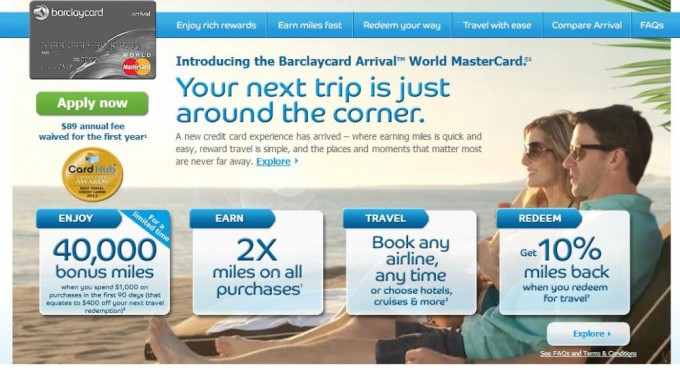

The BarclayCard Arrival Card offers some of the best value for travelers who need to book something a little different, from a Boutique Hotel, to a less known Airline, this is the card that you should have in your wallet, because when you do, it offers the best value of any Travel or Cash Back Card with complete flexibility.

How it works

You earn 2 ‘miles’ for every dollar you spend, and start off with a 40,000 mile bonus when you spend $1000 in the first year.

Use the card to pay for any travel expenses you might have, and then use your accrued points as a Statement Credit. You can offset anything you purchase, including non Travel related spending, however when you do this you get just 1 penny per point as a credit. When you offset Travel spending you get a 10% rebate on your miles.

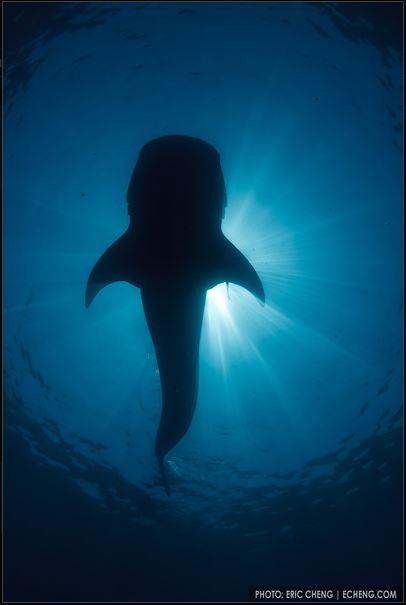

We are on a constant quest to find Whalesharks in the wild and dive with them; it is one of the few things that we simply haven’t managed to do yet despite trying in some of the most populated places in the world, including the Conrad Maldives. Next up on our hunt for the elusive beauties will be Isle Mujeres, a little Island off the coast of Cancun, where it is reported that up to 50 Whalesharks at a time can be spotted swimming nearby.

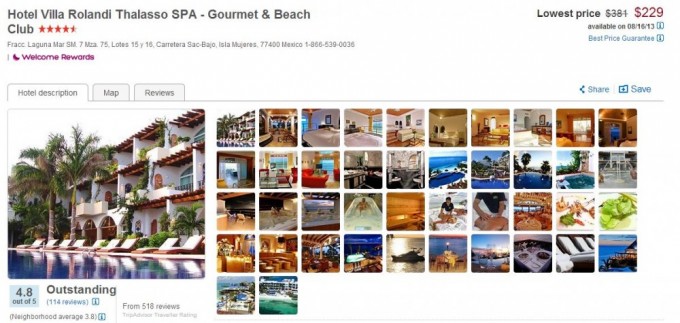

For that trip we would take a flight from NYC – Cancun then a ferry ride to the Island, which has a number of Hotels located on it, but none of the big chains, so we cannot do a points stay. Instead we would book through a third party like Hotels.com, and pay with the BarclayCard Arrival.

If you paid with BarclayCard Arrival you would earn 2 ‘miles’ for every dollar (just like with the Chase Sapphire Preferred) but when you decide to pay for the hotel with the Barclaycard Arrival you can select the Line Item from your Credit Card Statement and elect to pay it off using your ‘miles’ when you do this you get that 10% rebate.

Since the BarclayCard Arrival starts us off with a 40,000 bonus upon spending $1,000 in the first year, and it earns double miles on everything we would be able to pretty much wipe out the cost of that hotel. At $229 per night, for a weekend stay would cost $458 plus taxes. If we met the minimum spend, then booked the rooms with taxes for say, $500 we would have the following:

- Signup Bonus of 40,000 miles

- Min spend $1,000 for 2,000 more miles

- Hotel Spend $550 for 1100 more miles

- Total Miles 43,100 at 1cent per mile would reduce the $550 hotel bill to just $119!

- Additionally, we would get 10% back on that towards our next trip, which would be worth 4,310 miles (another $43).

This card is a great addition to the wallet for any traveler like ourselves that likes the freedom of booking non large chain hotels, and is very useful for travelling off the beaten path. It offers the best value in terms of rewards, and has a solid signup bonus too. The Annual Fee of $89 is waived in year 1, meaning that the savings are even greater.

(disclosure – this post contains links to the BarclayCard Arrival that are my affiliate links, if you decide to use them I will receive compensation from BarclayCard)

Hmmm, 40,000 seems pretty nice looking at it. $430 off is nothing to sneeze at for a signup bonus. Might have to look into this before I signed up for too many Chase cards in 1 year and burn my rewards bridge with them….

Yep- good to have a mix, when we apply now we ‘app-o-rama’ and aim for at least 5-6 cards at a time, needs to be a couple from each bank or it doesn’t work out. This is certainly the best Barclay’s card out there.

Matt, please do not forget to post the whole story about your new ‘app-o-rama’ 🙂

Ha! Yes indeed….

Preferably before the end of the month as I may want to do it for the 2nd time this year after 5 month and I may need some new ideas when it comes to the cards 🙂

Yup, we have this card. When combined with the conscious decision to largely avoid chains, and the knowledge that growing our family will make airline miles unnecessary for the next 12 months, this card makes a lot of sense. It feels rewarding to get 2.2 cents instead of one mile for non-category purchases.

Nice – I’m still riding out the big chains from old sign up bonuses, but I don’t want to get too loyal to them. Frankly have had much more memorable experiences at smaller hotels thus far in my travels.

As a family guy, what do you think about low end hotels – just using points for destination? I think there might be some value in the lower end Hilton awards if the hotel is just a hub for resting. Thinking to write about that.

We’re still waiting for our first (in a few weeks), so I can’t speak to that. I will say that I’ve been camping and I’ve stayed in dodgy places, and I’ve carried bedbugs back to the States. We’ve also stayed at the Singapore Hilton and KL Sheraton Imperial. I think that, unless you’re in a remote area or an all-inclusive, thinking of a hotel as anything but a place to lay your head and start your day is silly. Luxury hotels don’t really do anything for us. When looking at cities, we just go for best low-end value. (Told my wife about the Fairmont cards and her response was that we never stay anywhere like that usually, so what’s the point?) As a result, hotel points don’t hold the same value for us; the counterfactual of what we might have booked is usually much less than the rack rate at the award night place.

My wife was one of three kids, and as a result her parents favored timeshares and apartments over hotels. There aren’t many hotels with non-suite room with second bedrooms.

Remains to be seen if Barclays will let me redeem points for Hotels.com, my go-to booking site, as travel. That’d be nice.

(I think I misunderstood your question, so feel free to ask again.)

I think I got it! I was wondering about writing more about the non ‘aspirational’ hotel stays, and think it might be handy for people based on this.

Hey, just to follow-up. Did hotels.com work out? That is my go-to site as well (along with booking.com) and this would be a great thing to know. Thank you so much in advance!

I didn’t get around to booking that trip, though I hope to soon!

I just got this card earlier this year. It is working out well for me so far. I haven’t done a lot of traveling so I still have most of my bonus points to spend.

It is always good to have a stash of points/miles available for emergencies. After I hit a reasonable level I move onto the next program, or revert to cashback. But at 2% for non travel this rivals my Fidelity card and the 2.2% for travel beats that too.

Matt,

What is your assessment about keeping the card after the first year when the annual fee becomes due? Second year onwards, the first $4000 spend would go towards just covering the $89 annual fee. Any thoughts?

Thanks!

It’s a tough question. The ongoing spend bonus of this card certainly make it one of the best you could have in your wallet. The fee isn’t great, so the question is very subjective. 40000 bonus and no fee is clearly not as good as zero bonus and $89 fee but the question becomes opportunity cost, if you use this card frequently, it’s well worth the $89 in the second year. If you don’t then it’s probably not.

Thanks for your inputs! On a related note, I do believe that the Chase Southwest Premier card is a spectacularly good card because even though it has a $99 annual fee, it comes with an annual bonus of 6000 miles. Even after the devaluation of Southwest miles, that will still be worth about $84-85 or so. So overall this amounts to buying 6000 Southwest miles every year, which I can very easily put to use. And even if I don’t use the Southwest card for my everyday purchases, I won’t worry about paying an annual fee for nothing.

And the Barclays Arrival sounds like *the* card for everyday non-bonus category purchases. I should calculate how much that is on average and whether there’ll be a bonus to be had beyond the $4K. Something to think about.

Nice- I’ve not got a Southwest card yet, though I hear great things about them, especially with the companion pass.

Matt are you allowed to dive with the whale sharks at Isla Mujeres? I haven’t been there but I did snorkel with 5 at Donsol Philippines. I would have swam with more but I was exhausted.

Yep – it seems that way from the tours I saw. I am very envious of you and your experience, it is one of our last few things to do on the bucketlist (not that we really have a bucketlist, but if we did it would be #1)