SQUARE CASH LAUNCHES: A lot of you are probably familiar with Square, the company that makes those credit card readers you can plug in to your cell phone. Some of you may have even tried running prepaid debit cards through a Square reader just for the heck of it. Square is now branching out with Square Cash, a service that lets you send money from one debit card to another. [Read more…]

44 points per dollar at Sears! And Walgreens gets into the financial services industry

HOW TO EARN 44 POINTS PER DOLLAR AT SEARS: Frequent Miler reports that there’s some sort of triple witching hour confluence of promos going on right now to holders of the proper credit cards. If you have a Chase United card and a Chase Freedom card, you can get a relatively safe 32X or a possible 44X if you’re brave and a possible double dip works. [Read more…]

A new blog, a new Citi trick, a new 2% card, and the dark side of prepaid debit cards

NEW BLOG: A poster on Fatwallet Finance just left a 9-5 finance job for a job as a traveling circus accountant. It’s an unusual career niche, and he’s started a blog about his adventures called Working for Peanuts, so why not check it out and give a new blogger some encouragement? And here’s the FWF thread that launched the whole thing, “Financial Considerations for Joining the Circus”, which is one of the better FWF titles.

REDEEM THANKYOU POINTS FOR AMAZON AT ONE CENT PER POINT: Speaking of Fatwallet, you may remember that Citibank recently devalued the Amazon redemption option in its ThankYou rewards program. But several posters in this thread have reported success redeeming their ThankYou Points for Amazon gift cards at the generous (by TYP standards) rate of one cent per point by picking up the phone and calling.

ANOTHER 2% CARD: Just in case you want another 2% card in the wake of the demise of the 2% Priceline Visa, the FNBO ExtraEarnings card gives 2% on everything for the first 12 months.

THE DARK SIDE OF PREPAID DEBIT CARDS: Prepaid debit cards are popular among people looking to earn miles or points, but in at least one case they’re also a form of prison currency:

One brand of cards — Green Dot — is so ubiquitous that it has become part of the lexicon on the inside. The recent federal indictment of two dozen inmates and corrections officers in an alleged Black Guerrilla Family corruption scandal at the Baltimore City Detention Center notes several instances in which suspects refer to “dots” in transactions.

…U.S. Attorney Rod Rosenstein said Green Dot cards have become the primary source of payment among gang members and other inmates in the city jail. Using a simple code number to make transactions makes the cards hard for authorities to detect, he said.

“Once a person has a Green Dot account number, people can add money to the account in many ways without anyone being able to trace it,” he said.

Green Dot Corp. is just one of many providers of this type of card, and there is no allegation that the company has done anything illegal.

The California-based company declined to comment for this article. Its website says millions of customers use its products to access banking services such as ATMs and online bill payment. The company collects identifying information about account holders, which according to court documents helped the FBI locate a suspect’s home in the BGF case.

Such cards, like phones and many other outside conveniences, are banned among inmates. No cash is allowed at the Baltimore jail.

According to court documents from the recent federal indictment, inmates would receive text messages on contraband phones containing 14-digit codes linked to Green Dot “MoneyPak” cards sold in stores.

No word on how many ThankYou points the inmates accumulated before Citibank shut them down.

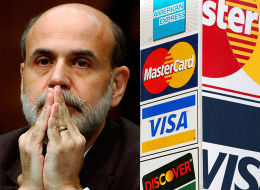

The Federal Reserve just made things easier for credit card fanboys and credit card thieves

Some of you may have already read about this on Flyertalk or Million Mile Secrets, but it’s now possible to get a PIN for prepaid gift cards. Let’s get the obvious implications out of the way first: it’s now easier to churn your credit cards for points. You can now use prepaid gift cards to load your Bluebird Amex at Wal-Mart, to buy money orders, and and to get cash back from point of sale transactions, among other things.

We don’t have much to add to the max-out-all-your-5%-cards-ASAP-before-this-deal-dies discussion, other than maybe to refer you to our Best Buy post a few days ago for another possible angle. There is one aspect of this whole development which is very curious, however. As a poster on Flyertalk pointed out, all of this is happening because the Federal Reserve released new guidance for the gift card issuers which prompted them to very hurriedly start issuing PINs for their cards. Check out this excerpt from The Hill’s coverage of the situation:

“Quite honestly, the prepaid industry was shocked when the staff of the Federal Reserve Board issued [the informal guidance] less than three weeks before the effective date,” said Brad Fauss, the executive vice president and general counsel of Brightwell Payments, a payroll card company.

The guidance is not officially binding in theory, but in fact it’s usually what the financial services industry has to follow, thus the sudden rush to make this happen. Here’s a relevant excerpt from the Fed guidance:

Q2. Must an issuer of a general-use prepaid card that is enabled for processing transactions over a PIN network and an unaffiliated signature network provide or permit activation of the PIN at the time the prepaid card is purchased for the card to comply with § 235.7(a)?

A2. An issuer complies with § 235.7(a)’s prohibition on network exclusivity only if card transactions can be processed over both unaffiliated networks on the card. Transactions can be processed over a PIN network only if the cardholder has a PIN to use for card transactions. Where an issuer intends to meet the requirements of § 235.7(a) by enabling a PIN network on the card, the issuer may comply by activating the card at the time of purchase and providing a PIN at that time or by activating the card by telephone subsequent to purchase and providing a PIN at the time of activation.

What on earth is all this about? To find out, let’s go to rule 235.7(a):

§ 235.7 Limitations on payment card restrictions.

(a) Prohibition on network exclusivity. (1) In general. An issuer or payment card network shall not directly or through any agent, processor, or licensed member of a payment card network, by contract, requirement, condition, penalty, or otherwise, restrict the number of payment card networks on which an electronic debit transaction may be processed to less than two unaffiliated networks.

So the Federal Reserve is saying that issuers must allow their cards to access more than one network, and that the only way for them to do so is to provide PIN numbers with prepaid gift cards. Why do they have a concern about network exclusivity? We’re not sure, but our guess is that it involves antitrust concerns.

Maybe we’ve been reading Barry Ritholtz’s blog for too long, but we’re just too cynical about our nation’s financial authorities to be surprised that the Fed is requiring prepaid gift card issuers to do something which makes it easier for credit card aficionados to more easily exploit the credit card rewards system and make it easier for people with stolen credit cards to convert them to cash.

Of course, this particular blog is not likely to have any effect on Fed regulations, so we’re certainly not about to advocate for any sort of change, especially when we and our very clever readers are in a position to benefit from the Fed’s incompetence. All we’re going to say is, whip out your Chase Inks and your Citibank Preferreds and make hay while the sun shines!

And congratulations to Ben Bernanke! We’re only one week into April, but you’ve already got the PFD Man of the Month award wrapped up!

Recent Comments