While it’s a lot of fun to write about the same product as 30,000 other bloggers, such as the Chase Sapphire Preferred or the Hawaiian Airlines® World Elite MasterCard®, it’s also fun to take a look at stuff off the beaten path. Thus today I bring you news of an obscure card I’ve never seen mentioned: the UBS Preferred Visa Signature card.

There’s no online application for this one; it seems as though you need a UBS financial adviser in order to apply. The card has an annual fee of $495. (There is also an unremarkable fee-free UBS card if that’s more your style.) What do you get for laying out that cash?

First off–and I know this will disappoint several thousand of readers poised to transfer assets to UBS and chat with a financial adviser–there is no sign-up bonus for this card. The spending rewards are as follows:

- 3 points per dollar on air travel

- 2 points per dollar on gas and groceries

- 1 point per dollar on everything else.

What are those points worth? In some cases, more than a cent each. You can get a $1,000 off a cruise for 60,000 points. You can also get a $900 flight for 50,000 points. The latter redemption would net you 1.8 cents per point in a best case scenario, making this as much as 5.4% on air travel, 3.6% back on gas /grocery, and 1.8% back on everything else. Not bad, but not worth $495.

What sort of perks do you get? The card offers the standard Visa Signature Luxury Hotel Collection as well as Lounge Club membership. If that’s not enough for you, you can get any membership you want covered, up to $500–but only if you spend more than $100,000. I guess that gives you an additional half percent on your spend per year, assuming you meet the high threshold, making this a two percent-ish card.

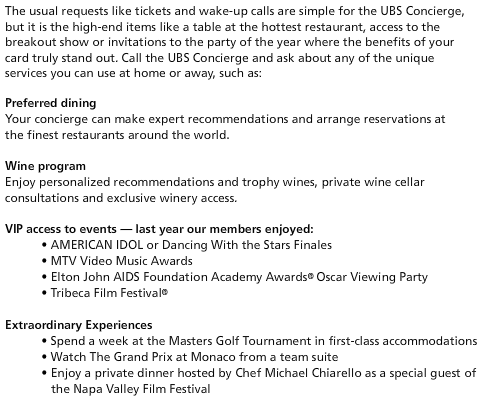

UBS also promotes its concierge service for this card as follows:

I have no experience with high-end concierge services (I’d probably just waste their time and mine asking them to recommend a good BBQ joint), but for those of you who do, there you go.

That’s about all there is to this card. I can’t think of anybody for whom this would be a great card, but if you are such a person, get in touch with your UBS adviser and let me know how it works out for you.

Shot in the dark here – maybe the fee is $495 so that when your account churner (er, I mean advisor) waives $400 of it, you feel like you immediately got some value (and hopefully give him more of your assets to churn.)