We see a headline like this…

Introducing the 97-Month Car Loan

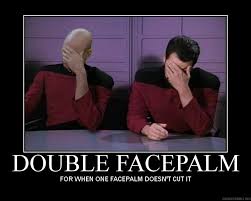

and our immediate reaction is this:

The article has some ominous data:

In the final quarter of 2012, the average term of a new car note stretched out to 65 months, the longest ever, according to Experian Information Solutions Inc. Experian said that 17% of all new car loans in the past quarter were between 73 and 84 months and there were even a few as long as 97 months. Four years ago, only 11% of loans fell into this category.

Such long term loans can present consumers and lenders with heightened risk. With a six- or seven-year loan, it takes car-buyers longer to reach the point where they owe less on the car than it is worth. Having “negative equity” or being “upside down” in a car makes it harder to trade or sell the vehicle if the owner can’t make payments.

Loosening up the loan terms so that people can buy stuff they can’t afford… we tried this with real estate last decade and it did not end well. This will not end well, either.

New cars are more expensive these days, as are used cars, thanks to the cash-for-clunkers program a few years ago that took a lot of cheap-yet-driveable cars off the road. But it’s still possible to be thrifty. If you want to buy new, do it the FWF way. If you’re considering used, here’s My Money Blog on the Edmunds.com $3,500 debt-free car project:

With an initial budget of $3,500 and the simple criteria of a reliable brand car with an odometer under 165,000 miles, they eventually settled on a 1996 Lexus ES 300 sedan with 135,000 miles that cost roughly $3,300 ($3,800 including tax, title, and fees). They took the average monthly payment of a “deep subprime” borrower of $365 (per Experian) and made that their maintenance budget.

Over the next 13 months, they drove that 16-year-old Lexus another 18,000 miles and spent $3,286 in repairs and maintenance. This included both preventative maintenance things like new tires, new battery, oil changes, etc. as well as two breakdowns and other unexpected repairs. This worked out to $253 per month, under their maintenance budget but high when compared to the purchase price. On the other hand, many of the repairs won’t be repeated for a while and 18,000 miles is higher than average. They ended the experiment by selling the car to an Edmunds employee for $2,700, although they probably would have gotten more on the open market.

And who knows, you might even get the status boost that comes with driving a luxury brand.

Of course, just buying the car is only one part of your total car expense; driving it is another. The Simple Dollar digs into the numbers a bit and concludes:

One of the best subtle financial moves you can make is to simply live close to your work. Ideally, choose to live close enough so that you can walk there or, even better, find some way to work from home. Your commute length – which is essentially part of your workday – virtually disappears, as do many of the expenses related to your commute. It doesn’t have any impact on your other buying decisions or your quality of life. It just leaves more money in your pocket and more time in your day.

This has been our strategy, and we highly recommend it. Up until recently we lived in a location where we were close enough to walk to work. We could also bike or take a bus if needed. Because of this, we were able to get by with one car despite having three kids.

We recently took a job that’s not within walking distance, so we had to buy a second car (used, of course), but that brings us to our next piece of advice about auto costs: live in a central location if possible. It may cost more to do so, but you’ll save on commuting expenses, not to mention your time.

And if you really do feel the need to drive a Porsche, you may want to check to see if there’s a rental option first.

Recent Comments