BASICALLY, THEY DON’T WANT TO: The big thing among the gaming-the-system crowd the past several months has been reloadable prepaid gift cards–Vanilla reloads, Paypower, Netspend, etc. It seems that everybody has been writing about this topic recently. It goes like this:

- Find a store that will let you buy gift card reloads using a credit card.

- Use a card that gives you an unusually high bonus at that particular type of merchant (for example, 6% for Amex Blue Preferred at the grocery or 5% for Chase Ink at Office Depot) to buy said gift card reloads.

- Drain the funds from the reloads.

It sounds simple, but the devil is in the details. Frequent Miler, who first brought this practice out into the open with his famous post One Card to Rule Them All, had a post recently where he described all the pitfalls that await practitioners of the dark financial arts. If you’re new to the game, there’s still time to try this out. The Points Guy has a good rundown of the current state of affairs.

Some people like doing this stuff, some people don’t. But a question that doesn’t get much coverage is, why don’t the banks do anything about this? Surely they know what’s going on, right?

The answer is, it’s complicated. In response to “they know what’s going on”, it’s important not to anthropomorphize the banks. (You may recall we warned against anthropomorphizing banks in a previous post. It’s a trivial yet meaningful cause, and it’s also the biggest word we’re able to use in a sentence, so we’re going to keep harping on this.)

The bank itself does not “know” what’s going on in any meaningful way. There are people within the bank who know what’s going on–but which people? And are they in a position to do anything about it? The answer is usually “no”. If so, do they have they incentive to do anything about it? Another “no” in most cases.

There’s no guarantee that any human being will ever pay attention to your data. Banks are set up so that as few people as possible will see your data since it costs money to have an actual human being look at what you’re doing. So if you don’t trip any fraud algorithms, nobody will notice. Why would you catch the attention of a fraud algorithm? Buying lots of gift cards in a short period of time looks an awful lot like money laundering, which banks very much want to stop, unless you’re worth $100 million or so and have a Swiss bank account, in which case they’ll look the other way. (Just kidding, banks, relax! We kid because we love!).

Customer service associates are likely to be the first ones to see what are going on as they’re the only ones who regularly see customer data. Customer associates are also the lowest paid employees, have the highest turnover rates of any group of employees in the bank, and the least power within the organization to change anything. So if a customer service associate notices somebody buying a bunch of gift cards–which is not easy, by the way, since banks can only see the purchase amount and the merchant in any transaction and can’t see what you’re buying–he will have to care an awful lot to sound the alarm to management, and then be successful in persuading them that there’s a problem, then those managers will have to be successful in persuading their managers that there’s a problem, and so on. But odds are that customer service associate just wants to punch his timecard and go home.

Now if you get the attention of the fraud department, it’s a different story. Customer service people aren’t paid to give a damn about this stuff, but people in the fraud department are. Unusual activity tends to get their attention. What’s unusual? It depends on the customer’s history, their patterns of behavior, typical patterns of fraudulent behavior, and so on.

A fraud algorithm has to detect suspicious activity while simultaneously not flagging normal activity, and that’s why bloggers remind you not to be so obvious about your gift card purchasing. A whole bunch of transactions for $503.95 in the space of a week are a lot more easy for an algorithm (or a human) to notice than transactions for $509.28, $523.82, and $518.43 spaced over a month.

Right now you’re probably asking yourself, “Why don’t banks do the obvious thing and put a fairly low cap on 5% rewards?” They eventually wise up and do that, but it takes a while. The reason it takes a while is that it takes a long time for relevant information–like the fact that people are earning hundreds and even thousands of dollars in rewards from a single credit card via an easily preventable loophole–to reach the decision-makers.

Moreover, the decision-makers often have perverse incentives for bringing in the wrong kind of business. This dynamic was at play in the Chase AARP 5% card fiasco recently, where Chase launched a credit card with 5% unlimited cash back and was totally surprised when it was overrun with people who figured out ways to run up a lot of credit card charges on their 5% card. Who could have seen that coming, right?

More hilariously, this same thing had happened in 2007 with a Citibank card, the Citi CashReturns. It offered 5% unlimited cash for a three-month promotional period and as with Chase, Citi took a good 18-24 months to notice. Not only that, but very clever people found that they could keep cancelling the card and getting a new one with a new 3-month 5% promo. Chase didn’t learn from history, and probably nobody else did either because thanks to high turnover and low morale, institutional memory is short in big banks. Mark our words: in the next few years, somebody is going to get desperate and again repeat the unlimited 5% mistake, or at least something similarly stupid.

The reason they do this is because short-sighted CEOs (or line of business executives, or whichever borderline-sociopath is calling the shots) decree that Metric X Must Increase Y% this year to please investors. Metric X can be revenue, or number of new cardholders, or market share, or anything. This puts unrealistic pressure on the people below, until some sociopath-in-training from the lower ranks says, “Hey, if we offer 5% unlimited cash back, we’ll get lots of new accounts, and I’ll get credit for making the numbers and get promoted and/or hired away, and then somebody else will have to clean up the inevitable mess after I’m gone! Sweet!”

Of course, it doesn’t always happen this way. Sometimes it’s a fool instead of a budding sociopath. The point is, the bank’s upper management puts in place incentives for people to do things like this. And surprise, surprise, the wanna-be ladder-climbers figure out how to game the system and are rewarded for it by the CEO who is himself gaming the system. And then they put into place products and programs which reward customers who figure out how to game the system. And then the bank makes a half-hearted and/or belated attempt to stop people from gaming the system that was devised by people who themselves were gaming the system in order to appease the idiot CEO who became CEO not because he’s good at banking but because he’s good at gaming the system–or, as it’s called in corporate America, “playing politics”.

If this sounds like a giant mess, that’s because it is. Remember how in the last few decades banks kept merging and they always claimed “efficiency” as a justification for the mergers? Well guess what: bigger banks are not more efficient. Yes, they do get more efficient at some things, but those advantages are offset by the banks’ becoming less efficient at other things.

A few years ago Tom Brown at bankstocks.com quantified this. He compared bank size vs efficiency and found no relationship:

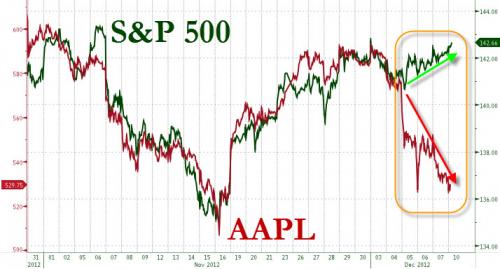

For those of you not trained in statistics, an r-squared of .000022 is translated into English as “no meaningful relationship.” But guess what is correlated with bank size?

If you’re surprised by this, then we’d like to sign you up as an Amway representative. Please go read ZeroHedge–just blocked by Bank of America!–or at least Barry Ritholtz until you’ve developed a healthy cynical streak. In the meantime, we encourage you to go sign up for that Citi 5% card we keep talking about and have some fun.

AREA GENIUS AVOIDS BAGGAGE FEES: Speaking of gaming the system, we’re so proud of this guy for actually doing this. And this isn’t Gen-X sarcasm, mind you, this is authentic praise. Baggage fees too high? Wear your clothes! All of them.

HALF PRICE PIZZA: Courtesy of Slickdeals comes a large pizza for 50% off from Papa John’s. Enter the code 50DEC when you order online. Offer expires December 23.

Recent Comments