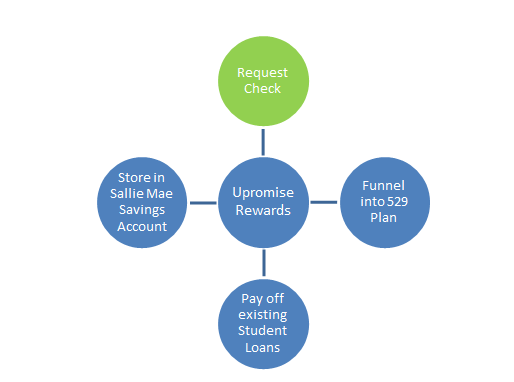

Upromise is an excellent savings program owned by Sallie Mae. At its core it is designed to create cash back savings that are targeted towards college expenses – either in the form of a 529 College Savings Plan, or to be funneled into Sallie Mae Student Loan payments, however there are also other options, such as linking a high earning (sic) savings account, OR… simply requesting a check.

The interesting angle for those who have not considered this program in the past is the check option – if you want to look at this as pure cash back you can request the check from the points and enjoy the money. The risk you face is if you first transfer the money into the 529 or possibly the Savings account as that might tell the IRS that you are now saving for college, and if you make withdrawal then you will have to pay tax (plus a 10% penalty) on the interest earned side of things (you wouldn’t pay tax on the initial investment amount).

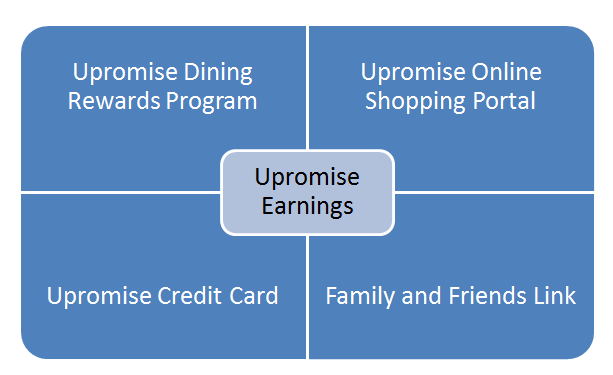

>Getting Started – set up a Upromise Account, this will be the holding vehicle for all your earnings, from here you can then access the following earning options:

Upromise Dining Network

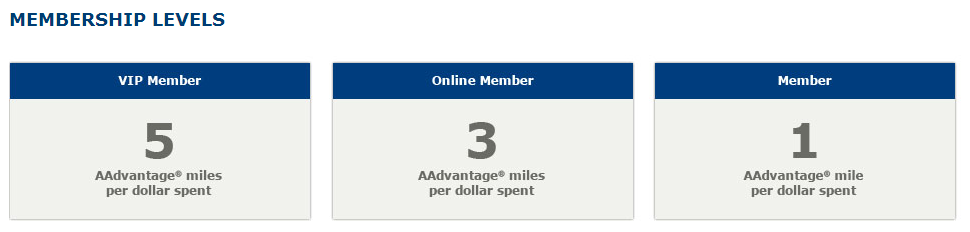

I personally think this is the most generous Dining Network programs available. Most of the big loyalty programs are linked to a Dining network, but they typically require a fixed number of dines to reach ‘VIP’ status typically that seems to be 12 dines. Once you reach that level you become a VIP and earn at 5 miles per dollar.

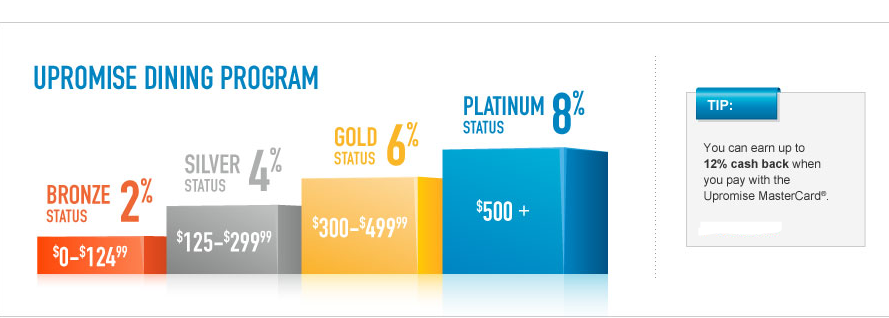

The Upromise Dining Network is a revenue based system, which in my opinion is much better, since living in New York I find that a meal for 2 is easily over $100 each time, and they include Tax and Tip in what you spend to earn status with them! Check out the Upromise Dining Network Rewards Tiers here:

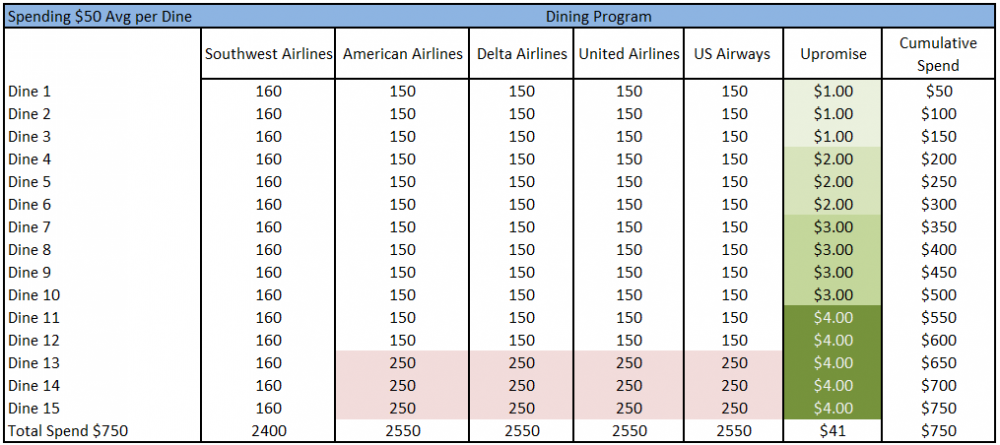

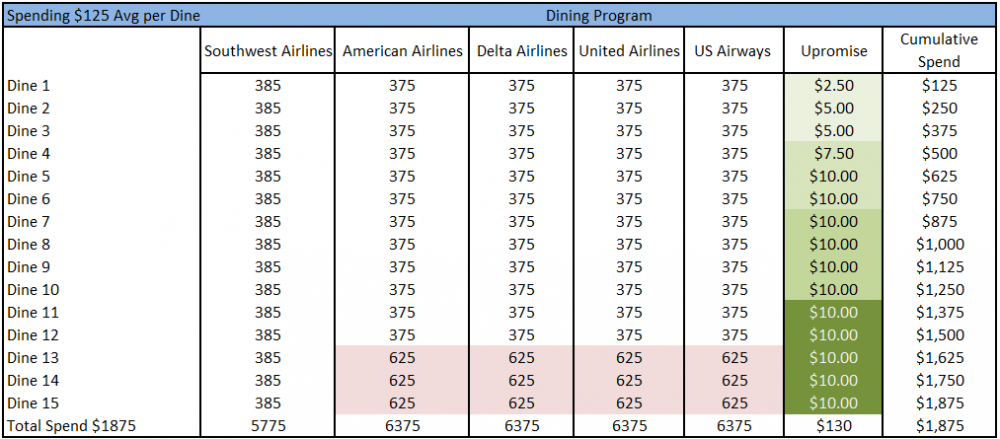

Taking a quick look at earnings based upon different meal prices:

Now, again we hit that part where the value of a mile is subjective, so to keep it as objective as possible, if you are earning the Miles vs Cash back with an average spend of $50 per dine then you are saying you would forgo the cash and accept the Miles at a cost per mile of: 1.6 Cents.

If we look at a higher average dine rate, which I think is not uncommon for two people with wine (including tax and tip) then $125 is very easy to spend. The earnings with Upromise Dining are even higher, because you get to VIP Platinum status that much faster and are earning at 8% Cash back. Here you by accepting Miles over Cash you are paying 2.04 Cents per mile… really not good value IMO.

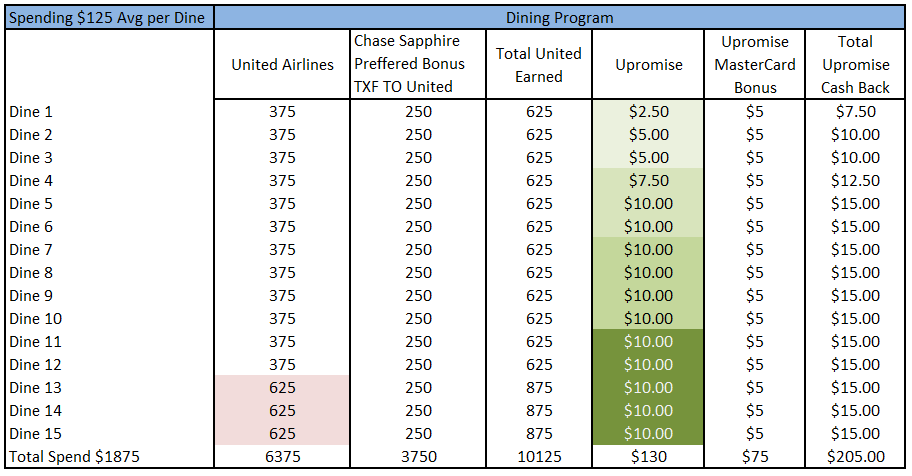

Note – you can link ANY card to the Upromise Dining network; many people like using the Chase Sapphire Preferred card for Dining as it offers 2x Ultimate Rewards, however, if you use the UPromise MastercarBut note that 4% multiplier only works at the participating restaurants in the network, whereas the Chase card works everywhere.

Comparing paying for your meal with Upromise Mastercard rather than than the Chase Sapphire Preferred (you could also mix and match)

In that last example you would give up 10125 from the ‘old route’ of paying with your Chase Sapphire and the United Program. But you would earn $205 with the Upromise Mastercard. If you pick the United Miles you are buying them at 2.02 Cents each.. not good.

The Upromise Mastercard

You can really start stacking your earnings potential by adding the Upromise Mastercard, but I should note there are a few caveats.. firstly on those earning multipliers:

1. Dining 4%, as mentioned previously only applies to those restaurants in the Upromise Dining Network – otherwise it will be 1%.

2. Gas 3% at Exxon or Mobil only – and you need to pump 20 Gallons per month in order to get the 3% rate – doesn’t apply to Diesel, non-fuel and Fleet Purchases. You might want to consider cards like the Chase Freedom or DiscoverIT Card that are currently both offering 5x on Gas for this Quarter in their rotating bonus categories too.

I think its a good deal if you plan to get the multipliers working for you, if you are the type of person that likes to plan their meal ahead and would be happy to check the Upromise Dining Network for your restaurant then earning 12% Cash back is unheard of, and also their online shopping portal is excellent – you double dip by paying with this card. If the merchant is offering 5% you get 5%+5% for 10% cash back. If you want to get the card the links here are my affiliate links, and come with a $50 sign up bonus to get you started.

The Upromise Online Shopping Portal

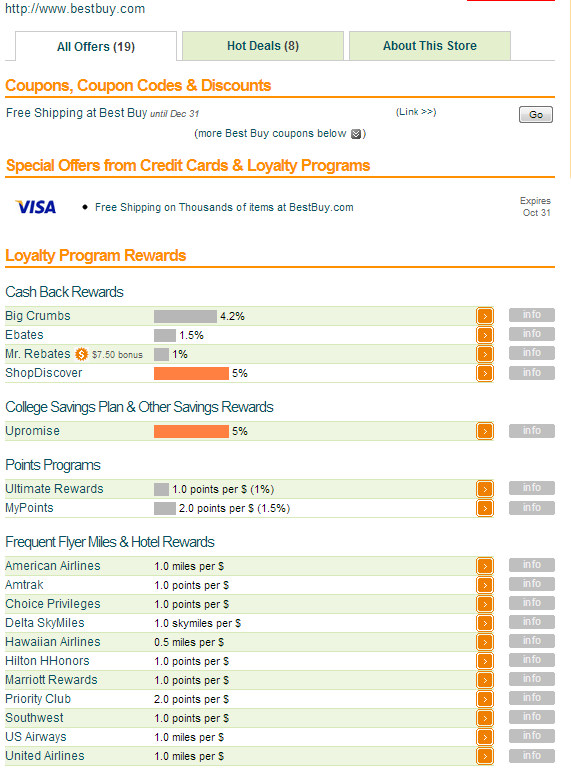

I cross check the best Online Shopping Portal using Evreward.com (people use others, but I’ve found this one OK for me) I ran a few random companies through Evreward to see how Upromise compared.

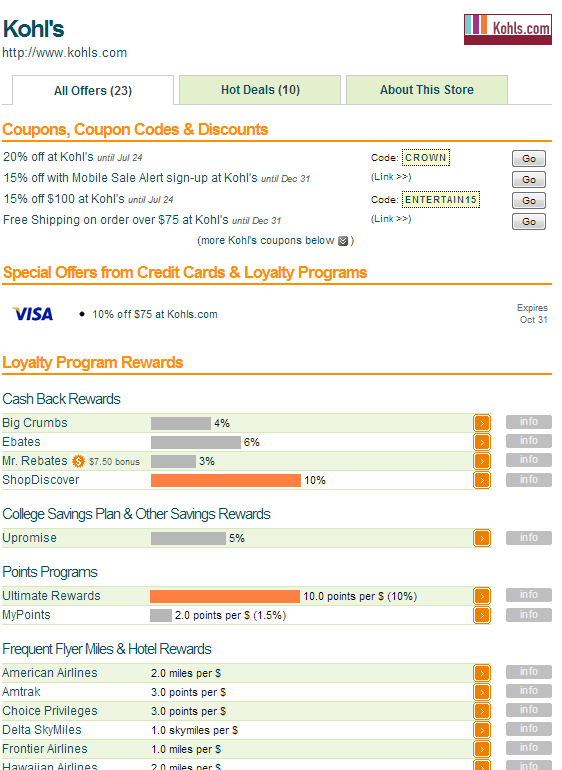

For the most part, the companies that list on Upromise Online Shopping Portal seemed to offer 5% Cash back – you get double that if you pay with your Upromise Mastercard. However even then it isn’t always the best offer, as I punched in some random companies – ShopDiscover offered 10% for one (you would a get an extra 1% from the DiscoverIT Card for 11%) or here if you look at Kohls the leader is Chase Ultimate Rewards shopping, as you would get your 10% plus whatever card you used on the top.

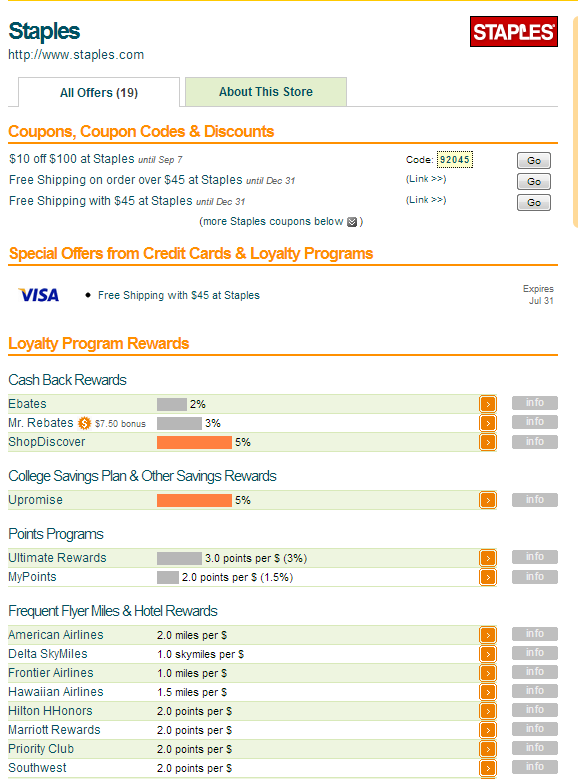

I didn’t do an exhaustive search, but my opinion is that if you see something that is traditionally offering 2-3 Ultimate Reward Points, such as Staples, you could get the 5% from Upromise, and double that with the Upromise card for 10% Cash Back (or use the Ink Bold for 5% Cash back and 5x Ultimate Rewards if you prefer).

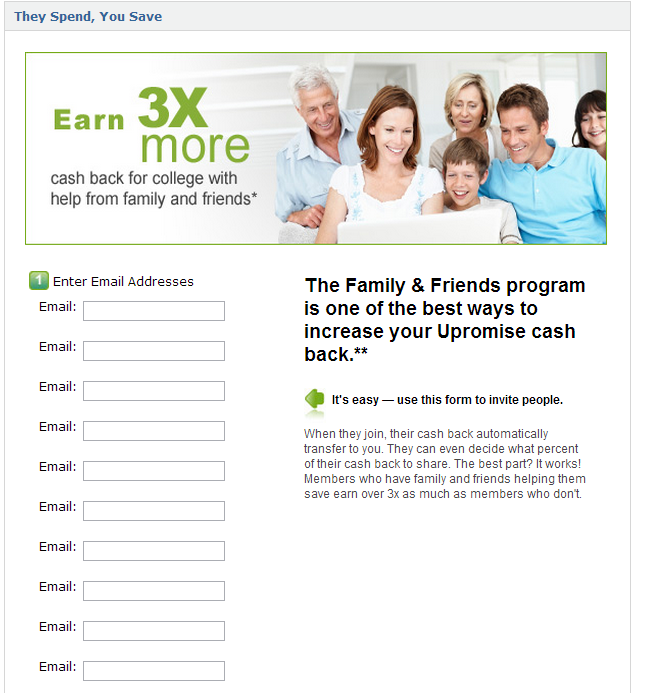

Upromise Friends and Family Program

Upromise allows you to invite Friends and Family to your program, and offers them the ability to send you all of their earnings, or just a part that they feel they want to share. You can have many people join your program to feed the account, and they claim people who do this on average earn 3x more than someone who does not.

Caution here – the amounts transferred into your account are considered ‘gifts’ from a Tax perspective, so you need to factor that in if you are already receiving cash gifts from these people you need to factor that into your maximums before you start having to pay tax on the amount (you can receive $14,000 per person, $28,000 per couple in 2013 from each person).

All in all, I think Upromise is a very interesting program, and with the ‘send check’ option is available to a much wider audience than those just going for a 529 Plan, or seeking to pay down their Sallie Mae Student Loans, it is in fact, open to everyone!

Please note, the links in this post for the Discover IT Card and The Upromise Mastercard are Affiliate links, if you should sign up for these cards using these links I may receive compensation from them. These are the best links that I know of for both cards.

That’s quite an extensive update. I’ve looked at UPromise a couple of times in the past but honestly have not acted. Maybe it’s time to give it another look-see 🙂

Yep – I think the major turn off has been the focus on 529 accounts which people are scared of. But if you just cash out the check then there are some good earning potential here for regular cash back.

Very good and thorough review. We only like one of the Dining Rewards restaurants around here, and don’t dine at it frequently. Perhaps if we move, the calculation might change.

Thanks Harvson – we have a bunch of them in the city, but to be honest what I like best about Dining Rewards is not actually planning my meal around who participates, but rather getting a surprise when the restaurant I randomly picked was a part of a program – with that in mind linking my CSP is probably best. But for planners then the 4% card is attractive as an alternative.

I think it’s a great way to get some extra money for school – a very unique program that a lot of people don’t know about. If only more people got the word out – especially to lower income students – this could be a real winner.

Super old post, but the last one in financial products.

You can actually get up to 15% back with iDine (iDine.com). The tiers are slightly higher (5% base, 10% at $250 spend, 15% at $750+ spend), but I easily hit that by 3 months into my anniversary this past year.

iDine is really terrific and I link most of my cards to that, not to the various mileage plan dining programs. Only two downsides:

1) generally, no promos (double miles for a month, for example, for 10 AA miles is better than 15% cash); and

2) you get rewarded in these funky cash back iDine gift cards monthly. Which is fine, except I can only liquidate them by using them, so on the back end I don’t get spend points again. (Example: I use my CSP for $500 spend in a month, netting me 1070 UR. I also get $75 in a reward card from iDine. I put that $75 towards everyday spend I would have put on my SPG card, so I lose 75 SPG, or 99 AA miles. So you don’t get quite 15%, more like 12-13%.)

Again, still better than uPromise, and you can use any card you want. I signed up for upromise dining anyhow, but, like you said, the random rewards are too good to pass up. So wouldn’t want to use their card for it.

That’s really interesting thank you. I will certainly look into it further. I guess the redemption options for the giftcards is key, but the earning is excellent.

So do I understand correctly that one can open a Upromise rewards acct without opening a 529 at all, and just request all rewards be paid as a check? Thanks!

Yes you do. Though I haven’t done that yet as my cash is pending, I will in the next few days.

I have been a member of Upromise since August 2006. My credit cards are registered with them, as well as my grocery cards. The majority of my shopping for non-food items is online. I always check Upromise before making a purchase. I have only earned a little more than $200 in the past eight years. I would say that at least 50 percent of the time I do not receive credit for my purchases. Somehow there is no record of me accessing partner sites through Upromise.

That sucks – thus far I’ve been pretty lucky, but sometimes it is better to find a more stable portal even if it pays less.

@Matt @saverocity

shopping portal noob. here.

upromise claims to offer 1% for ebay. additional 5% for using the upromise credit card?

is there a monthly spend limit?

seems too generous.

thanks.

Thats a very astute question. Im not sure, but Im going to find out.

“You will receive the extra 4% bonus cash back when you make online purchases with eBay.com using a Upromise MasterCard as long as your purchases are not made through a third party payment processor including, but not limited to, Google Checkout, PayPal, Bill me Later and purchases made with more than one payment mechanism (e.g., a gift card and the Upromise Credit Card), “

I visit everyday a few sites and information sites to

read content, but this blog offers quality based content.