JetBlue took an unusual path today in announcing some significant changes to its product. Investors and analysts were presented with a fairly comprehensive plan to drive shareholder returns through “differentiation” during today’s Investor Day event. This plan involves what amounts to a downgrade in its basic product across the board in order to project revenue growth over the next five years. The impact will be very visible to customers, so naturally, JetBlue managed to get an email out to its TrueBlue members at around 7:30pm. If I can sum up the changes in a sentence or two, it would be this: Do you know how people on the internet try to sound smarter than they are (mostly dumb guys, bloggers, like me) by referring to airlines by their airline code (US, AA, B6, etc.), or companies by their stock ticker? Well, let’s just say that JetBlue effectively rebranded itself today as JBLU.

As I mentioned, this news first went out through the investor relations channel, as today was Investor Day for JetBlue. That means that the information was public to all, but not immediately obvious unless you were looking for investment information and not merely a customer browsing the website. The presentation and press release can be found here.

Originally, I thought better about covering this, but I saw some discussion on FlyerTalk and other blogs picking it up. Some of what I’ve read makes it clear that the actual presentation wasn’t fully read. Let’s break things down a bit and get to the customer impacts.

JetBlue Will Be “Tiering” Fares, Eliminating The Free Checked Bag On Its Lowest Priced Offering

Maybe taking a cue from American, who bundles bags and some fee waivers into its “Choice” fare tiers, JetBlue will eliminate its free bag benefit on its lowest price fare. They will instead offer two additional fare tiers, with one and two checked bags bundled in with other benefits.

As loyal JetBlue customers and even many casual travelers know, JetBlue has been fairly unique in continuing to offer a free bag on every ticket. In fact, only they and Southwest currently do so, with Southwest allowing two bags per ticket to “fly free.” Coming soon on JetBlue, you will pay a checked bag fee for that first bag or pay more for your ticket to include it along with yet-to-be-defined “other benefits.” In other words, just like American’s “Choice” tier, the same Choice tier that started off reasonably priced but ended up creeping high enough that it is now sometimes cheaper to pay for the bundled benefits a la carte. Let’s hope JetBlue learns from that.

Still, the free luggage allowance has been a big differentiator for JetBlue. You don’t have to take my word for it, it’s plastered in their advertising. As a family traveler, I check luggage like many of you, but the impact will be felt by everyone – even people who don’t check bags, as they will have more competition for the overhead bin when the fees kick in.

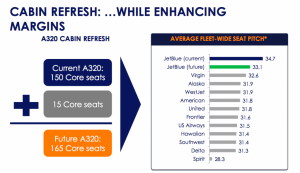

JetBlue Will Be Adding 15 Seats To Its A320 Fleet, Decreasing Seat Pitch And Your Legroom… But Will Still Lead The Industry

I love run-on headings, don’t you? JetBlue plans to cram 15 more seats into the current A320 fleet during a cabin refresh, taking their industry-leading ~35″ of pitch and reducing that. To an industry-leading 33″. At first glance, this doesn’t sound too bad. Anyone that has flown JetBlue can attest, they are well ahead of any other domestic carrier in making you feel like you’re in an actual seat instead of a battery cage. Even with the reduction, I really can’t get too spun up since it’ll still be fairly roomy, but probably not “why would I fly any other airline?” roomy.

It’s not all bad news, either. They’ll be upgrading the personal TV screens to a 10″ model, and all seats will have power. No one else is doing that across their mainline fleet, and it’s a nice thing to have for gadget lovers. JetBlue is basically saying you can watch our nice 10″ screen with DirecTV for free, or you can watch your iPad without draining the battery, or knock yourself out – charge one and watch the other. I like that they are solidifying what, in my opinion, will remain their only competitive differentiator.

As it stands today, nothing was announced regarding the E190 fleet.

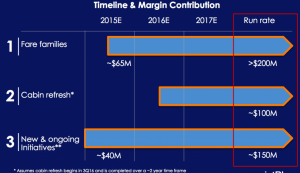

This Will Happen Over The Next Few Years

A lot of the initial reactions that I’ve read include some notion of no timeline having been communicated. That part isn’t entirely true.

As you can see from the slide, the plan is to begin implementing tiered fares in mid-2015. The cabin refresh is intended to start in 3Q 2016. Keep in mind that investor communications tend to be optimistic, so take those time frames as the earliest change date. It also takes time to refresh planes, as they need to rotate out of service for a period of time to fit the new interior. We may also see this on new aircraft as JetBlue takes delivery.

The Bottom Line, or Top Line, or Something

Here’s the deal. JetBlue has been hearing it from Wall Street for a while now that it’s revenue growth is lagging. I can sum up what you’re seeing today pretty succinctly – JetBlue is betting that it will grow revenue through bag fees and 15 extra seats at a sum greater than what it will lose by turning off loyal customers who want the free bag and great leg room. In my opinion, this is a short term shot to the stock price intended to please its investors by squeezing customers a bit like the legacies already do.

Yet, in addition to having problems with this as a customer, I also have a problem with this as a potential investor – and yes, I am that crazy idiot in the room willing to throw good money at airline stocks. As a customer, the issues I might have are fairly obvious – I will be in tighter quarters with 165 of my closest friends and will likely have paid to check two pieces of luggage, as is the norm for our family travels. I’ll probably like a free snack, but could care less about IFE because it’s 2014 and I have more tablets than I do family members. The leisure traveler is going to look elsewhere, because let’s face it, JetBlue is positioning itself as really not that different from American, United or Delta. As a business traveler, JetBlue has a thin network compared to the legacies, some rough scheduling – especially going west to east, and virtually no frequent flyer program of any significance.

As an investor, I’m taking the consumer sentiment and thinking ahead. JetBlue is commoditizing its product. They will now offer basically the same seat everyone else does with an extra inch of room, good but no longer great. Bag fees carry binary significance to me, meaning the fact that they exist mean more to me than the fee itself – even charging a buck a bag would cause consumers to behave differently. For me it boils down to free (or more accurately, included) or not free, and JetBlue is choosing not free. Just like American, Delta and United. On top of this, I see a weak loyalty program that isn’t going to attract business travelers. Even Mosaic status doesn’t get you in their Even More Space seats, while the legacies are giving it away at booking to mid-tier elites and at check in to bottom tier. Maybe I’m mixing customer and investor sentiment here, but a weak loyalty and elite program won’t capture the business revenue. And again, weaker network, worse schedule, with a planned product closer to the legacy offerings than it ever has been in JetBlue’s history.

Overall, I’m seeing the potential for short term revenue growth, but I’m not sure that I’d buy and hold this sort of thing. This move could work in a consolidated industry with the rest of the players hesitant to add route capacity. On the other hand, the commoditization of JetBlue’s product means they’ll need to compete even more aggressively on price. They’ve taken away the major reasons to pay a few bucks more. Analysts contend people weren’t paying a few bucks more for the free bag and larger seat and that was the problem, so they’re going to take those away and project the revenue that 15 more people on the plane will bring. The question will remain, will those 15 people actually buy a ticket, and at what price? All else equal, I’m likely to get better schedule and frequency with a legacy, so how much lower does B6 need to price to win the business now? Are we seeing an inevitable shift to LCC/ULCC operations? We’ll find out, but I’m not betting on this one with my money or my butt in the seat.

I suppose what I’m getting at is that I now have even less reason to buy a seat on B6 and even less reason to buy shares of JBLU. What are your reactions to these changes?

Funny semi-related, I was talking to my buddy who works on a hedge fund – they’re long on a couple airline stocks right now. Bought on the Ebola scare.

I sold my airline stocks when the ebola scare started to ramp up. I was previously long AAL, and kind of wished I’d gone back in near the bottom.

Does pitch for the even more room seats stay the same? I have only flown JetBlue once and enjoyed it for the most part (even springing for an extra legroom seat) which still makes them a viabale alternative to an Alaska or US Airways on a similar route. I don’t normally check a bag but I appreciate having the option to check a free bag as an Alaska and US elite… But JetBlue’s even more seats still have about as much pitch as F on Alaska.

I’m not sure – the investor presentation didn’t speak to Even More Space or any plans in general for the E190 fleet.

People often compare JetBlue and Alaska as smaller airlines with strong regional networks in their respective footprints, and solid competitive differentiation to help them compete. Alaska still does it well, their FF program in general is IMHO the best domestic program when you factor in the strength of their elite benefits. JetBlue, on the other hand, is basically becoming what Alaska would look like without any differentiation. I don’t like it.

FWIW, I’d take an Alaska flight over JetBlue any day. If you’re an Alaska elite, you can reserve the bulkhead if you’re not flying F – on most aircraft it’s not a hard divider, meaning tons of legroom and underseat storage. That and the US Airways Express E75 bulkhead are the two best coach seats in the sky.

Yeah… row six is my go-to row on Alaska. US has some great economy seats like row 22 on the A321s.