ACTUALLY, THEY’RE WORTH BOTHERING WITH FOR MANY PEOPLE: Over on TheStreet.com, Scott Gamm, proprietor of Help Save My Dollars, has an article called “Don’t Bother With Prepaid Debit Cards“. It’s a well-intentioned but misguided piece that deserves some commentary. Quoth Scott:

This brings us to the first problem with prepaid debit cards: the fees.

“It’s hard to find a prepaid card without a menu of different fees, from a monthly fee, to an inactivity fee, to a fee for a paper statement, plus fees for talking to a customer service representative,” says Gerri Detweiler, director of consumer education at Credit.com.

No, no, no, Gerri! Let’s rephrase her statement to make it more accurate: it is easy to find prepaid cards with lots of fees. We covered a few in our celebrity debit card roundup last week. But it is also easy to find a reputable prepaid debit card with minimal fees: the Amex Bluebird. Take a look at the fees for yourself and you’ll see it’s free to talk to a customer service rep. You can get it online or at Walmart, and it doesn’t get much easier than that.

It is really–and we say this without a hint of irony or malice–a great product, and Amex and Walmart are to be commended. And mind you, we seldom commend big banks or retailers.

Gamm continues:

And if you’re looking to develop credit history, a prepaid debit card won’t come in handy, since none of the activity on the card is reported to the three credit bureaus, Experian, Equifax and TransUnion. The way to build credit is to stick with a traditional credit card.

True, but that’s like saying you shouldn’t ride a bicycle because it doesn’t develop credit. Look, we love credit cards and use them wherever possible, but you have to have cash somewhere, and a product like the Bluebird makes sense for plenty of people. As Gamm’s article says:

“Unbanked and underbanked [people] are a popular market for these cards, which is one reason one might end up with a prepaid card. And it may be cheaper than a checking account, especially if you’ve been paying overdraft fees lately,” Detweiler says.

In other words, debit cards are a great product for the market they’re intended to serve. Glad we’re all in agreement! They’re also a great product for markets they’re not intended for, such as Frequent Miler‘s readers, but that’s another story.

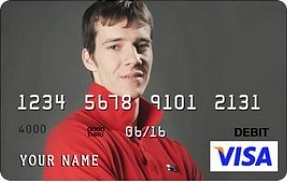

BOTTOM STORY OF THE DAY: “The new Mike Conley and Goran Dragic debit cards are here!” reads the headline on Yahoo Sports. We’re not sure how much market demand there is to have the two points guards available in debit card form, but who wouldn’t want to whip this out at the cash register?

That’s pretty sweet, right? And how about the Mike Conley card:

That’s pretty sweet, right? And how about the Mike Conley card:

Awesome! It’s like Mike Conley finished up his Hanes photo shoot and jumped right into your wallet!

As the article finishes:

These cards are only going to get more popular, obviously, and it was a smart move for Conley and Dragic to get involved. Perhaps next time they can even wear basketball uniforms for their photoshoots.

Please. Has anybody told Bill Simmons about these things yet?

STOP WHINING AND READ THIS: We’re always inspired to read about those who figure out how to make do with less, even if we’re not too keen on following exactly in their footsteps. So today we bring you Jason and Danille Wagasky, proprietors of Blissful and Domestic, who live with their two kids on $14,000 per year. It’s not rocket science, they’re just really thrifty.

Recent Comments