Things are looking up for credit card aficionados! Consider:

- According to Cardhub, card sign-up bonuses increased 5% in the second quarter. Interestingly, the article notes, “And some consumers have likely learned over the years how difficult it can be to actually use the rewards that credit card companies dangle in front of them. Such restrictions are part of the reason that a third of all credit card loyalty awards dispensed each year are never redeemed.”

- The Cardhub study also notes that bonuses are up 10% year-over-year.

- Citibank is adding airline transfer partners! See Miles Professor for more. Hopefully Citibank will introduce some new options for earning ThankYou Points as well.

- My wife just got her 50,000-point Fifth Third card.

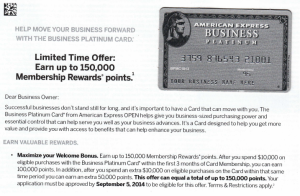

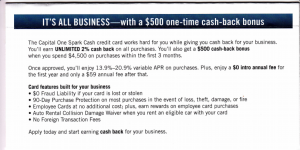

- A friend of mine just received two solid targeted sign-up offers: Capital One Spark ($500 cash back with a $4,500 spend) as well as the 150,000-point Amex Platinum offer shown below. It’s $10K for the first 100,000 points, plus $10K more for the next 50,000. It’s a lot of spending but 150K MRs is good compensation.

EDIT: I’ve also added in a scan of the Spark offer.

Can you post a pic of the Spark offer? I would like to try to get matched. Thanks.

My dad just got the Capital One offer too for $500. Any idea on how to make sure we’re opted into getting such offers from banks? I rarely, if ever, get targeted offers.

I’ve added the Spark offer to the post.

Make sure you’re not on any do-not market lists. Usually you have to ask to be put on these lists, but you can call your bank and check. You may be able to check online too.

Beyond that, it’s a matter of luck. They’ll pick you if you’re similar to people they’ve successfully marketed to in the past. And sometimes you just luck out and get randomly placed into a group where they’re testing an especially lucrative offer.

Thanks. The offer I got when I signed up was $250 after $5k + $50 for adding an authorized user. I chatted to try to get matched to the higher bonus, but no go. I sent an SM, so we’ll see what happens.

I have a similar question, it seems that I never get offers from AMEX, and the offers I get from Citi and Chase are always 0% APR offers. Did I opt out of these deals somehow; i’m just surprised I haven’t gotten any good credit card offers via the mail yet.

The only good targeted Amex offers I ever see are for the gold/platinum business cards, plus Delta. As for Chase/Citi, I can’t recall seeing many targeted offers from them recently other than the BTs; their best sign-up bonuses are usually open to the public.