I got the Brooks Brothers credit card two years ago to see if it would offer the same sort of occasionally generous promotions that the Banana Republic / Gap / Old Navy credit cards frequently do. So far, it has not. They gave me a “make 5 purchase, get $20 in rewards” offer a few months after I joined, but that was the last one. Once a year cardmembers get s $20 gift card, which I happily take to Brooks Brothers to put toward a new shirt, but aside from that this card has been sock-drawered.

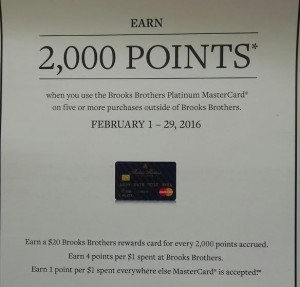

But at long last, the marketing machine has spring into action. Check this out:

$20 for five purchases! Ka-ching!

Okay, I know it’s only $20, but that’s $20 more of an offer than I’ve received the last two years, so I’ll take it.

Note that Citi acquired the Brooks Brothers card from Synchrony (aka GE Money) last year. Citi gave me a single promotion like this on the Best Buy card, and then never again, so I would guess this offer is a one-off and not the first of many to come.

Here’s a philosophical question to consider: how many offers like this per year would it take to get you to apply for a retail card? For example, suppose this card (or one for the retailer of your choice) offered a $20 gift card promotion like the one above four times a year. Would an annual stipend of $80 in gift certificates with no annual fee be enough to get you to pull the trigger on the card? For me, I think the answer would be yes. As always, YMMV.

Not strong enough unless you can open it without a HP. The pulls are just too valuable. I’m taking a $40k vacation later this year for about $6k thanks to airline and hotel cards. A few bucks at a clothing store isn’t even close to enough to sway me to waste the pulls. (Even if it is my favorite clothing store.)