Some of you may have already read about this on Flyertalk or Million Mile Secrets, but it’s now possible to get a PIN for prepaid gift cards. Let’s get the obvious implications out of the way first: it’s now easier to churn your credit cards for points. You can now use prepaid gift cards to load your Bluebird Amex at Wal-Mart, to buy money orders, and and to get cash back from point of sale transactions, among other things.

We don’t have much to add to the max-out-all-your-5%-cards-ASAP-before-this-deal-dies discussion, other than maybe to refer you to our Best Buy post a few days ago for another possible angle. There is one aspect of this whole development which is very curious, however. As a poster on Flyertalk pointed out, all of this is happening because the Federal Reserve released new guidance for the gift card issuers which prompted them to very hurriedly start issuing PINs for their cards. Check out this excerpt from The Hill’s coverage of the situation:

“Quite honestly, the prepaid industry was shocked when the staff of the Federal Reserve Board issued [the informal guidance] less than three weeks before the effective date,” said Brad Fauss, the executive vice president and general counsel of Brightwell Payments, a payroll card company.

The guidance is not officially binding in theory, but in fact it’s usually what the financial services industry has to follow, thus the sudden rush to make this happen. Here’s a relevant excerpt from the Fed guidance:

Q2. Must an issuer of a general-use prepaid card that is enabled for processing transactions over a PIN network and an unaffiliated signature network provide or permit activation of the PIN at the time the prepaid card is purchased for the card to comply with § 235.7(a)?

A2. An issuer complies with § 235.7(a)’s prohibition on network exclusivity only if card transactions can be processed over both unaffiliated networks on the card. Transactions can be processed over a PIN network only if the cardholder has a PIN to use for card transactions. Where an issuer intends to meet the requirements of § 235.7(a) by enabling a PIN network on the card, the issuer may comply by activating the card at the time of purchase and providing a PIN at that time or by activating the card by telephone subsequent to purchase and providing a PIN at the time of activation.

What on earth is all this about? To find out, let’s go to rule 235.7(a):

§ 235.7 Limitations on payment card restrictions.

(a) Prohibition on network exclusivity. (1) In general. An issuer or payment card network shall not directly or through any agent, processor, or licensed member of a payment card network, by contract, requirement, condition, penalty, or otherwise, restrict the number of payment card networks on which an electronic debit transaction may be processed to less than two unaffiliated networks.

So the Federal Reserve is saying that issuers must allow their cards to access more than one network, and that the only way for them to do so is to provide PIN numbers with prepaid gift cards. Why do they have a concern about network exclusivity? We’re not sure, but our guess is that it involves antitrust concerns.

Maybe we’ve been reading Barry Ritholtz’s blog for too long, but we’re just too cynical about our nation’s financial authorities to be surprised that the Fed is requiring prepaid gift card issuers to do something which makes it easier for credit card aficionados to more easily exploit the credit card rewards system and make it easier for people with stolen credit cards to convert them to cash.

Of course, this particular blog is not likely to have any effect on Fed regulations, so we’re certainly not about to advocate for any sort of change, especially when we and our very clever readers are in a position to benefit from the Fed’s incompetence. All we’re going to say is, whip out your Chase Inks and your Citibank Preferreds and make hay while the sun shines!

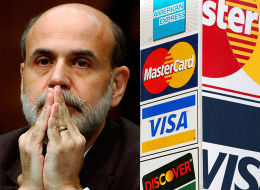

And congratulations to Ben Bernanke! We’re only one week into April, but you’ve already got the PFD Man of the Month award wrapped up!

Recent Comments