Yesterday I confirmed that my Gains and Loss report from my Brokerage was incorrect, this report is the base information that they use to create your Schedule D, an IRS form that you will be using to calculate, and support, your Capital Gains or Losses for the Tax Year. These are critical numbers when reporting your taxes and when it comes to Capital Losses you can carry forward numbers for years by offsetting up to $3,000 per year against regular income. For an introduction to Capital Losses see this post.

Here is my Schedule D from OptionsHouse, provided by Maxit Tax Software. Maxit produces reports for a number of Brokerages so don’t assume this problem is unique to OptionsHouse (or even to Maxit) if you want to be sure your numbers are correct then you are going to have to check manually in an Audit, which is what I will be doing over the next few days.

Here is the form (IRS Form 8949) that OptionsHouse/Maxit provides to me to be added to my Schedule D, the errors are invisible because they are omissions; unless you know the trade is not showing when it should be you wouldn’t think to look at this. Omissions are the hardest thing to spot unless you are looking for them, but luckily (perhaps..) these two large losses for 2012 and 2013 are firmly in my memory.

http://saverocity.com/wp-content/uploads/2013/02/ScheduleD_Forms2012.pdf

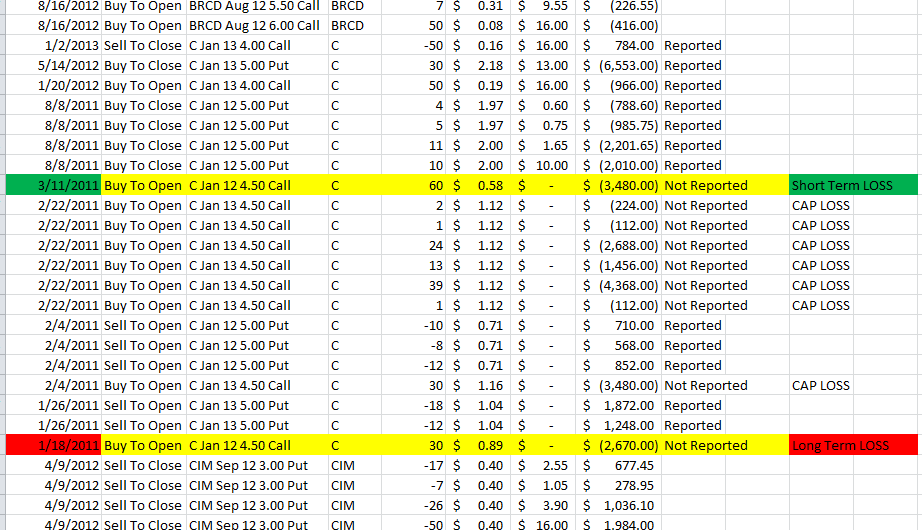

Both the Short term and Long Term Loss Pages are missing a vital trade from Citibank (C) as shown below in the excel sheet I am using to Audit this:

To find the problem trades I sorted the Excel sheet by Symbol Name, so I get to look at every trade I made with C between January 2011 and January 2013, the two that are missing from the Schedule D for 2012 are highlighted in Green and Red above, differentiated because the positions opened on different days, and the one in Red is actually qualifying for a Long Term Capital Gain so should be reported as such, and the one in Green is Short Term.

So I have to edit my IRS Form 8949 to reflect this, and now the real works starts… I knew already that these trades were missing because I remembered them. But how many trades did I make that I don’t remember? So it is a case of going through each line, sorting by year and by opened and closed trades. A tedious task, but something that I have to go through.

The biggest concern for me as a naive user of the Maxit and other brokers services to provide me with this information is that I trust them to do it right, when you get the data provided for you on an IRS Official Form it conveys a level of trust that the information within it is accurate, but yet again I am learning that if you want to trust someone with your money, that someone should only be yourself.

Here is the revised Form 8949 for 2012 with just the initial Citibank C Changes, the difference is $6,150 to my Capital Loss Claim..and onto the rest of the audit for any other errors (I already found the $12,440 missing for next year in addition to this).

http://saverocity.com/wp-content/uploads/2013/02/Corrected-9849.pdf

Leave a Reply