BA 100K: The on-again, off-again 100,000-mile offer from British Airways is on again. Whether or not this is a good deal depends on whether you’ll take advantage of the sweet spots of this program, [Read more…]

Credit card pop quiz

Pop quiz, hotshot! I’m going to give you two mystery credit cards, and you’re going to tell me what credit card I’m talking about, what airline I’m talking about, and which card is better. Ready?

CREDIT CARD A: Earns 1.25 miles with Airline X per dollar spent on all purchases. $95 annual fee.

CREDIT CARD B: Earns 1.30 miles with Airline X per dollar spent on all purchases. $0 annual fee.

You can probably guess what card A is, since not too many airline cards give you 1.25 miles per dollar. It’s the Chase British Airways card, of course! (Note: this is not an affiliate link, and I get no money if you click through.)

And credit card B? It’s the American Express Blue for Business (Note: this is not an affiliate link either):

The card earns 1 Membership Reward point per dollar spent. MR points can be exchanged for Avios at a 1:1 ratio, plus you get a 30% bonus on all purchase-related points earned each year. Voilà, 1.3 points per dollar spent. (Though before you rush out to get this card, please note that you do need to have a more premium Amex card, e.g. a Gold card, in order to be able to transfer points from this card to one of the MR partners.)

So which card is better? That’s a trick question. The answer, as always with these things, is it depends. The Chase card comes with 50,000-point sign-up bonus, vs 10,000 for the Amex Blue, so clearly if you’re looking for a big one-time gain, the BA card wins.

But the Amex Blue for Business belongs in the conversation. You can actually earn more Avios with it than you can with the branded card, and there’s no annual fee. There are many cases where you can get two cents of value or more per Avios, so you’re talking about a 2.5%+ card with no annual fee. I could get a CLT-LGA roundtrip ticket with seven months of Amazon payments.

Another pop quiz: why don’t other bloggers in the points and miles community talk about this card? It’s not an amazing card, but like I said, it belongs in the conversation since there are some people and some situations for which it would be useful.

Frequent Miler, to his credit, is the only major points-n-miles blogger I know of who has mentioned this card (he even has it on his best credit card deals page). I wasn’t able to find any mentions of this card by the rest of the boardingarea.com crew, or by Points Guy or Frugal Travel Guy. If I’m missing one, by all means let me know and I’ll gladly correct the record.

This goes back to what Matt wrote about the other day regarding the economics of blogging. The incentives of big league bloggers are not aligned with the incentives of their readers. This doesn’t mean that they’re bad people, or that there’s anything wrong with getting paid to sell, just that most of them are sacrificing the quality of their product in exchange for card-whoring. They get paid to push certain cards, and they don’t write about other potentially useful cards since they’re not getting paid to do so.

I don’t mind if a blog has advertisements, or if they promote a really good deal, or if they subtly work a relevant link into an article, or if they ask me to use their links to help support the blog. Bloggers have to eat, right? Just be honest about it and don’t punish your readers with irrelevant and/or subpar affiliate links.

There are some who still produce a good blog despite the temptation to do otherwise, and hats off to them, because it’s got to be awfully tough to resist the temptation to cash in for a substantial short-term gain. Those of you who merely read and don’t blog should be aware of the incentives underlying some of the content you’re reading.

How to double your sign-up bonuses… and free money from Amex

IT DEPENDS ON WHAT THE DEFINITION OF ‘PRODUCT’ IS: Most credit card companies will only let you have one of any card product at any given time, but those of you who went to law school should be asking, “What exactly do you mean by product?” Great question! It’s one posed by a reader over at The Points Guy, who was wondering if a MasterCard and a Visa flavor of the same card count as different products and therefore make one eligible to get a sign-up bonus twice:

“I’m currently holding a Visa Sapphire Preferred card and the annual fee is due to hit soon. I was told that I could get the Mastercard version, hence saving on the annual fee for another year and also getting another sign-up bonus. Do you know if this is true? My friend actually has the opposite issue, where he has the Mastercard and is thinking of getting the Visa, so I’m assuming it could work both ways if possible.”

TPG posed the question to his readers. It was not unanimous, but most reported that they were able to get the sign-up bonuses on both the Visa and the MasterCard Sapphire preferred. Advice for people who want to try this: cancel one before you get the other, and transfer your Ultimate Reward points out before you cancel the card.

Keep in mind that the product definition loophole works with several other products so that you can get the same sign-up bonus twice. Off the top of our head:

- Chase Ink Bold / Chase Ink Plus

- Barclays NFL Visa / Barclays NFL Mastercard

- Citi AA Visa / Citi AA Amex

- Bank of Hawaii Hawaiian Airlines Visa / Bank of America Hawaiian Airlines Visa

And that’s not even taking into account the personal and business varieties of many cards…

AMEX SELLING $25 GIFT CARDS FOR $15: Amex is running another one of its Twitter promotions. Their latest one lets you buy a $25 Amex gift card for $15 when you sync with your Twitter account. Note that you can do this for every distinct Amex account number that you have, and note that the Amex cards actually issued by Amex give different numbers for both the card owner and the authorized users.

In other words, if you and your wife both have a Blue Cash card, your wife’s account number will be different from yours. That means that you can do the $25/$15 deal for your card and she can do it for hers… and you can do it for every other Amex card you have as well, though you’ll have to create new Twitter accounts for all of them. (H/T: SlickDeals)

AN AVIOS BENEFIT WE WEREN’T AWARE OF: Thanks to Mommy Points for pointing out an Avios benefit we didn’t know about. Check out the last bullet point in her summary of the benefits of using the British Airways frequent flyer program:

• No close-in booking fees

• No online cancellation fee – just lose the taxes that you paid for the flight which is often $5 – $10 for domestic flights.

• Just a $40 change fee – which is much lower than many other airlines (of course, you could potentially just cancel and rebook for even less)

• Free checked bag, priority access in the airport, and priority boarding on American Airlines (this is not a published benefit anywhere I know, but my family was still getting this “perk” as of last week, though some in the comments report they have not been getting free bags, so YMMV)

We have the AA credit card, so we didn’t notice that last perk. We’re big fans of Avios, so we’re always happy to see another perk on top of what is already a great program.

740 is the new 36-24-36, plus get $125 of Chase’s hard-earned money

HOW *YOU* DOIN’?: If the New York Times is to be believed–and we’re not merely being rhetorical with our use of that ‘if’–then it is no longer merely banks who use your credit score to size you up. Along with anecdotal evidence of men bringing up credit scores on first dates, the NYT points out the existence of credit score dating sites creditscoredating.com and datemycreditscore.com. We suspect the credit score dating stuff is overblown, but there are some more grounded concerns brought up in the article. For example:

Lauren Dollard, a 26-year-old assistant at a nonprofit in Houston, said her low credit score had helped to stall her romantic plans. Her boyfriend is wary of marrying her until she can significantly pay down the more than $150,000 she owes in student loans and bolster her credit score, she said.

It is striking how many financial ills can be traced back to student loans, yes? College is an increasingly bad financial deal for many in the middle class, as ZeroHedge recently pointed out. Then there’s a more mundane issue brought up here:

John Hendrix, a 33-year-old chemist in San Francisco, said he worried that the vast disparity between his girlfriend’s credit score and his own low one could create tension in their relationship. When the couple leased a car in October, Mr. Hendrix had to leave his name off the contract because his poor credit scuttled his chances for the bargain interest rate that his girlfriend qualified for.

Hopefully Mr. Hendrix has availed himself of the internet and at least tried to get that black mark removed from his record. Then again, going in on a car with somebody you’re not married to is generally not a strong financial move, so maybe FICO speaks the truth about his reliability. (H/T: Flyertalk)

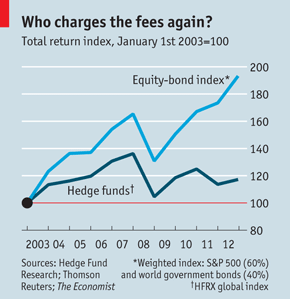

HOW TO MAKE OTHER PEOPLE RICH: We find the continued existence of most hedge funds a mystery to some degree. Take a look at this graph from the Economist:

We can understand why somebody would want to run a hedge fund: the fund generally gets paid 2% of assets per year plus 20% of the gains, so if you get lucky you can find yourself with millions or even billions of dollars in a fairly short period of time. But why would you want to invest in one? Sure, there are a few hedgies who are very good at what they do, but as Barry Ritholtz points out, good luck identifying the best managers ahead of time.

It’s not just that hedge funds do badly; it’s that people pay them a lot of money to do badly. Monkeys with a dartboard could perform much better at a much lower cost (this is the idea behind indexing, and it works more often than not). Hedge funds are essentially a wealth transferance mechanism: they transfer wealth from pension funds and retirement accounts to the people who run them. Asset managers ought to know better, but then again there is a lot of pressure in today’s low-rate environment to generate above-average returns, and better to fail with the herd than fail alone.

A HELPFUL CHART: Hack My Trip recently posted a very helpful chart we hadn’t seen before showing the amount of Avios it takes to redeem for flights of a given length. The chart shows why we love British Airways’s frequent flyer program so much. There’s a sweet spot for flights of less than 1,151 miles–you can do such flights for only 9,000 to 15,000 miles roundtrip. Taxes and fuel charges are minimal if you’re flying domestic and you can book at the last minute. What’s not to like?

$125 FOR OPENING A CHASE CHECKING ACCOUNT: Here you go. You need to keep a minimum balance of $1,500 or do a monthly direct deposit of $500 per month. If your date asks about your FICO score, this would be a great way to re-direct the conversation.

Recent Comments