I have in front of me a copy of the Capital One Rewards Barometer survey. As per the fine print, it’s a poll of “1,000 U.S. rewards card holders ages 18+, between April 3rd and April 14th, 2014, using an email invitation and an online survey.” Which is to say, the methodology isn’t perfect (understandable, since perfect methodology is expensive), but good enough. So what can we learn about U.S. rewards card holders, you ask?

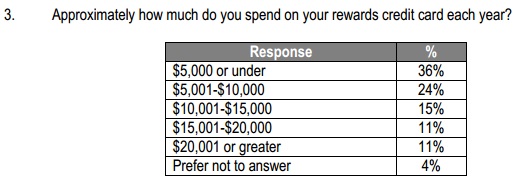

I circulated the following result on Twitter a few nights ago and folks wondered whether this was monthly spending:

…And no, that was annual. (Hard to believe we’re not normal, right?) As for the matter of what people like to redeem for:

Hotels and flights come in 4th and 5th place? Maybe people get too confused by that stuff.

Simplicity reigns! It seems most people don’t like Byzantine rewards schemes (Key Bank and PNC, I am singling you out for the one hundredth time. You don’t even have to pay for your consumer research! I’m trying to help you here!)

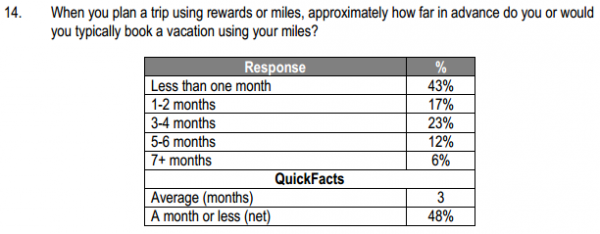

And most people don’t like to buy tickets 330 days ahead of time, either:

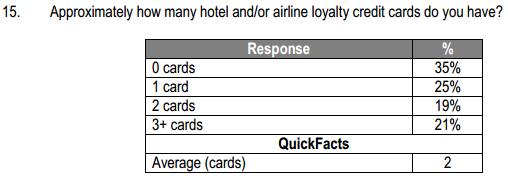

And you may find this shocking, but John Q. Public does not possess 30 different credit cards:

Don’t laugh! I, myself, once thought that I was pretty sharp for having TWO credit cards! You see, I had a backup in case something happened to the first one! A savvy consumer I was!

But enough about me, let’s talk about betrayal:

The disappointment runs closer to 100% in the point-and-miles blogosphere, of course, what with the Weimar Republic-style inflation eating away at our rewards balances.

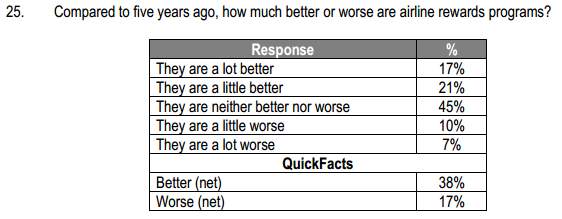

And finally, I was surprised to learn how much airline rewards programs have improved in the last five years:

Devaluation notwithstanding, the future’s so bright that 1,000 randomly selected participants gotta wear shades!

That’s all for this week. I will be on vacation next week (hint: Category 1 Hyatt!), so posting will range from sporadic to non-existent.

Have a great weekend!

Interesting results, it’s important to remember a few things though: Capital One is largely a sub-prime credit card issuer (a lot of their customers are part of the credit steps program), there is obviously a large self selection bias (they don’t make it clear what cardholders were offered if anything to complete the survey) and the number of participants is low enough that it’s impossible to draw any meaningful conclusions.

It’s interesting none the less though, would be interesting to pull a few thousand credit reports at random to check the # of credit card statistics.

One thousand participants is plenty if you want to draw meaningful conclusions–assuming you have a representative population, which, as you pointed out, we probably don’t on account of self-selection.