I am often asked the question ‘what funds are best for my Vanguard ROTH IRA?’ by all types of people, at all stages in their lives. As you might be able to guess, each answer is different. The primary driving factor when deciding your fund allocation is: ‘how many more years until retirement?’

These days retirement means different things to different people, gone are the days of working til 65 and drawing a full pension. Often times retirement can mean stopping your main career and switching to a more hobby focused role, but one that still produces some sort of income. For me, I think a good definition of Retirement is when you are ‘unable to earn external income through wages’.

When that happens, and there is no more external money coming into your account your portfolio should look very different from a person who is in their prime earning years. Many people wisely start shifting the allocations within their accounts as they reach retirement age in order to prepare for this. The reason that this is critically important to your successful retirement is that if you are in a volatile position for your stocks and you have no more money coming in you can wipe out your savings if things crash, and somethings crash more than others…

Stocks, Bonds and Cash

The theory is simple – Stocks move up and down the most, Bonds less so, and Cash less so again. However that thinking is a little dated now and a lot of people are very worried about long term Bond holdings, but you would be OK with short term bonds still.

According to common thinking you should always have a mix of all three of these Asset Classes, though personally I am exposed almost exclusively to Stocks and Cash positions. I have a small bond holding in one retirement account. This is primarily due to my age and risk tolerance, at 36 I want the money to grow as much as possible, and have earning years ahead of me where I can replace any losses to the accounts. If I was 66 my mix would be very different, and stocks would be reduced overall.

Stocks are the most volatile investment

Even when traded as Index or Mutual funds stocks are the most volatile investment you will likely see in a ROTH IRA – a Fund is a collection, or basket of stocks, keeping them in a fund rather than an individual stock by stock basis protects from some risk that can be found with holding a single or few stocks- for example if you were fully invested in Apple, one piece of bad news regarding a Patent Law for the iPad could see your entire retirement fund drop by 25%, however if you were in a fund that picked the top 10 biggest stocks, and a mix of others, you would be holding Apple still, but when it dropped its impact would be less than 1%.

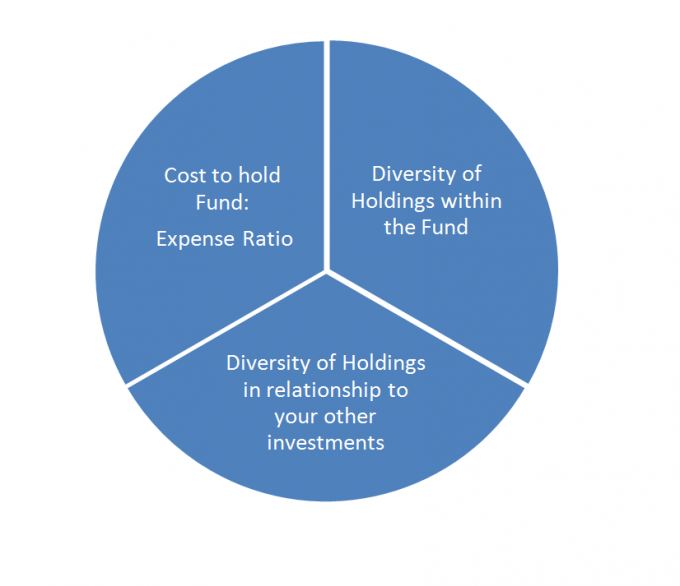

What makes a ‘good’ Stock fund:

In order to hold a Fund there are charges and fees that will be levied by the Investment Management Company. These fees obviously cut into what would have been your profit, so keeping them low is best. Vanguard is very good at keeping the fees low, but they are not alone in this as these days there are many other firms in the same ballpark. An all stock (US based) fund should have a fee no more than 0.20% and ideally half of that amount.

Within Stock funds there are more diverse ‘flavors’ of investment mix, for example you could get an Indian All Stock fund or only Small Cap firms. As you move into more diverse flavors you will see the benchmark Fee rate increase, primarily due to the additional costs to manage overseas funds, though there is no doubt a little extra added in there for their efforts. These funds may not be the most efficient.

Diversity within the Fund

This is your decision when it comes to how widely spread out you want your investments to be – the best fund for your ROTH IRA based upon its underlying stocks is impossible to guess, all you can do is make a decision based upon costs to hold it, and decide upon your risk tolerance.

Vanguard Total Stock Market Fund Options

- VTSAX is perfect If you want a piece of the entire market, it requires a $10,000 minimum investment and has a 0.05% Expense Ratio with no trade fee.

- VTSMX offers the same exposure, but has a lower entry price of $3,000 minimum investment, and a higher 0.17% Expense Ratio with no trade fee.

- VTI is an ETF version of these funds from Vanguard that allows an entry price of 1 Share, which is currently $84.73 and has a 0.05% Expense Ratio – this will require a trade fee of $7 to purchase.

There are a plethora of Stock funds within Vanguard, and all are decently priced in terms of Expense Ratio, the decision on your Stock fund comes down to how broad (lower risk) or focused (higher risk) you want your exposure to the stock market to be – if you pick a more specific sector you will have less diversity, but could in turn earn greater rewards. If you feel you have years ahead of you to repair any losses with extra income saved then go a little more aggressively, if you are later on in your earning life then slow down by staying in stocks, but buying more broadly such as the funds above.

Personally, I have the entire market in VTI, and also then double up by buying specific sectors that I like within areas such as REITs and BioScience Index Funds.

Diversity in relationship to your other Investments

This is very important. If you want a mix of 80% Stocks and 20% Bonds and have any other accounts you should consider what their holdings are in order to find the right blend for your Vanguard ROTH IRA. If you have a 401(k) that is 50% Bonds 50% Stocks then you would need to have to more stocks as a percentage in your new account in order to balance things out as an average.

Whilst subjective, depending on your stage in life you might always want to decide to factor in your spouses asset allocation too, and use your allocations to balance out overall to the level you want.

What makes a good ‘Bond’ Fund?

Right now (Summer 2013) a good Bond fund is a very stable, government backed, short term fund such as one that focuses on TIPS (Treasury Inflation Protected Securities) these don’t pay out a huge amount, basically enough to cover the raise on inflation, but they are better than just holding cash as that is losing money every year due to that inflation, and it means you have some safety from the stock market.

Long term Bond’s do have value, but the have so many moving parts to them, and I feel that the current economic climate isn’t ripe for their purchase as raising interest rates are starting to happen, which do impact bond values negatively.

Other than that, a Bond Fund operates in a similar manner to a Stock Fund so we are looking for diversity and low Expenses, a good couple to look at would be:

Vanguard Short Term Inflation Protected Bonds

- VTAPX is a blend of US Government 5 year or less Bonds, it requires a $10,000 minimum investment and has a 0.10% Expense Ratio with no trade fee.

- VTIPX offers the same exposure, but has a lower entry price of $3,000 minimum investment, and a higher 0.20% Expense Ratio with no trade fee.

- VTIP is an ETF version of these funds from Vanguard that allows an entry price of 1 Share, which is currently $49.26 and has a 0.10% Expense Ratio – this will require a trade fee of $7 to purchase.

What is the right mix of Bonds and Stocks based upon your current Age?

This is a tough one, really it doesn’t matter what your age is, what matters is how much money you have saved, how much money you want to spend every year to keep your lifestyle, and how many of these years you need to sustain. If at 35 you have $10MUSD saved up already, you don’t need to be risky – after you hit a certain point it isn’t about growing your wealth it is about keeping your wealth, and trying to earn a little to counter inflation and spending.

There is an old adage about ‘your age in bonds’ but that is really ridiculous to me, especially with the increasing life expectancy of the nation. If I was to throw out a completely arbitrary and asinine adage I would say ‘half your age in bonds’ is probably a much better guideline right now.

People do get caught up within the asset allocation mix and when they hear 80/20 Stocks to Bonds ratio they forget that within those 80% and 20% areas there is room for diversification. However, the most stable portfolio with the lowest will have the the following characteristic:

The fewest number of funds, but those funds holding the most number of assets.

As such if you were to just hold a mix of Stocks/Bonds as shown in the funds above, EG 80% VTSAX and 20% VTAPX you would have a very broad and stable mix of funds. For most investors though, this would be too low risk (low reward) and as such they would want to add a little variety.

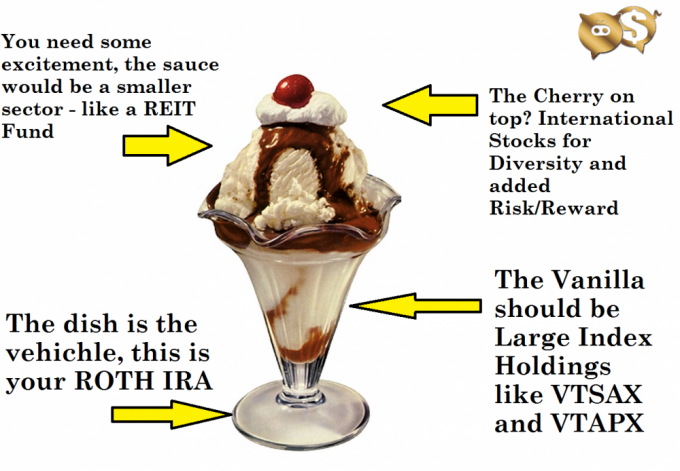

You could think of it like an Ice Cream – the VTSAX and VTAPX are plain vanilla, now lets add a little sauce and a cherry to get things exciting:

I would personally only mess with the Stock side of the Allocation, and leave the Bonds totally in the VTAPX or other short term fund. The stock side I would liven up with the addition of two key Sectors that would increase risk and reward:

REITs

Real Estate Investment Trusts, offer great long term growth as they pay large regular dividends, the market for REITs has been taking something of a hammering right now, so the prices are low and the value is high in this area. By adding some REITs to your stock side you get a chance to earn more (which of course comes with the chance to lose more).

Vanguard REIT Index Fund Admiral Shares

- VGSLX is a diverse blend of REIT companies, it requires a $10,000 minimum investment and has a 0.10% Expense Ratio with no trade fee.

- VGSIX offers the same exposure, but has a lower entry price of $3,000 minimum investment, and a higher 0.24% Expense Ratio with no trade fee.

- VNQ is an ETF version of these funds from Vanguard that allows an entry price of 1 Share, which is currently $69.29 and has a 0.10% Expense Ratio – this will require a trade fee of $7 to purchase.

International Stocks (Ex US)

This would be the 4th component of the portfolio, International Stock exposure is great as it is less like that the entire world will enter a recession than just one Country, so if things are going badly in the US, there is a chance you can still earn something on a global market. In fairness, with the US being such a strong global economy there is a good chance that bad things here would have a bad negative knock on effect elsewhere too, but you still would benefit from things like exchange rate fluctuations and exposure to emerging markets worldwide – a great addition to the portfolio for diversity.

Vanguard Total International Stocks

- VTIAX is a diverse blend of International companies, it requires a $10,000 minimum investment and has a 0.16% Expense Ratio with no trade fee.

- VGTSX offers the same exposure, but has a lower entry price of $3,000 minimum investment, and a higher 0.22% Expense Ratio with no trade fee.

- VXUS is an ETF version of these funds from Vanguard that allows an entry price of 1 Share, which is currently $46.21 and has a 0.10% Expense Ratio – this will require a trade fee of $7 to purchase.

By adding the REIT and the Total International Stocks to your 80% side of Stock allocation (you have to make room for them by holding less Total US Market) you now have a 4 fund portfolio for your Vanguard ROTH IRA – very simple to manage and track, and with enough diversity to grow with a large degree of stability. Here is more on such asset allocations.

Other options you might want to consider would be a Target Date Retirement Fund – here is a primer on that: Target Date Retirement Funds -An Introduction And here is some more information on My Experience opening up a Vanguard ROTH IRA

Hope that helped with the question of which funds to pick – you need low cost, diversity and enough excitement to add a little chocolate sauce and a cherry to things in order to get the gains you want, on the other hand, if you don’t need that much growth and are looking to maintain your wealth, keep things boring!

Terrific post. I have emailed links to both my kids. We are in the process of moving one of my kid’s assets from Wells Fargo Advisors and into something else. Do you also like Vanguard for non-IRA investments?

Hi Elaine, glad you liked it! I like Vanguard for their low fee funds – you don’t actually need to be in Vanguard to own these, but if you are you get to access them for no fee which is nice.

The best place to stash money really is dependent on the investment style of the person, some people like to trade in stocks more and if this is the case two factors become more important: Cost of Transaction and Ease Of Use. Vanguard is a little more old fashioned in its trading platform, so if someone has a slow and steady buy and hold type approach it is fine, but if someone is looking for technical trading it falls flat (people who are trading very quickly to lock in profits, theoretically..)

So the answer is yes, if they can follow a solid passive investment approach then I would certainly put non retirement investments in Vanguard. But if they want bells and whistles I would go elsewhere. I actually have brokerage accounts (retirement and non retirement) with TD, Fidelity, OptionsHouse, eTrade and Vanguard. My favorite to trade with was eTrade, but also the most expensive, TD and Fidelity are jointly useless, and OptionHouse is good because it is cheap, but it is aimed at a more Pro market so you need a little more knowledge sometimes to feel comfortable.

Vanguard does also have full brokerage so for $7 per trade they can buy and sell individual stocks, so all in all it should be good.

“I actually have brokerage accounts (retirement and non retirement) with TD, Fidelity, OptionsHouse, eTrade and Vanguard.” – Oh, my, don’t tell George! He just wrote and tweeted about how helpful it is to not have a bunch of accounts. 😉

Truth be told, we also have accounts in a variety of places. We strive to consolidate and succeed to a point, but then there is always a reason to open or maintain an account, and the result is lots of statements and assets in different accounts.

As for our 20something, the costs of the funds he was in at Wells were higher than they need to be for similar investments. So we pulled the trigger and sold a bunch of stuff, but he and his dad have been remiss in getting it re-invested. His latest job came through around then, and his focus is now on that, so the cash is just sitting…. ;(

On the upside, the job (4 months on the road for a major, luxury foreign car company) is a good one. It’s his first time as a tour manager in the events marketing business. He’s worked many promotional events and was on the road for 6 months with another car company, but now he is in charge of staff, responsible for 9 cars, and handles just about all the logistics for his team as they go from dealer to dealer, running special events for them. So while the cashed in funds may be just sitting, he is earning nicely and getting super experience.

Still, I do think he needs to focus on investing. Maybe Vanguard is a good solution for them.

I’m a little all over the place, but can keep track generally – the ones that caught me out in terms of overlapping investments came when we set up Allisons company 401(k) and 403(b) plans – have to watch overall allocations to make sure we don’t go too heavy. I do use Personal Capital too to link my Investment Accounts and track all the allocations (the link in the footer is an affiliate link for them).

If they really want to do nothing regarding investing they might want to use Betterment – they do charge a fee, but for that the interface is very easy to use. I have met with their CEO and VP of Product and am very impressed with them – it basically uses Vanguard (and another fund) to make a basket of funds – or the Icecream idea above, and manages the rebalancing. If they are OK with rebalancing themselves (once a year or so) then I wouldn’t pay the fee for Betterment. Betterment can make you lazy too and not want to learn, which is not good in the long run, but can be good if you are too busy in the short term.

His job sounds great! I love anything that involves travel as when you get away from home base and things go wrong you really need to think outside the box to fix them – plus the perks of being in a far away place make things like dinner fabulous each time.

Thanks for the suggestions. Just signed up for Personal Capital and will suggest it to my husband. Yes, my son’s job is giving him some great experience as he handles whatever gets thrown at him that day, from hotel reservations that go awry to car damage and break-ins; from staff and management issues to broken display pieces and drop-shipments that don’t arrive. Yesterday they had the biggest attendance yet and it went great. Today he’ll get some logistical work done and then head to NYC for some R&R before heading off to the next dealership.

I think father and son just need to sit down and pick some Vanguard funds to complement the TIAA-CREF Roth IRA accounts he has. But neither seems to make it a priority. It is not an area I like and I am happy to leave it to them, but then it is hard to nudge them too much if I have abstained!

Yep I hear you! The Personal Capital portfolio analyzer will allow all the accounts to be looked at as a whole and that will help suggest where to fill in the gaps, it makes it a lot easier, but still many people are daunted by the task.

Sounds like he has a great job, hope he packs some shorts for NYC, weather here is crazy hot right now!

Matt, I’d love to get your opinion on “target date retirement funds.” I’ve been looking at these types of funds at Vanguard. I’m attracted to the idea of a “set it and forget it” solution that automatically re-balance and reallocates the asset mix.

Hi Marcus, I wrote an Intro to them here: https://saverocity.com/finance/target-date-retirement-funds-an-introduction/

My opinion of them is that they are too conservative. I don’t like the actual date they propose as the mix of stocks/bonds is off in my thinking. I would consider them better ideas if you go for one and push the retirement date on the fund back a ways… but don’t pick the one that actually will see you into retirement.

Thanks, just finished reading your intro to target-date retirement funds. I was a bit confused by this part of your reply:

“I would consider them better ideas if you go for one and push the

retirement date on the fund back a ways… but don’t pick the one that

actually will see you into retirement.”

Did you mean plan on setting the retirement date later than I’d expect, because people are working longer? Like for example, if I plan to retire at 55, push the date for the target retirement fund to 65 instead?

Then have another, different mutual fund to cover the first 10 years of retirement? One that’s more actively managed?

Sorry, if I’m being obtuse. Glad that you’ve covered this topic. Until now, the only information I had on target-date retirement funds was from Vanguard itself. Good to get an outside perspective.

Hey Marcus, I just wrote a post about it for you – check it out and let me know if it makes sense. My point is to not be attached to the date on the box – if you change it you can make a ton more money, because the years before your retirement are when you have the biggest amount of capital saved up. If you become too risk averse here, as I feel a Target Date fund can be, then you can lose out on the biggest gains (needless to say, with risk, comes the chance of loss too).

Awesome post! Time for an update? 🙂

Hello, and thanks for your post. How come you recommend VTAPX for the bond side of the allocation and not the vanguard total bond market index fund? I also read somewhere that corporate bonds in a Roth IRA yield higher returns. I’m not too sure on which bond fund to choose because I’m hearing opposing information. Are you confident on choosing VTAPX? Do you currently hold this bond fund in your Roth IRA portfolio? Thank you for your time.

Hi Thomas, I just picked a shorter duration fund in order to help avoid the impact of raising interest rates.

Total bond fund is good also, it pays more, but is more susceptible to price movement.

In my case I have very low bond positions due to my time and risk horizon so I decided to lose out on return in order to have more dry powder.

If you have a 60/40 portfolio there is more room for a total fund, but I might still have short terms in there right now.

Hey Matt, just looking back a bit, and noticed that this entry says “VTIAX is a diverse blend of REIT companies”. Probably worth fixing.

Cheers,

Dan

Crikey! Thanks.