There’s been a lot of credit card action this week, so we’ve been heavy on credit card coverage. It’s therefore as good a time as any to bring up the Chase GM business card, especially since we can’t seem to find much writing about it on the interwebs.

We wrote about the GM consumer credit card offered by Capital One a while back to point out its shortcomings, but we’re pleased to report the business version, which is issued by Chase for some reason, is better. How?

Simple: no earnings cap. The consumer version lets you get 5% on all purchases, but the amount you can redeem toward a vehicle or lease purchase is capped depending on what type of vehicle is purchased. The amount of the cap can be as low as $500 if you buy a low-end car.

The business version has no limits on either earnings or redemptions, however. It does not have 5% earnings, but it does offer 3% back on gas stations, restaurants, and office supply stores, and that’s not too shabby. There is no annual fee, either.

If you’re interested in buying or leasing a new GM car, we’d recommend getting both cards. Earn up to the limit on the consumer version, then earn beyond that on the business version.

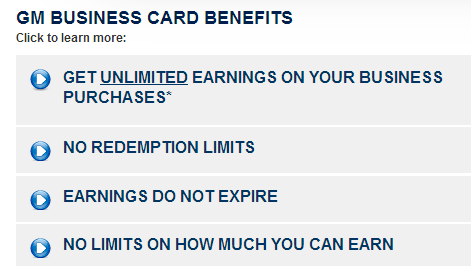

And in light of the events of the past week, with Citibank shutting people down for earning unlimited rewards, we thought we’d make note of the marketing verbiage on this card:

That’s right: the lack of limits on earnings is emphasized two times in the first four bullet points.

In light of what happened with the AARP card, all we have to say is…

[…] Digest @ Saverocity wrote an email to me noting that he covered this way back in May. Check out his post, where he also notes the lack of […]