Final update.. 3/27

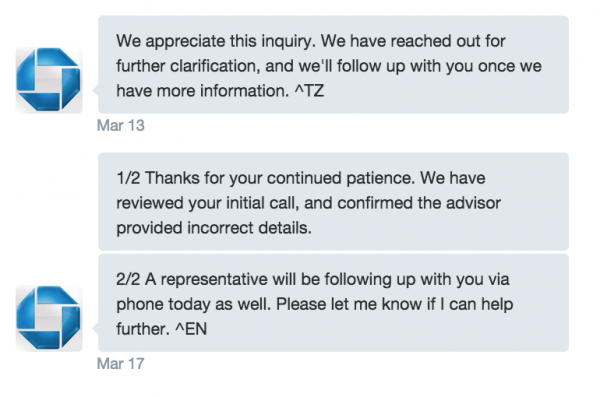

It seems that Chase is telling me the agent I spoke with doesn’t know what they are talking about and that I am covered. My claim has not yet been processed so I don’t really know if this will be the case, but I can say the entire process is confusing and does not instill me with confidence. These aren’t the sort of feelings you should have when waiving insurance….

Update 3/13

I called into the Ritz Carlton card to ask them the following questions:

1. Do you provide coverage if I waive CDW?

- Yes

2. Are you sure, because the CSP said that then denied me last night….

- Let me transfer you to benefits.

Ritz Carlton actually transferred me to the CSP benefits team and they asked for my CSP number to pull up my record. The rep I spoke and said I was covered, and the first rep ‘made a mistake’. When I explained that the mistake was somewhat convoluted (citing state law in 5 states) it emerged that there is such a law that applies to Chase cards, but not all Chase cards. I asked for examples and they cited the Freedom card. IE State law kicks in on the Freedom and ‘some other’ Chase cards, but not the CSP.

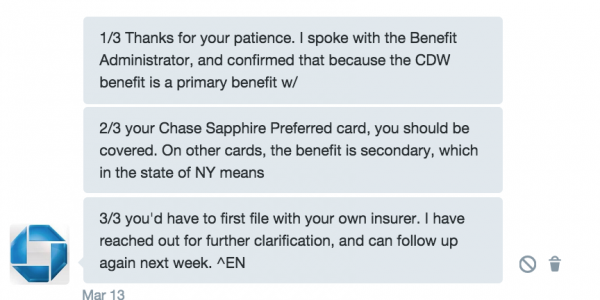

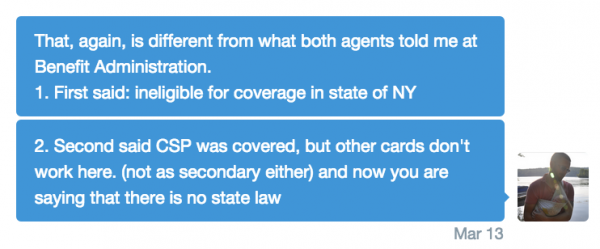

I’ve reached out to Chase Support via twitter for their ‘vote’ on the topic.

–Original Post Below–

I’ve skirted around the topic of credit card car rental insurance because I’ve been a bit unsure of it all, and didn’t want to put something out there that was incorrect. But despite that, I tend to take the advice of others, waive the CDW and put the car rental insurance onto a credit card. The ‘best’ card for this seemed to be the Chase Sapphire Preferred because it offers Primary rather than Secondary coverage.

This means that the first payment comes from Chase in a claim, and if the coverage is sufficient then your insurance company never dips its hand in its pocket, and therefore (I think) your premium isn’t hit by the claim. Secondary coverage would mean that the credit card company picks up the bits that your insurance doesn’t cover, so you do (I think) perhaps get a ding for that.

Anyways.. we rented a car and got a flat. I called up the CSP benefits line and explained we were returning tomorrow, but wanted to know what we should do to ‘do it right’.

After giving out all the details of the claim to the rep on the phone they came at me with this zinger:

I’m required to tell you that in the state of New York we will not cover you for any claims of liability for damage to the property of others. I stopped them in their tracks and said ‘we hit a rock/pothole’ there was no liability claim.

The response was that ‘property of others’ means:

A car rented from another.

Yep – apparently in New York, you don’t get Car Rental insurance from Chase. To clarify, that means if you live in New York, and rent anywhere in the US. I was informed that international rentals are ‘of course covered’.

Apparently this also applies to residents of Michigan, Texas, Rhode Island and North Dakota.

Couldn’t find any mention of this clause on the Chase website.. #developing.

this is why I am downgrading my CSP to a Freedom card.

I recently noticed that World MC does not cover any type of tire damage, whereas World Elite MC has no such exception. If Visa have a similar exception, they might not cover it even if you lived in a different state.

What?! That is shocking. I don’t live in any of those states, but still. How can they say that they have rental car coverage when it sounds like that clause precludes them covering anything? I’m interested in hearing more about this. Did you have a chance to talk to another rep?

Has anyone been able to find the clause in the chase bank issuer’s contract?

Just called Chase Auto Rental Insurance Department 1-888-880-5844 and you are correct about personal liability. No credit card carries personal liability insurance. You must accept the Personal Liability insurance on your contract to be covered. It is only Collision Damage Waiver (CDW) that is covered and that would be Primary. All States in the USA are covered including International Travel. There is currently no county exclusion except if there is a law against it. You must decline the CDW on the rental agreement to be covered by your credit card company. Additionally, you can not rent for more than 31 days and no more that 7 people can be in the car.

That’s not the way I understand it.

They said ‘personal liability means liability to the property of others’ which means if the car received damage it would be personal liability to that car.

Which I hope you agree is insane…

Still working on this with Chase.

Primary CDW is all that the cards provides and that must be waived to be implemented. They don’t provide coverage for personal damages to you or others – that is called personal injury insurance. This is what was explained to me by the agent. CDW provides for damage to your rented vehicle only and not to any damage to any other vehicle that may have occurred. You should be covered under CDW?

That’s what I’m saying- but the NY law means you can’t have that CDW. However I’m starting (hoping rather) to believe that this applies to other cards and not the CSP by some magic.

I have to agree with Jamie. That is utterly preposterous. I’ve always used my AmEx Platinum with the extra rental protection (I pay $25 extra per car rental) but now I’m wondering what would happen if I ever needed a claim.

Post updated. A second rep disagreed. It seems there IS a state law but it doesn’t apply to every card. However, it could apply to cards that you don’t expect.

I called Amex this morning and they refused to tell me if the Business Gold would work in NY, but said they would send me terms and conditions via email which I could review.

Im confused. If you get a flat in a rental you are held liable for that? Isnt that normal wear and tear? I would think you should only be held responsible for negligent driving

Workaround: set your corporation up in Wyoming and use that corp’s Ink card for rentals.

I have one of those already 🙂

Could you point to a resource on this? I have never heard of this 🙂

I have tried to use the CSP in Cancun and Costa Rica in the last month and both Avis and Dollar would not let me use the card because it “does not have raised numbers” for them to do the old impression on paper process.

Mexico and CR have a law for renters to have Liability insurance that is not covered by CSP.

When I spoke to the Chase CSR, they said they did cover it in Mexico. They transferred me to the insurance group (not part of Chase) who told me no, no liability coverage.

Given that I have had to pay insurance of $27-$38 per day for cars in CUN and CR, I don’t see much value in using the CSP for car rental but do think that cancellation protection on hotel and flights will still have value.

So what is the intent here–to find the best CC for primary and then make sure it’s 100% coverage?

Interestingly enough I just started to research this for an upcoming trip to Hawaii and was about to post this question on the forum. We’ve always declined everything, used our best CC (this was before I paid much attention to “primary” vs “secondary– I now know they were secondary) and then depended on personal auto policy for coverage. We’ve never had to use it.

I’m now re-thinking this and have just started researching. Our company, USAA, covers everything as primary EXCEPT “loss of use.” So even using own auto coverage there’s a risk– loss of use is can really be scammed but rental companies–everything from charging 30 days rental because it took them that long for the car to be repaired– or so they claim– to even higher charges if the car is totaled.

Finally, I’m about to research if I use own car insurance will:

a) secondary CC insurance will cover loss of use

b) or can I just get “loss of use” coverage from rental company and decline CDW c) and then there’s the deductible we have on personal policies that would have to be paid, will secondary CC coverage cover that?

I guess the intent here is to figure out what the hell is going on first, and then once we have a place of ‘clarity’ decide what is the best solution. At this time I have no confidence in Chase. I just heard back from Twitter support and they gave me a third, different answer. They say I’m covered primary, with a different card secondary, and no mention of the state law at all…

Call me selfish 🙂 I want answers to my questions also! I want to determine– and you’re certainly helping–what’s the best thing to do. What about the Amex $25.95 (whether you trick it or not) theft and damage coverage? Do folks use it for that and then revert to their personal and/or CC coverage for CDW.

I’d love the outcome of these to be a complete guide to rental car coverage insurance step by step with the choices one needs to make.

Yeesh, this is crazy. I’m looking forward to hearing how this gets resolved. At the same time, I have the same question as Jonathan: did the rental company actually charge you for the flat tire? I’ve had a few flat tires in the past when renting cars and it has always been handled as the rental company’s fault. They brought me a different rental car to drive and I wasn’t charged extra.

I’ve had 3 different answers from Chase already – hoping for clarity at some point.

Re the flat. I wrote the post prior to returning the car so not sure how they will react. That said it really was quite an impressive flat…

Have you read the CSP Guide to Benefits section on Auto Rental CDW Waiver? Here you go: https://cdn.f9client.com/api/file/1130203/inline/SapphirePreferred_World_Mastercard_M0000035_BGC10379_Eng_P.pdf (check out pp 2-3 of the PDF). From my reading of the fine print, it sounds like you should definitely be covered for the flat. I’m also traveling to Hawaii, like Annie above, and I’ll be bringing a copy of this Guide to Benefits PDF with me, since I’m planning on declining Avis’ CDW when we rent the car and I’m putting it on my CSP card.

Just realized the link I included was the MasterCard version of the CSP “Guide to Benefits”. Here’s the one for the “Visa Signature”: https://cdn.f9client.com/api/file/1130204/inline/SapphirePreferred_Visa_Signature_V0000037_BGC10374_Eng_P.pdf