70 contracts. Looking at Feb Expiration for that trade I would make the following profit for selling $2 Calls in each of the following accounts:

Current Stock Price $1.91 Bid Ask Spread 0.20-0.25

Let’s be optimistic and assume I get the asking price of 0.25 for the contract, I would be selling 70 Contracts.

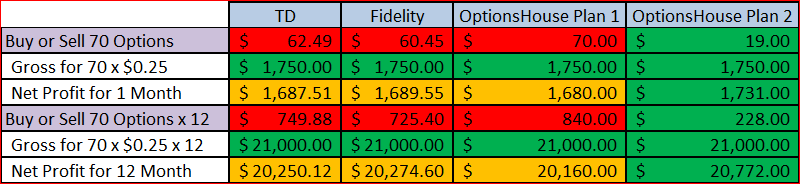

Charges by Broker for one side of trade

As you can see, the prices for TD and Fidelity are really hurting now (as is the 5 for $5 plan at OptionsHouse) but the second plan there is fantastic. the amount you will save here is immense. This play, as you can see is for February options in January, so the plan is 30 days of coverage. That means you do it again every month, 12 trades a year.

Lets look at the total profit for 1 month and 12 months when you include costs below, making the same trade in OptionsHouse Plan 2 is over $500 better for you over the year than any other plan!

It is a no brainer for me to move over to OptionsHouse with all my accounts, including Retirements. Frankly I was a little concerned about the Retirement Accounts as I felt that TD and Fidelity are somehow more established or something compared to OptionsHouse, but at the end of the day that is just perception, and what matters is insurance and coverage, they are a member of SIPC and FINRA and seem as good as any other brokerage on this account. (Disclaimer, I am not a financial adviser, I am just sharing my own personal thoughts on this)

The trick now is to get the funds out of my other accounts and into OptionsHouse without paying a penalty. There are 3 ways to do this:

Liquidate all holdings and transfer cash -cost would be $9.99 per stock, plus a wire transfer of $25, then I would have to repurchase them and trigger a wash sale, what a headache!

Full ACAT. An ACAT is a transfer like for like from one brokerage to another. OptionsHouse will charge me nothing to transfer the positions in, but TD will charge me $75 as a farewell present. Fidelity it seems does not charge the ACAT, but will charge me $50 to close the IRA I have with them. So doing ACATs will cost me a total of $175 upfront to load up all my positions in OptionsHouse.

Partial ACAT. This allows me to transfer some of my positions, TD doesn’t charge for this, and neither does Fidelity. This could be the solution, by transferring almost everything out and leaving a nominal amount in the account I could skip around fees – I just need to confirm there is no account minimum that I could trigger a maintenance fee on and if not then this would be a great way to fund OptionsHouse without paying the fee.

If you don’t already have an OptionsHouse account, then you can get a signup bonus too, they have an ACAT Transfer fee bonus of $100, but if you fund it like this you can try for another bonus instead (in case they do not stack) such as:

Sonus 3, Dell Monitor or a Kindle Fire (you need to deposit 10K and make 15 trades within a certain time limit for these bonuses) I got these from a pretty interesting blog called Hustler Money http://www.hustlermoneyblog.com/best-brokerage-bonuses/

Leave a Reply