My dear friends, we are gathered here today to mourn the death of one of my personal favorite deals, the Blue and Yellow Consumer Electronics Company Credit Card Extremely Generous Promotion. [Read more…]

How does $200 + 5% cash back sound for a credit card bonus?

Via Fatwallet Financial, TD Bank is offering a $200 sign up bonus plus 5% cash back for six months on gas, groceries, dining, and utilities (no drugstores, alas) when you sign up for their TD Easy Rewards Visa. What’s the catch? The catch is that you have to live in the bank’s footprint (FL, SC, NC, VA, DC, MD, DE, NJ, NY, MA, RI, NH, VT, ME) plus you have to open the account in-branch if you don’t already bank with them.

It may be of interest to those of you on the east coast. $200 is a decent bonus, 5% is very good as well, and the two of them together is even better. I have no idea how TD Bank’s credit lines are, nor do I know how they handle people who like to make large purchases at gas stations and supermarkets, though anybody who has experience with this bank’s credit cards is welcome to chime in below.

Small transactions and monthly deals: worth the trouble?

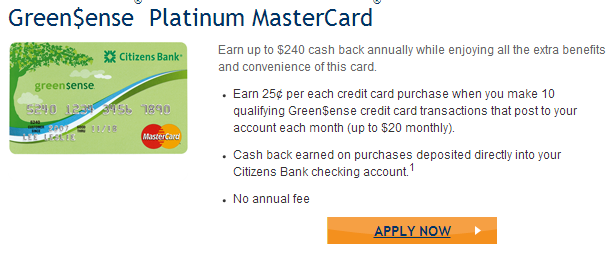

Chasing The Points alerted me to a new credit card from Citizens Bank, the Green$ense Platinum:

You can earn $20 per month with this thing, BUT you would have to make 80 transactions per month in order to get that $20. It’s a lot of work unless you can figure out a way to automate a bunch of small transactions. Given the much lower-hanging fruit to be had with manufactured spending, there probably aren’t a whole lot of people into this sort of thing right now. That makes it a great time to talk about this since there’s probably little danger of killing this deal by writing about it.

Where can you do a bunch of small transactions? Back in the good ol’ days that cranky old-timers are always talking about, you could buy Amazon gift certificates in one cent denominations. Ka-ching! In fact, Chase was paying out ten points per purchase at this time, and this led to a hundred-page credit card statement for at least one person (and I would assume more). Chase later raised the minimum gift certificate purchase to $0.15, then just a couple of months ago it went up to $.50. So unless you already do a lot of shopping there, Amazon’s off the table.

Next, there’s the question of how you can automate. I think there’s something called iMacros that can be used for this, though I’ve never looked into it.

So yes, there’s some work to do upfront, but I would imagine that as you get up the learning curve it becomes less work. I could be wrong, but I would also guess that if you build up a competency in small transactions you might find other opportunities as well. Worth the trouble? Beats me.

If you have a spouse, you’re looking at $480 per year, which is roughly 1% of the median household income in the U.S. Question: how many deals are there where you can earn a few bucks per month? If you put them all together, how large an income stream would that potentially be? Off the top of my head, I can think of Staples ink recycling and the Santander Bank thing, but I’m sure there are others.

Chase screwed over its affiliate marketers yesterday

So Chase just put out a great offer on its United card: 50,000 miles (up from the previous public offer of 30,000), plus 5,000 miles for adding an authorized user, plus the annual fee is waived for the first year. This was also an affiliate link, meaning that Chase’s affiliate marketers–some of the bigger ones include boardingarea.com, Million Mile Secrets, and The Points Guy–were set to make some good money. Here, courtesy of TBB’s Twitter feed, is what the scene looked like on BoardingArea: [Read more…]

- « Previous Page

- 1

- …

- 16

- 17

- 18

- 19

- 20

- …

- 48

- Next Page »

Recent Comments